- Switzerland

- /

- Consumer Finance

- /

- SWX:CMBN

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence dipping and European stocks showing modest gains, investors are increasingly looking toward stable income sources like dividend stocks. In such an environment, selecting companies with strong fundamentals and consistent dividend payouts can offer a measure of stability and potential income in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

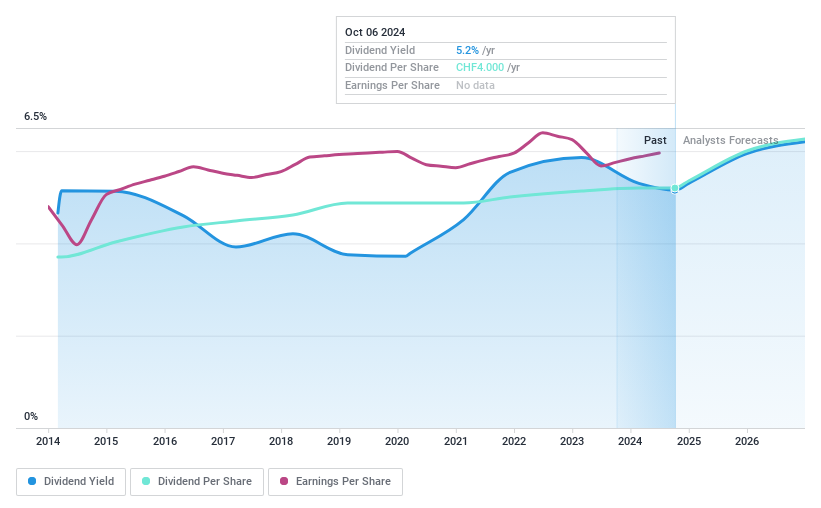

Cembra Money Bank (SWX:CMBN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cembra Money Bank AG offers consumer finance products and services in Switzerland with a market cap of CHF2.40 billion.

Operations: Cembra Money Bank AG generates revenue through its consumer finance products and services offered in Switzerland.

Dividend Yield: 4.8%

Cembra Money Bank offers a compelling dividend profile with a high yield of 4.77%, placing it in the top 25% of Swiss dividend payers. Its dividends have been stable and growing over the past decade, supported by a sustainable payout ratio currently at 72.7%. Future earnings forecasts suggest continued coverage, maintaining reliability. Trading at 24.9% below estimated fair value enhances its attractiveness for income-focused investors seeking stability and growth potential in dividends.

- Unlock comprehensive insights into our analysis of Cembra Money Bank stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Cembra Money Bank is priced lower than what may be justified by its financials.

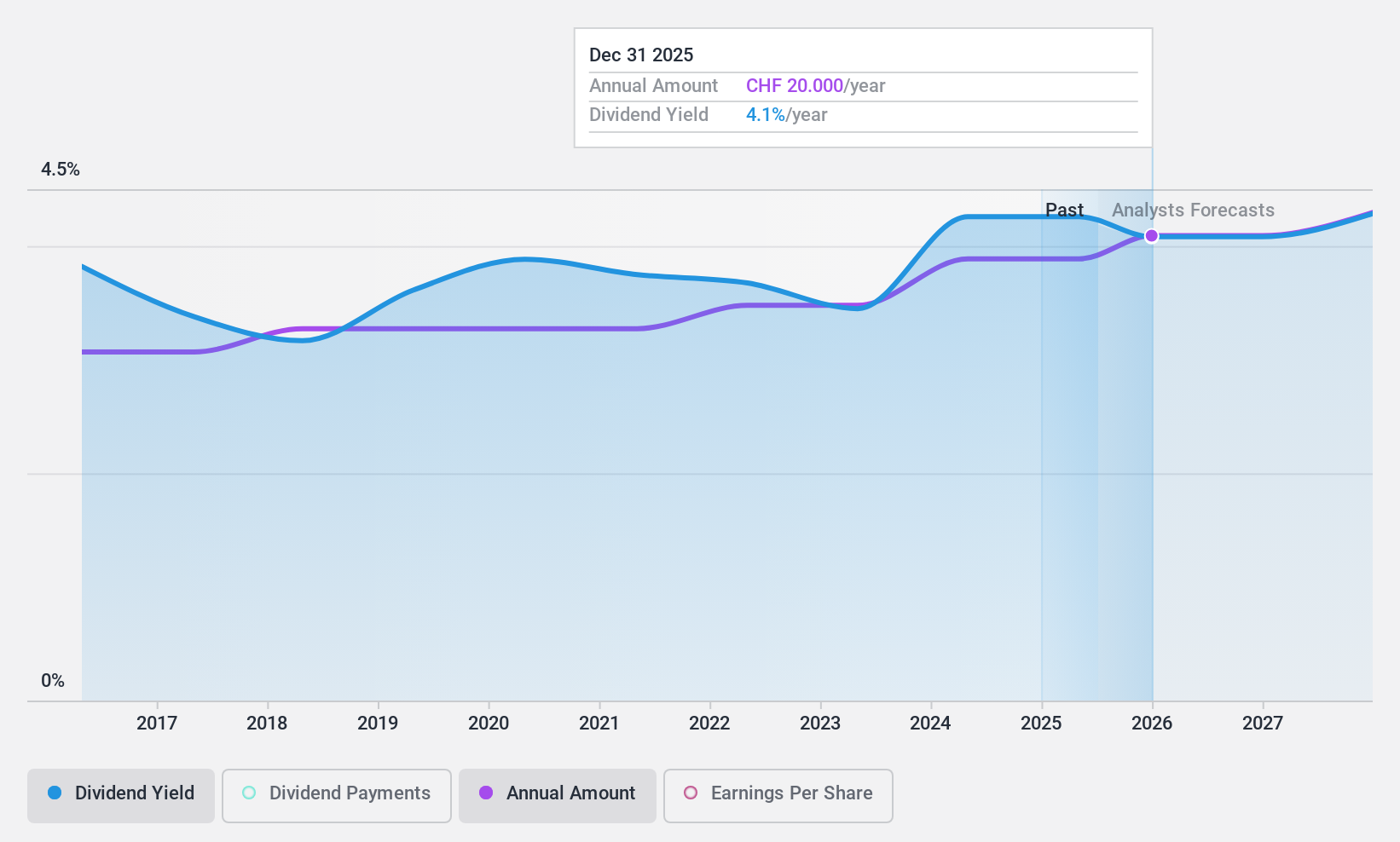

St. Galler Kantonalbank (SWX:SGKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: St. Galler Kantonalbank AG is a cantonal bank offering banking products and services to the local population and small to medium-sized enterprises in the Cantons of St. Gallen, with a market cap of CHF2.62 billion.

Operations: St. Galler Kantonalbank AG generates revenue through its provision of banking products and services tailored for individuals and SMEs in the Cantons of St. Gallen.

Dividend Yield: 4.3%

St. Galler Kantonalbank provides a stable dividend profile, with payments growing over the last decade and currently yielding 4.25%. Although not among the top Swiss dividend payers, its dividends are reliably covered by earnings with a payout ratio of 57.1%, projected to improve to 52.1% in three years. The stock trades at a discount of 30.7% below estimated fair value, offering potential value for investors prioritizing consistent income streams.

- Navigate through the intricacies of St. Galler Kantonalbank with our comprehensive dividend report here.

- The valuation report we've compiled suggests that St. Galler Kantonalbank's current price could be quite moderate.

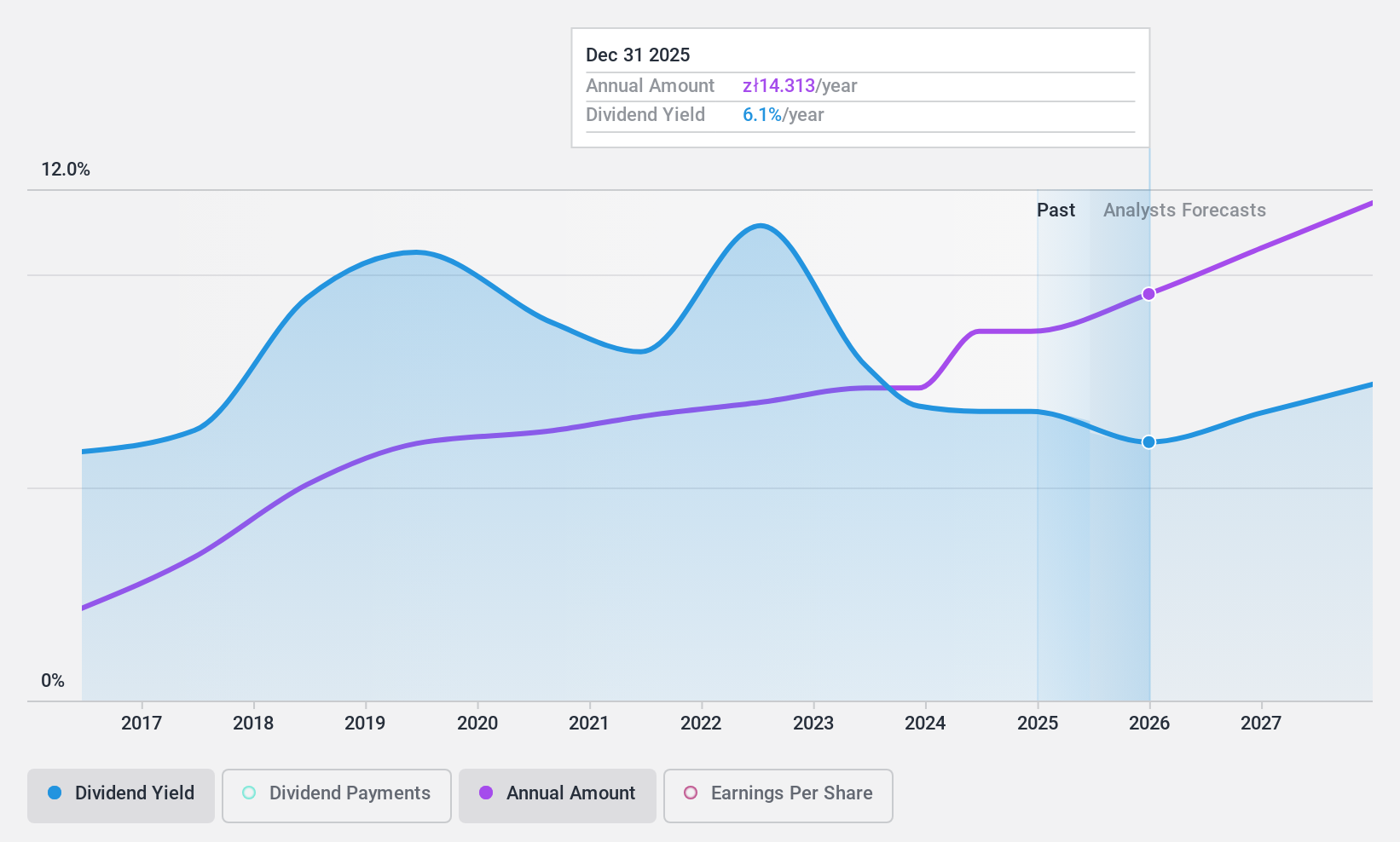

Dom Development (WSE:DOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dom Development S.A. operates in Poland, focusing on the development and sale of residential and commercial real estate properties along with related support activities, with a market cap of PLN4.84 billion.

Operations: Dom Development S.A. generates revenue of PLN2.80 billion from its residential and commercial real estate development and sales activities in Poland.

Dividend Yield: 6.8%

Dom Development has consistently grown its dividends over the past decade, supported by strong earnings and cash flow coverage with payout ratios of 33.8% and 74.2%, respectively. Despite a dividend yield of 6.84%, which is lower than the top Polish payers, its stable payments are well-supported by recent earnings growth, as shown in Q3 results where net income rose to PLN 64.68 million from PLN 37.71 million year-on-year.

- Click here to discover the nuances of Dom Development with our detailed analytical dividend report.

- According our valuation report, there's an indication that Dom Development's share price might be on the expensive side.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1982 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CMBN

Cembra Money Bank

Provides consumer finance products and services in Switzerland.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives