Amid cautious optimism in Europe, the pan-European STOXX Europe 600 Index has seen modest gains as investors navigate U.S. trade policy developments and geopolitical efforts to resolve the Russia-Ukraine conflict. In this environment of mixed economic signals and fluctuating indices, dividend stocks can offer a measure of stability and income potential, especially when they yield up to 8.6%.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Mapfre (BME:MAP) | 5.95% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.85% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.31% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.30% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.51% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.39% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 7.29% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 6.58% | ★★★★★☆ |

Click here to see the full list of 215 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

CaixaBank (BME:CABK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CaixaBank, S.A. is a financial institution offering a wide range of banking products and services in Spain and internationally, with a market cap of €47.28 billion.

Operations: CaixaBank's revenue is primarily derived from its Banking segment, which includes non-core real estate (€11.21 billion), followed by contributions from its Insurance (€1.82 billion) and Portuguese Investment Bank (BPI) segments (€1.23 billion), along with a smaller portion from the Corporate Center (€167 million).

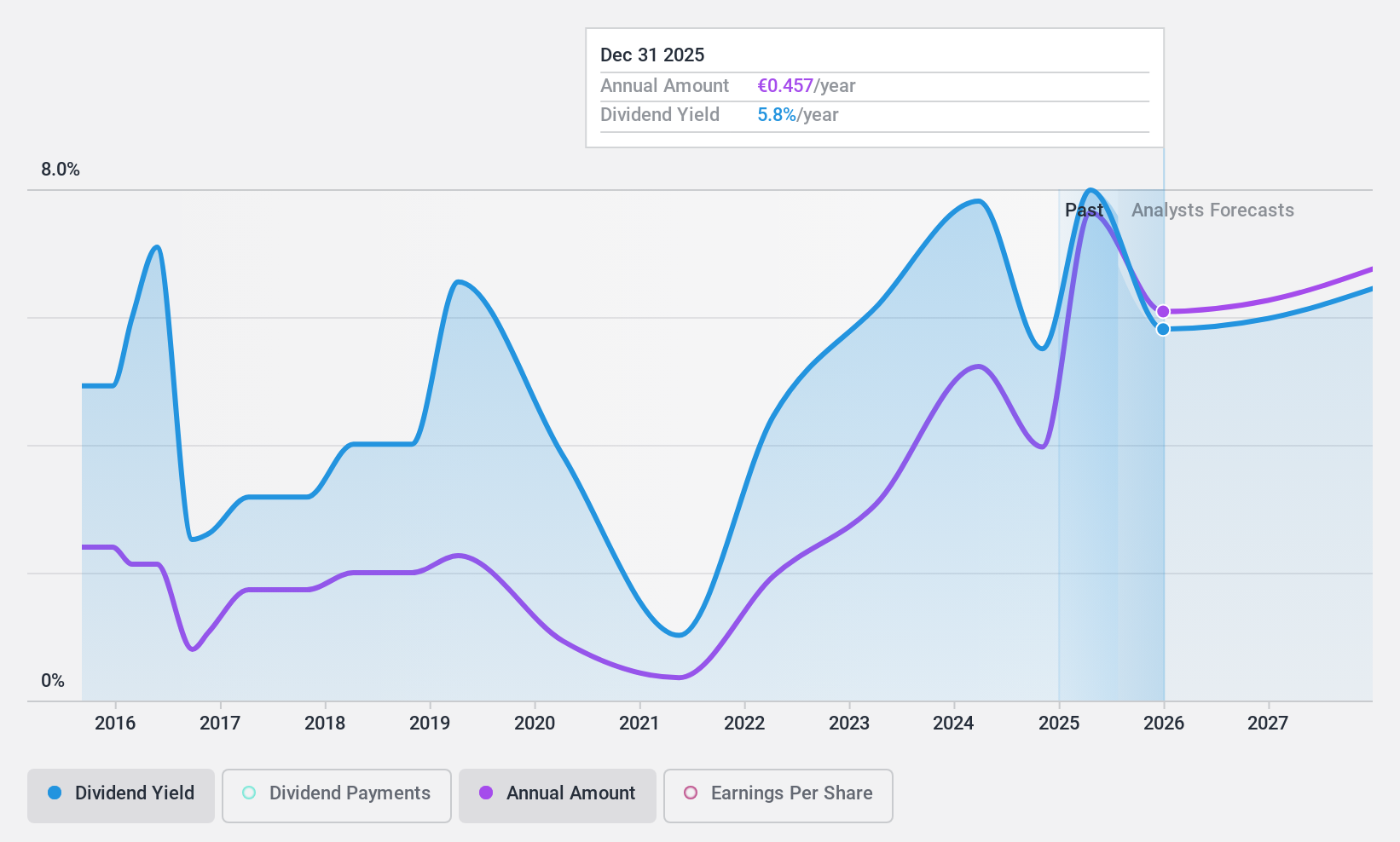

Dividend Yield: 8.6%

CaixaBank's dividends are currently well-covered with a payout ratio of 57.3%, indicating sustainability. However, its dividend history has been volatile over the past decade, making it somewhat unreliable despite recent growth. The bank's net income for 2024 increased to €5.79 billion from €4.82 billion in 2023, supporting dividend payments but earnings are forecasted to decline slightly by 0.2% annually over the next three years, which could impact future payouts.

- Take a closer look at CaixaBank's potential here in our dividend report.

- Our expertly prepared valuation report CaixaBank implies its share price may be lower than expected.

Toyota Caetano Portugal (ENXTLS:SCT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyota Caetano Portugal, S.A. imports, assembles, and commercializes light and heavy vehicles with a market cap of €189 million.

Operations: Toyota Caetano Portugal, S.A. generates revenue from several segments including Domestic Motor Vehicles Commercialization (€764.41 million), External Motor Vehicles Industry (€61.96 million), External Motor Vehicles Commercialization (€28.15 million), Domestic Motor Vehicles Services (€24.70 million), Domestic Industrial Equipment Machines (€12.25 million), and other smaller segments such as Domestic Industrial Equipment Services and Rentals, totaling a diverse portfolio of income streams in the automotive sector.

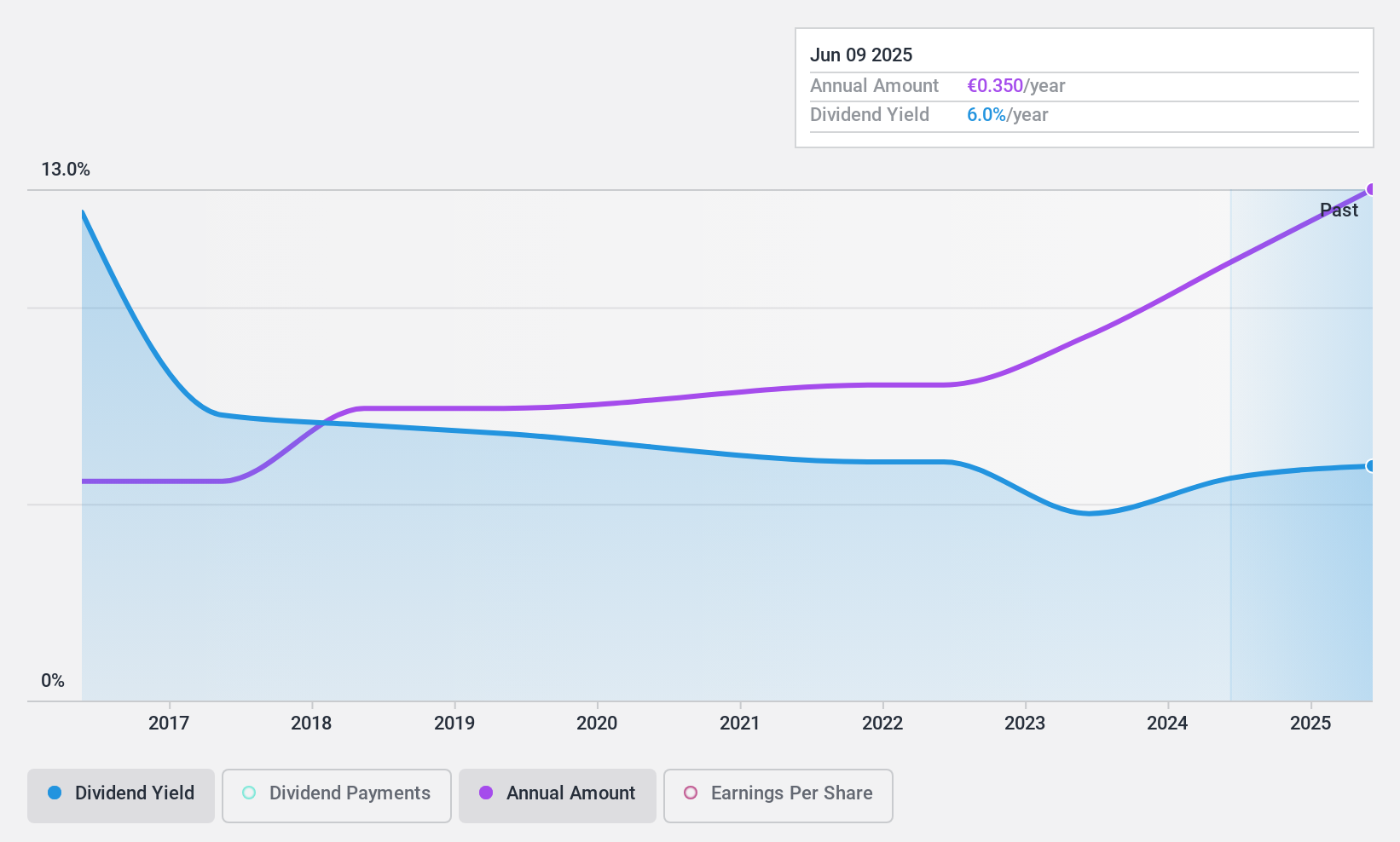

Dividend Yield: 5.6%

Toyota Caetano Portugal's dividend is supported by a payout ratio of 47.2% and cash flow coverage at 65.8%, suggesting sustainability. Although dividends have grown over the past decade, they have been volatile with significant annual drops, making them unreliable for consistent income. The current yield of 5.56% lags behind the top tier in Portugal, but its price-to-earnings ratio of 8.5x indicates potential value compared to the market average of 12.2x amidst recent earnings growth of 40.2%.

- Dive into the specifics of Toyota Caetano Portugal here with our thorough dividend report.

- According our valuation report, there's an indication that Toyota Caetano Portugal's share price might be on the expensive side.

Julius Bär Gruppe (SWX:BAER)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Julius Bär Gruppe AG offers wealth management solutions across Switzerland, Europe, the Americas, Asia, and internationally with a market cap of CHF12.34 billion.

Operations: Julius Bär Gruppe AG generates revenue primarily from its Private Banking segment, which amounted to CHF3.86 billion.

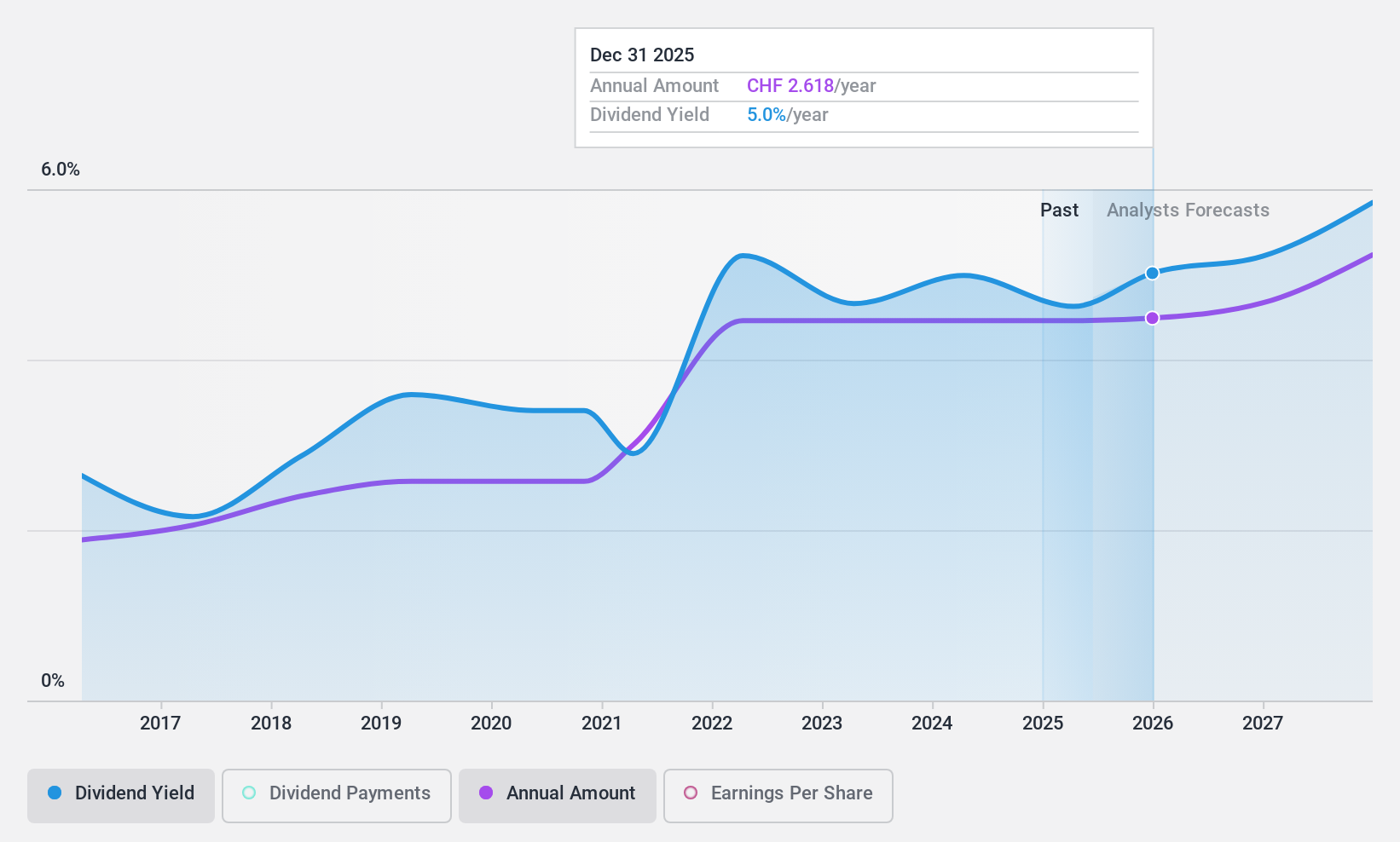

Dividend Yield: 4.3%

Julius Bär Gruppe offers a stable dividend, proposing CHF 2.60 per share for 2024, subject to approval. With a payout ratio of 52.2%, dividends are well covered by earnings and forecasted to remain so in three years at 49.7%. The yield of 4.31% ranks it in the top quartile in Switzerland, though high bad loans (2.1%) pose a risk. Recent $400 million fixed-income offerings and leadership changes could impact future strategies.

- Click to explore a detailed breakdown of our findings in Julius Bär Gruppe's dividend report.

- Our comprehensive valuation report raises the possibility that Julius Bär Gruppe is priced lower than what may be justified by its financials.

Seize The Opportunity

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 212 more companies for you to explore.Click here to unveil our expertly curated list of 215 Top European Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CABK

CaixaBank

Provides various banking products and financial services in Spain and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives