- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

Is UBS Group’s Response to First Brands Fallout Reshaping Its Risk Strategy (SWX:UBSG)?

Reviewed by Sasha Jovanovic

- In recent days, UBS Group has come under scrutiny as it evaluates its exposure to the bankruptcy of auto-parts supplier First Brands, while simultaneously seeking to transfer credit risk from a US$1 billion corporate loan portfolio in response to tighter post-Credit Suisse capital requirements. This raises fresh questions about UBS's risk management approach and resilience amid evolving regulatory expectations and unforeseen credit events.

- We'll explore how concerns over UBS's financial exposure to First Brands may influence the company’s investment narrative and outlook on capital strength.

Find companies with promising cash flow potential yet trading below their fair value.

UBS Group Investment Narrative Recap

To be a shareholder in UBS Group today, you need confidence in its ability to integrate Credit Suisse, realize cost synergies, and maintain capital strength through evolving regulatory demands. While recent headlines around UBS's exposure to the First Brands bankruptcy and ongoing risk transfer initiatives have generated some concern, the impact on near-term catalysts, mainly successful integration and capital unlock, appears limited for now. The largest risk remains the uncertainty over capital regulation in Switzerland, which could influence returns and deployment flexibility.

Among recent announcements, UBS's move to transfer risk from a US$1 billion corporate loan portfolio stands out. This action relates directly to regulatory pressures following the Credit Suisse merger, underscoring how capital requirements continue to influence UBS's ability to pursue growth and manage short-term risks. These financial maneuvers sit at the heart of UBS’s efforts to support a stronger balance sheet and maintain shareholder confidence.

By contrast, investors should also be keenly aware of the potential for new Swiss capital rules to require UBS to hold an additional US$24–$42 billion, with implications for...

Read the full narrative on UBS Group (it's free!)

UBS Group's outlook anticipates $52.8 billion in revenue and $12.8 billion in earnings by 2028. This implies a 4.0% annual revenue growth rate and a $6.5 billion increase in earnings from the current level of $6.3 billion.

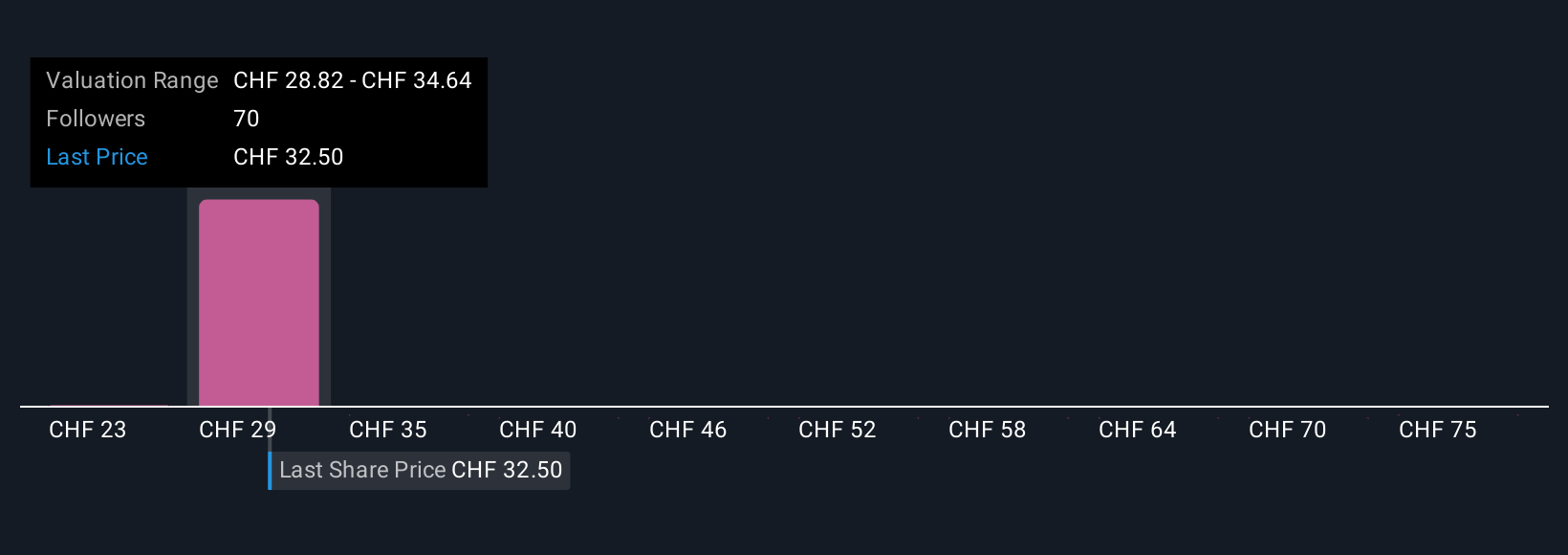

Uncover how UBS Group's forecasts yield a CHF32.69 fair value, in line with its current price.

Exploring Other Perspectives

Seven community fair value estimates on UBS Group from Simply Wall St range from US$23 to US$81.19, showing markedly diverse forecasts. In light of uncertainty around Swiss capital requirements, these differing views remind you that opinions on UBS’s future performance can vary widely, explore several viewpoints before deciding your next move.

Explore 7 other fair value estimates on UBS Group - why the stock might be worth 28% less than the current price!

Build Your Own UBS Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UBS Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UBS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UBS Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives