- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

UBS Group (SWX:UBSG) Shows Resilient Growth with 25.6% Earnings Projection Despite Recent Challenges

Reviewed by Simply Wall St

Dive into the specifics of UBS Group here with our thorough analysis report.

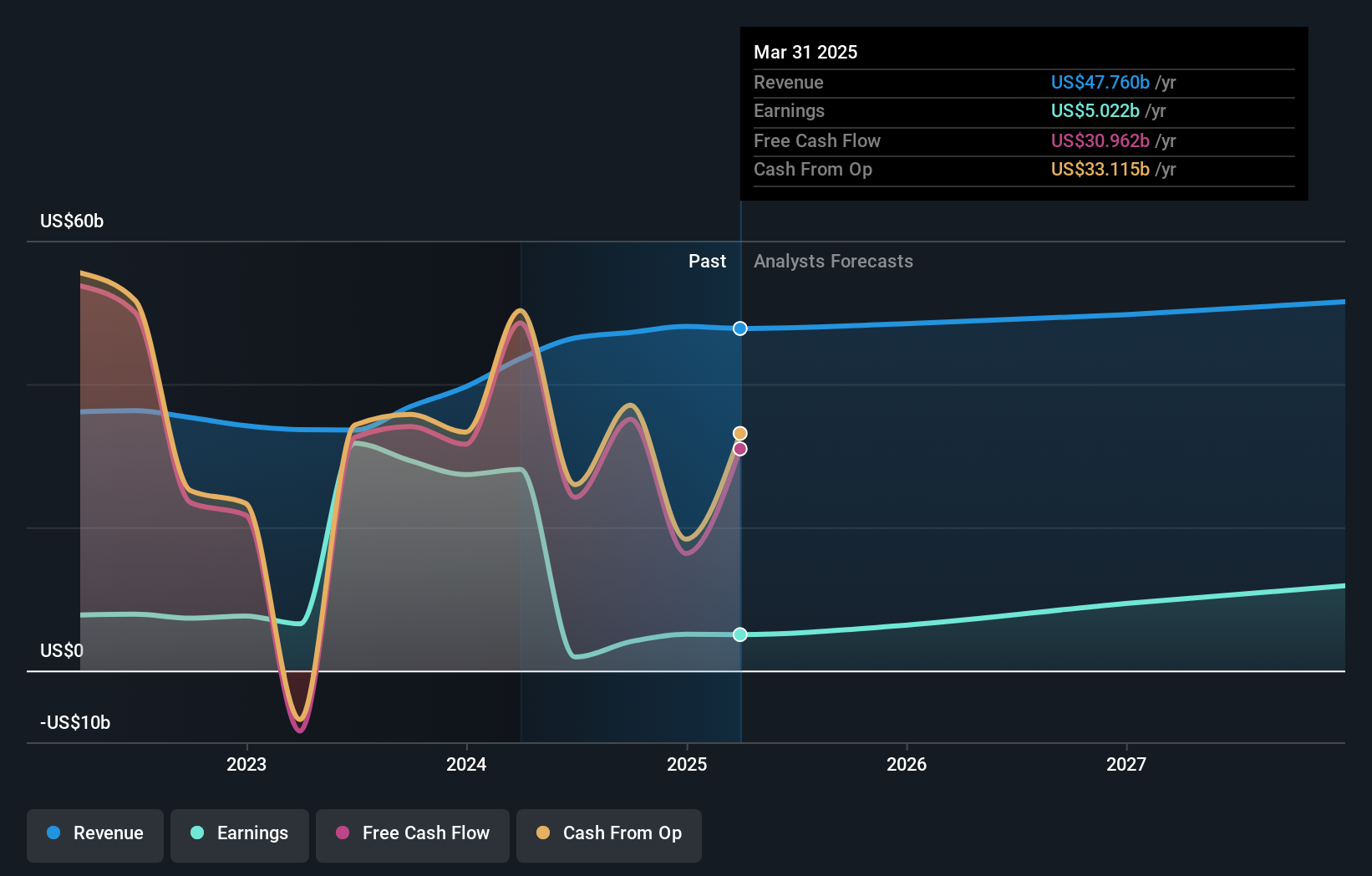

Innovative Factors Supporting UBS Group

UBSG has demonstrated a strong earnings trajectory, with projections indicating a 25.6% annual growth over the next three years. This growth is underpinned by a satisfactory net debt to equity ratio of 37.8%, reflecting financial stability. The company has also consistently increased its dividend payments over the past decade, maintaining a payout ratio of 49.7%, which suggests a strong capacity to cover dividends through earnings. CEO Sergio Ermotti highlighted a 15% year-over-year revenue increase, driven by expanded product offerings and enhanced customer engagement. This growth trajectory positions UBSG well in capturing market share and responding to customer needs. UBSG is currently trading above its estimated fair value, which may indicate an overvaluation compared to its peers.

Strategic Gaps That Could Affect UBS Group

However, the company faces challenges, such as a 7.3% decline in earnings growth over the past year and a significant drop in net profit margins from 79.5% to 9.6%. The Return on Equity stands at 5.2%, which is relatively low compared to industry standards. Additionally, UBSG's revenue growth is forecasted at 1.6% per year, lagging behind the Swiss market's 4.1% growth rate. These financial challenges, coupled with an unreliable dividend history, may impact investor confidence.

Potential Strategies for Leveraging Growth and Competitive Advantage

UBSG is poised to capitalize on emerging opportunities, with earnings forecasted to grow faster than the Swiss market at 11.1% annually. The company's strategic focus on expanding its footprint in emerging markets, particularly in Southeast Asia, presents substantial growth potential. Investments in digital transformation initiatives are expected to streamline operations and improve customer experiences, as emphasized by CFO Todd Tuckner. Furthermore, recent regulatory changes offer new avenues for exploration in financial services.

Competitive Pressures and Market Risks Facing UBS Group

Despite these opportunities, UBSG must navigate several threats, including large one-off losses amounting to $4.9 billion, which have impacted financial results. The unstable dividend track record may further erode investor confidence. Additionally, UBSG is considered expensive compared to the European Capital Markets industry average based on its Price-To-Earnings Ratio. The company is actively addressing supply chain disruptions, as noted by CEO Sergio Ermotti, to mitigate potential vulnerabilities and maintain operational efficiency.

Conclusion

UBS Group's projected annual earnings growth of 25.6% over the next three years, supported by a stable net debt to equity ratio, positions it to effectively capture market share and meet customer demands. However, challenges such as a recent decline in earnings growth and a significant drop in profit margins highlight potential risks to investor confidence. Despite trading above its estimated fair value, suggesting a premium price, UBS Group's strategic initiatives in emerging markets and digital transformation could drive future growth, potentially justifying its current market valuation. The company's ability to navigate financial setbacks, such as large one-off losses, and address supply chain disruptions will be crucial for maintaining operational efficiency and achieving long-term success.

Make It Happen

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives