Top Growth Companies With Strong Insider Ownership January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks outpacing growth shares significantly. In this environment, companies with strong insider ownership often signal confidence from those who know the business best, making them attractive considerations for investors seeking growth opportunities amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

We'll examine a selection from our screener results.

Anhui Huaheng Biotechnology (SHSE:688639)

Simply Wall St Growth Rating: ★★★★★★

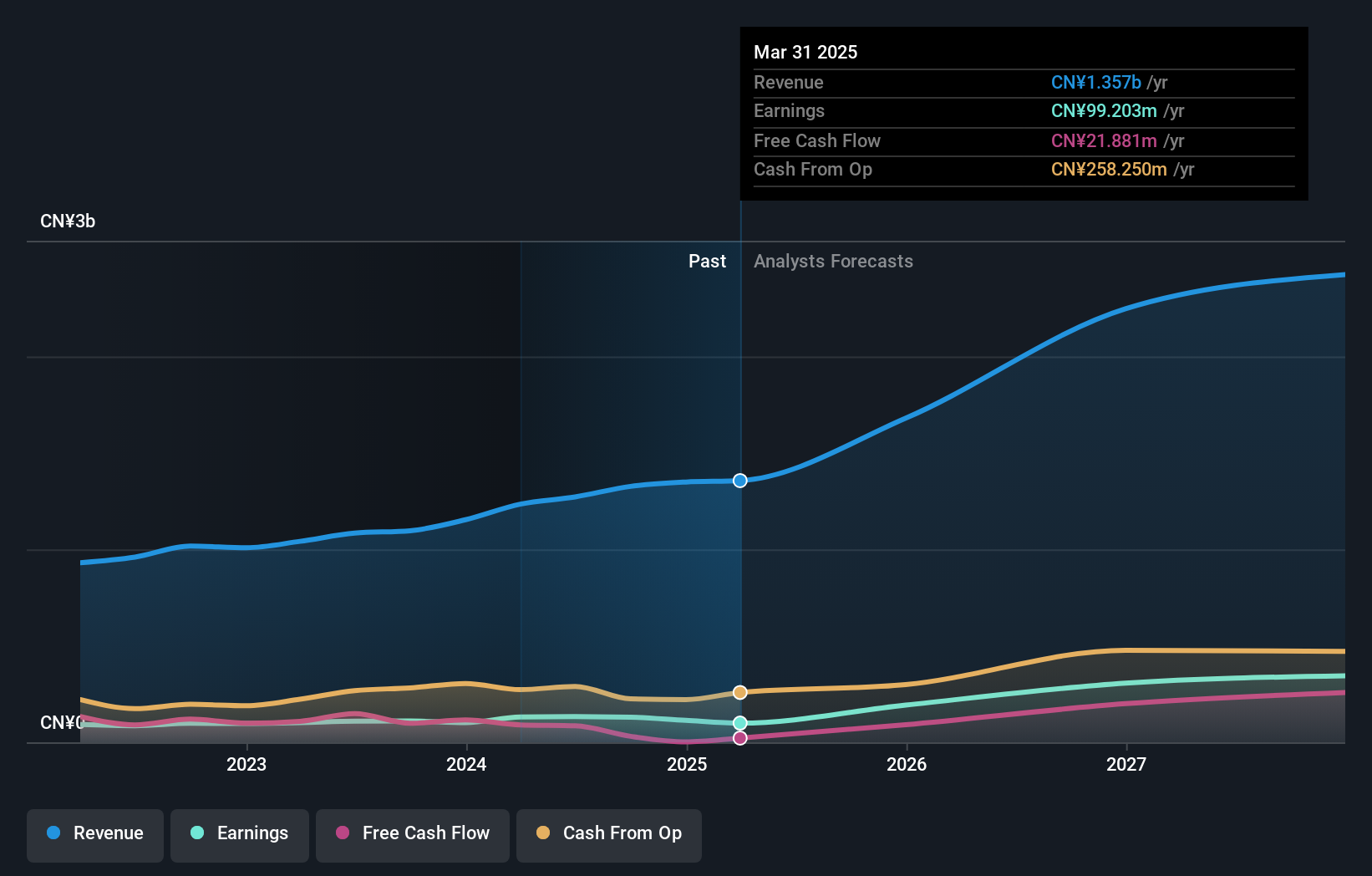

Overview: Anhui Huaheng Biotechnology Co., Ltd. is involved in the development, production, and sale of amino acids and other organic acids both in China and internationally, with a market capitalization of CN¥6.20 billion.

