- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

How Investors Are Reacting To UBS Group (SWX:UBSG) Resolving Major French Tax Case

Reviewed by Sasha Jovanovic

- UBS AG has resolved a longstanding French tax case, agreeing to pay a fine of €730 million and €105 million in civil damages for past cross-border business activities, bringing closure to legal uncertainties dating back to 2004–2012.

- This development removes a significant legal overhang for UBS, allowing the bank to focus more fully on its ongoing integration efforts and regulatory adaptation after its acquisition of Credit Suisse.

- We'll examine how the resolution of this major legal case could shape UBS Group's investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

UBS Group Investment Narrative Recap

To believe in UBS Group as a shareholder, you need confidence in the earnings potential from integrating Credit Suisse, UBS’s global wealth management reach, and its ability to manage regulatory change. The recent resolution of UBS's long-running French legal case removes a meaningful overhang but does not materially change the short-term focus, which remains on integration success as the main catalyst and potential regulatory burdens as the biggest risk.

Another timely update is the recent Swiss government proposal for higher capital requirements for systemically important banks like UBS. This announcement is directly relevant given that legal and regulatory issues remain the strongest risk factor, persistent regulatory change could impact UBS's ability to generate shareholder returns, despite progress resolving legacy matters in France.

Yet, investors should be aware that despite this closure, the evolving Swiss capital regime...

Read the full narrative on UBS Group (it's free!)

UBS Group's narrative projects $52.8 billion revenue and $12.8 billion earnings by 2028. This requires 4.0% yearly revenue growth and a $6.5 billion earnings increase from $6.3 billion today.

Uncover how UBS Group's forecasts yield a CHF32.13 fair value, in line with its current price.

Exploring Other Perspectives

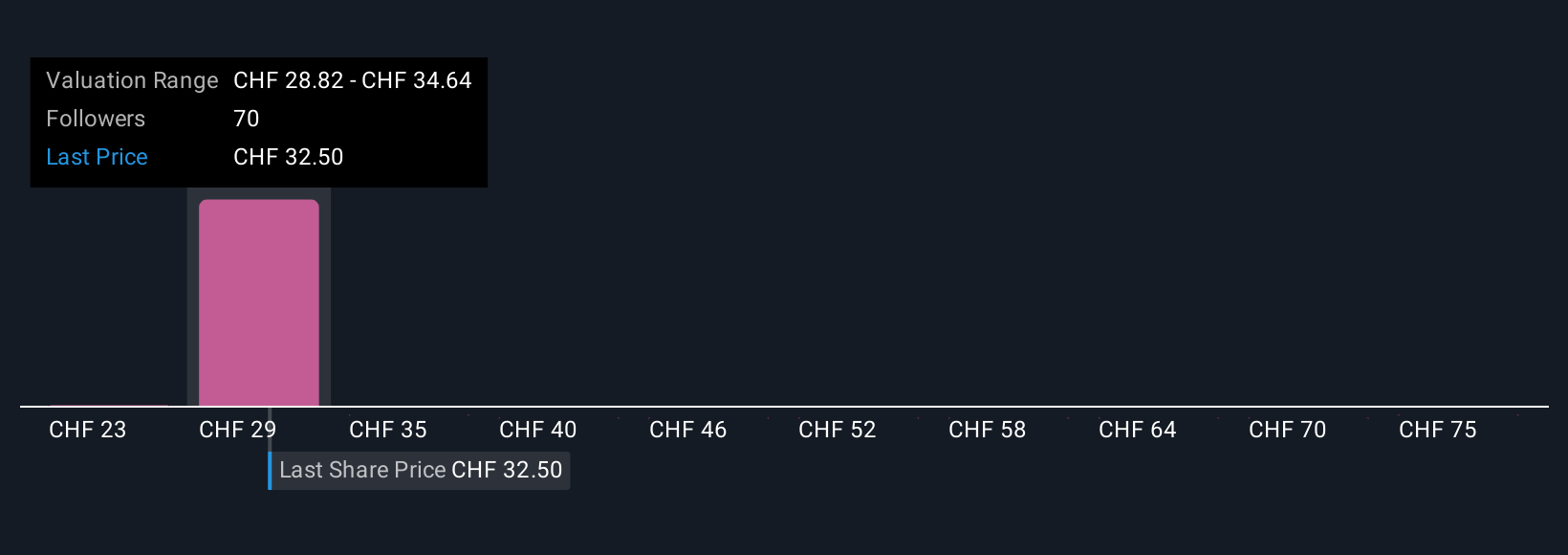

Seven private investors in the Simply Wall St Community value UBS Group anywhere from CHF 23 to CHF 81.19 per share. Against this backdrop, potential regulatory shifts and capital rules could be a deciding factor for future profitability, so take the time to compare these viewpoints.

Explore 7 other fair value estimates on UBS Group - why the stock might be worth 29% less than the current price!

Build Your Own UBS Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UBS Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UBS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UBS Group's overall financial health at a glance.

No Opportunity In UBS Group?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)