- Switzerland

- /

- Capital Markets

- /

- SWX:LEON

October 2024 Growth Companies With High Insider Ownership On SIX Swiss Exchange

Reviewed by Simply Wall St

The Swiss market showed resilience recently, with the benchmark SMI managing to edge slightly higher despite a challenging start to the trading session. In this context of fluctuating market conditions, identifying growth companies with high insider ownership can be particularly appealing as it often indicates confidence in the company's potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 24.1% |

| VAT Group (SWX:VACN) | 10.2% | 22.5% |

| Addex Therapeutics (SWX:ADXN) | 19% | 33.3% |

| Straumann Holding (SWX:STMN) | 32.7% | 21.8% |

| LEM Holding (SWX:LEHN) | 29.9% | 18.4% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 12.6% |

| Temenos (SWX:TEMN) | 21.8% | 14.4% |

| Partners Group Holding (SWX:PGHN) | 17% | 14.5% |

| Hocn (SWX:HOCN) | 14.6% | 122.2% |

| Sensirion Holding (SWX:SENS) | 19.9% | 102.7% |

Underneath we present a selection of stocks filtered out by our screen.

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

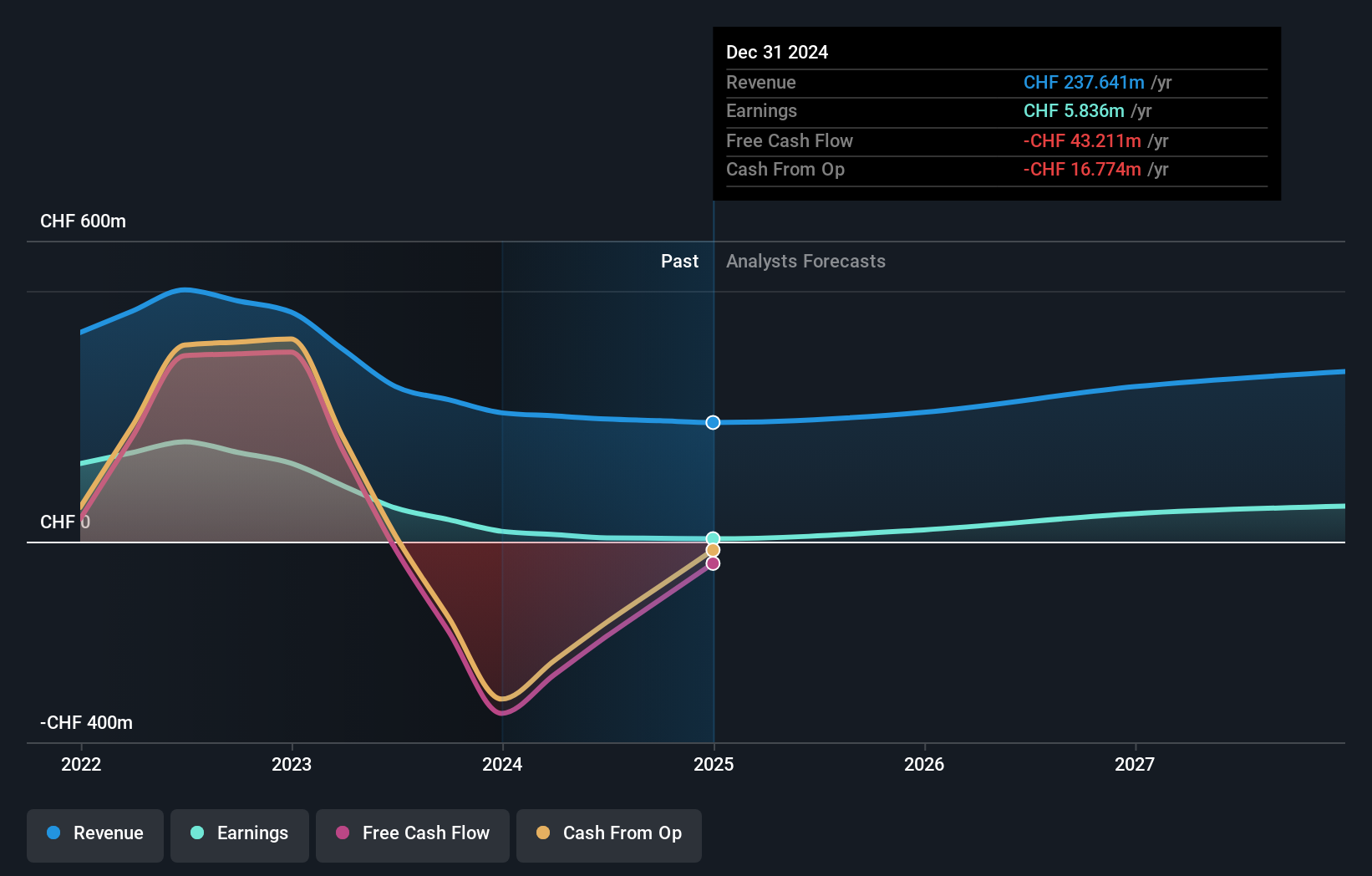

Overview: Leonteq AG offers structured investment products and long-term savings and retirement solutions across Switzerland, Europe, and Asia including the Middle East, with a market cap of CHF484.43 million.

Operations: Leonteq's revenue is primarily derived from structured investment products and long-term savings and retirement solutions across Switzerland, Europe, and Asia including the Middle East.

Insider Ownership: 11.9%

Leonteq AG, with significant insider ownership, is positioned for strong earnings growth, forecasted at 35.1% annually, outpacing the Swiss market's 11.7%. Despite a decline in recent financial results—revenue of CHF 133.4 million and net income of CHF 15.7 million for H1 2024—the company trades well below its estimated fair value and maintains manageable debt levels. However, profit margins have decreased significantly from last year’s figures, indicating potential challenges ahead.

- Delve into the full analysis future growth report here for a deeper understanding of Leonteq.

- Our expertly prepared valuation report Leonteq implies its share price may be too high.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide, with a market cap of CHF4.31 billion.

Operations: The company's revenue is derived from two main segments: Product, accounting for $879.99 million, and Services, contributing $132.98 million.

Insider Ownership: 21.8%

Temenos, with significant insider ownership, is poised for moderate earnings growth at 14.4% annually, surpassing the Swiss market's 11.7%. Despite a high debt level and slower revenue growth forecast of 7.6%, recent executive appointments aim to enhance its SaaS and US market presence. The company completed a CHF 200 million share buyback, reflecting confidence in its valuation, which stands at 24.6% below estimated fair value amidst discussions on selling its fund management unit for EUR 600 million.

- Navigate through the intricacies of Temenos with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Temenos' current price could be quite moderate.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: V-ZUG Holding AG develops, manufactures, markets, sells, and services kitchen and laundry appliances for private households in Switzerland and internationally, with a market cap of CHF348.43 million.

Operations: The company's revenue segment includes household appliances, generating CHF571.35 million.

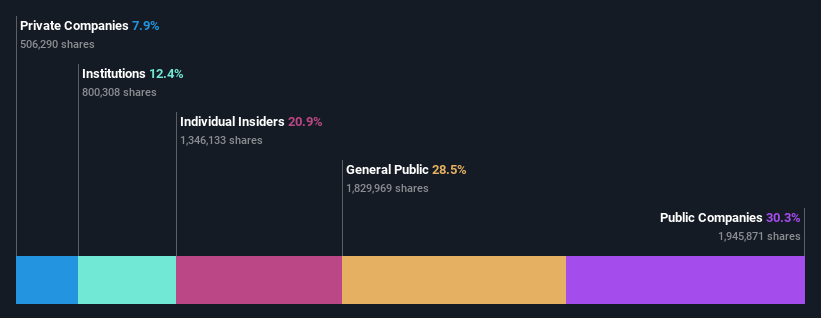

Insider Ownership: 20.9%

V-ZUG Holding, with substantial insider ownership, is set for significant earnings growth at 38.7% annually over the next three years, outpacing the Swiss market's 11.7%. Despite a modest revenue growth forecast of 4.4%, recent half-year results showed improved net income of CHF 8.73 million from CHF 4.33 million previously. Trading at a considerable discount to its estimated fair value enhances its appeal despite low future return on equity projections of 7.5%.

- Click here to discover the nuances of V-ZUG Holding with our detailed analytical future growth report.

- According our valuation report, there's an indication that V-ZUG Holding's share price might be on the cheaper side.

Next Steps

- Dive into all 13 of the Fast Growing SIX Swiss Exchange Companies With High Insider Ownership we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEON

Leonteq

Provides structured investment products and long-term savings and retirement solutions in Switzerland, Europe, and Asia including the Middle East.

Moderate with reasonable growth potential.