Operations: The company's revenue primarily comes from its Bio Manufacturing Industry segment, generating CN¥2.11 billion.

Insider Ownership: 32.9%

Anhui Huaheng Biotechnology demonstrates strong growth potential, with earnings expected to rise significantly at 44.52% annually, outpacing the CN market. Despite a decline in profit margins from 23.5% to 14.1%, its revenue growth forecast of 29.8% per year remains robust compared to the market's 13.4%. The company trades at a favorable P/E ratio of 20.9x versus the market average of 34.6x, though dividends are not well covered by free cash flows.

- Get an in-depth perspective on Anhui Huaheng Biotechnology's performance by reading our analyst estimates report here.

- Our valuation report here indicates Anhui Huaheng Biotechnology may be undervalued.

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Growth Rating: ★★★★★☆

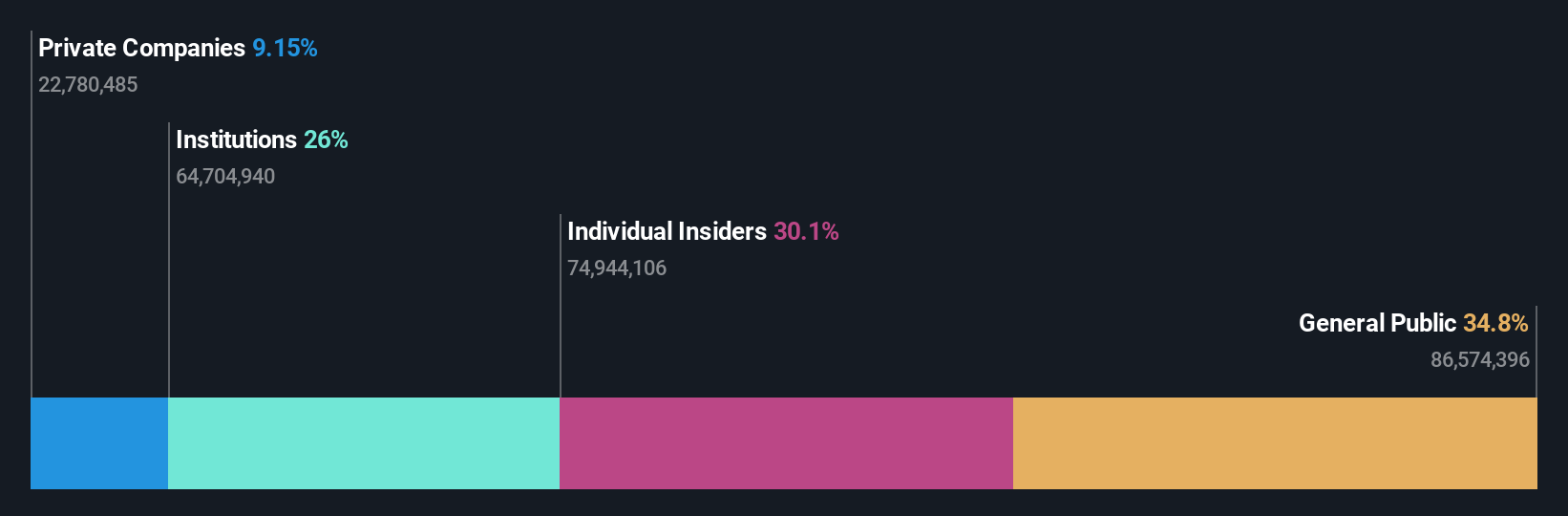

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the medical science industry with a focus on healthcare products and services, and has a market cap of approximately CN¥8.31 billion.

Operations: Unfortunately, the provided text does not contain specific details about the company's revenue segments. Please provide additional information if available.

