- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

UBS Group (SWX:UBSG): Examining Valuation After Recent Steady Share Price Movement

Reviewed by Kshitija Bhandaru

See our latest analysis for UBS Group.

UBS Group’s share price has gained momentum over the past quarter and remains firmly ahead on a 12-month view. The stock’s year-to-date performance is up double digits, while the total shareholder return over the past year stands at an impressive 21.7%, highlighting the bank’s resilience and renewed optimism after a period of transformation.

If steady progress in Europe’s financial sector has you rethinking your portfolio, now could be the perfect moment to discover fast growing stocks with high insider ownership.

The question now is whether UBS Group’s strength signals a stock trading below its true value, or if the latest rally means the market has already factored in next year's growth. Is there still a compelling case to buy?

Most Popular Narrative: 1.7% Undervalued

UBS Group’s fair value, according to the most followed narrative, stands slightly above the latest close, suggesting analysts see limited further upside in the short term. The subtle gap between price and target has the market debating whether UBS can deliver its ambitious integration and digital transformation goals.

The ongoing integration of Credit Suisse is progressing ahead of schedule, driving meaningful cost savings, increased scale, and improved operating efficiency. As these synergies are realized through further platform migration and operational streamlining, UBS's net margins and return on equity are likely to improve, supporting higher earnings growth.

Can this bank truly reinvent itself and leap beyond legacy rivals? The narrative hinges on profit margin reinvention and bold efficiency moves most investors aren’t expecting. Don’t miss what makes this fair value tick. The assumptions behind UBS’s path could surprise you.

Result: Fair Value of $32.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stricter Swiss capital requirements or slower than hoped integration progress could quickly shift the outlook and challenge UBS’s current growth expectations.

Find out about the key risks to this UBS Group narrative.

Another View: Looking Beyond the Fair Value

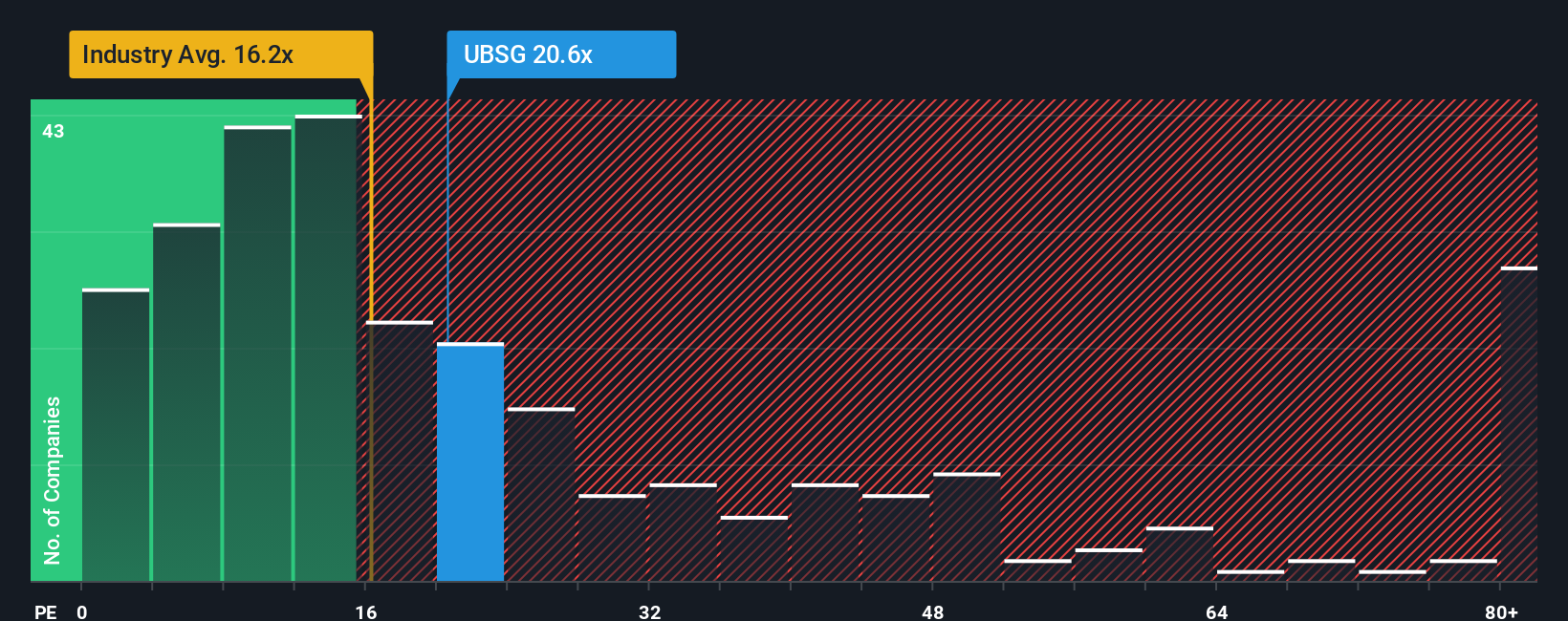

While some see UBS Group as trading just below its fair value, a closer look at its price-to-earnings ratio tells another story. UBS trades at 20.2x, which is higher than the industry average of 16.8x, but undercuts the peer average at 21.9x. Interestingly, it is still well below the fair ratio of 26.4x. The market could eventually move closer to this number, but for now, the elevated multiple signals both opportunity and risk. Are investors too optimistic, or does the growth profile justify paying up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UBS Group Narrative

If you see the story differently, or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your UBS Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for the next opportunity. Use the Simply Wall Street Screener to pinpoint unique stocks, seize fresh trends, and build your advantage before others do.

- Unlock growth potential and track these 891 undervalued stocks based on cash flows with healthy cash flows that could be primed for a market re-rate.

- Cement reliable income streams by evaluating these 19 dividend stocks with yields > 3%, which features yields above 3% and a history of strong payouts.

- Fuel your curiosity about technological advancements and see which names stand out among these 24 AI penny stocks powering artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives