- China

- /

- Auto Components

- /

- SHSE:601799

Changzhou Xingyu Automotive Lighting Systems Co.,Ltd.'s (SHSE:601799) Share Price Could Signal Some Risk

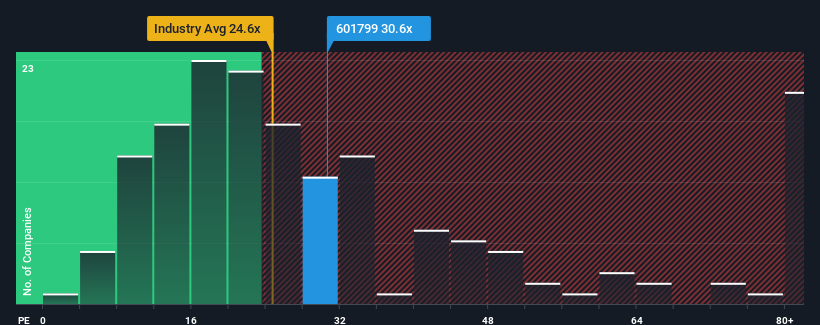

Changzhou Xingyu Automotive Lighting Systems Co.,Ltd.'s (SHSE:601799) price-to-earnings (or "P/E") ratio of 30.6x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 27x and even P/E's below 16x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Changzhou Xingyu Automotive Lighting SystemsLtd as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Changzhou Xingyu Automotive Lighting SystemsLtd

Does Growth Match The High P/E?

Changzhou Xingyu Automotive Lighting SystemsLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 14% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 25% each year over the next three years. With the market predicted to deliver 24% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's curious that Changzhou Xingyu Automotive Lighting SystemsLtd's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Changzhou Xingyu Automotive Lighting SystemsLtd's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Changzhou Xingyu Automotive Lighting SystemsLtd currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Changzhou Xingyu Automotive Lighting SystemsLtd (1 makes us a bit uncomfortable!) that you need to be mindful of.

You might be able to find a better investment than Changzhou Xingyu Automotive Lighting SystemsLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601799

Changzhou Xingyu Automotive Lighting SystemsLtd

Changzhou Xingyu Automotive Lighting Systems Co.,Ltd.

Flawless balance sheet with high growth potential.