Insider Ownership: 17.4%

Inner Mongolia Furui Medical Science shows promising growth potential, with earnings projected to increase 46.23% annually, surpassing the CN market's expected growth of 25.1%. The company's revenue is also forecasted to rise significantly at 30.2% per year, outpacing the market average of 13.4%. Despite a low future Return on Equity of 17.3%, insider ownership supports its strategic direction ahead of an upcoming shareholders meeting in January 2025 regarding audit firm appointments.

- Unlock comprehensive insights into our analysis of Inner Mongolia Furui Medical Science stock in this growth report.

- Our valuation report unveils the possibility Inner Mongolia Furui Medical Science's shares may be trading at a premium.

NEXTAGE (TSE:3186)

Simply Wall St Growth Rating: ★★★★☆☆

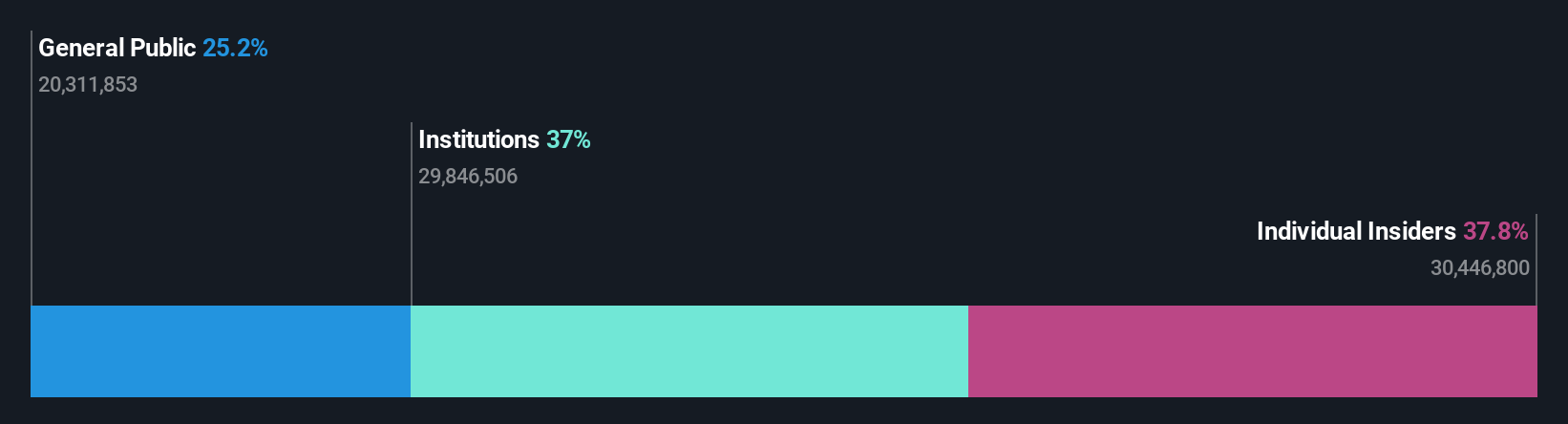

Overview: NEXTAGE Co., Ltd. operates in Japan, focusing on the sale of new and used cars, with a market cap of ¥114.40 billion.

Operations: The company generates revenue primarily through its automobile sales and related ancillary businesses, amounting to ¥552.78 billion.

Insider Ownership: 37.9%

NEXTAGE demonstrates growth potential, with earnings expected to rise 21.5% annually, outpacing the JP market's 8%. Revenue is forecasted to grow at 8.7% per year, exceeding the market's 4.3%. Despite trading significantly below estimated fair value and a volatile share price recently, insider ownership aligns interests with shareholders. However, profit margins have decreased from last year and dividends are not well covered by free cash flows. Debt coverage remains a concern due to limited operating cash flow support.

- Dive into the specifics of NEXTAGE here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, NEXTAGE's share price might be too pessimistic.

Where To Now?

- Explore the 1462 names from our Fast Growing Companies With High Insider Ownership screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300049

Inner Mongolia Furui Medical Science

Inner Mongolia Furui Medical Science Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives