- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

Shareholders May Be More Conservative With mobilezone holding ag's (VTX:MOZN) CEO Compensation For Now

Key Insights

- mobilezone holding ag's Annual General Meeting to take place on 5th of April

- Total pay for CEO Markus Bernhard includes CHF600.0k salary

- The total compensation is 32% higher than the average for the industry

- Over the past three years, mobilezone holding ag's EPS grew by 6.8% and over the past three years, the total shareholder return was 114%

Performance at mobilezone holding ag (VTX:MOZN) has been reasonably good and CEO Markus Bernhard has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 5th of April, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for mobilezone holding ag

Comparing mobilezone holding ag's CEO Compensation With The Industry

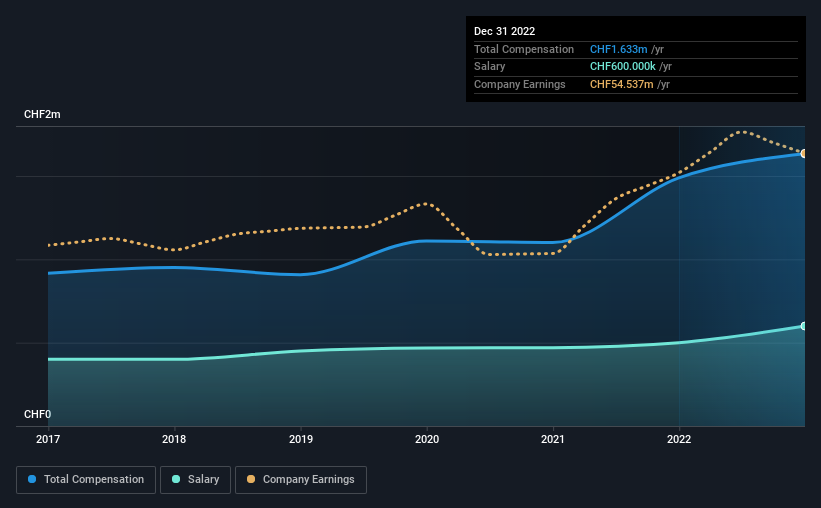

Our data indicates that mobilezone holding ag has a market capitalization of CHF633m, and total annual CEO compensation was reported as CHF1.6m for the year to December 2022. That's a notable increase of 9.7% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CHF600k.

In comparison with other companies in the Switzerland Specialty Retail industry with market capitalizations ranging from CHF368m to CHF1.5b, the reported median CEO total compensation was CHF1.2m. This suggests that Markus Bernhard is paid more than the median for the industry. What's more, Markus Bernhard holds CHF1.9m worth of shares in the company in their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CHF600k | CHF500k | 37% |

| Other | CHF1.0m | CHF989k | 63% |

| Total Compensation | CHF1.6m | CHF1.5m | 100% |

On an industry level, around 55% of total compensation represents salary and 45% is other remuneration. In mobilezone holding ag's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

mobilezone holding ag's Growth

mobilezone holding ag has seen its earnings per share (EPS) increase by 6.8% a year over the past three years. In the last year, its revenue is up 2.2%.

We'd prefer higher revenue growth, but it is good to see modest EPS growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has mobilezone holding ag Been A Good Investment?

We think that the total shareholder return of 114%, over three years, would leave most mobilezone holding ag shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for mobilezone holding ag that you should be aware of before investing.

Important note: mobilezone holding ag is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)