- United Kingdom

- /

- Consumer Finance

- /

- LSE:IPF

Three Undervalued Small Caps In Global With Insider Action

Reviewed by Simply Wall St

In a week marked by volatility, U.S. stocks rebounded despite concerns over regional banking issues and credit market risks, with dovish signals from the Federal Reserve providing some relief to investors. Amidst these broader market dynamics, small-cap stocks present intriguing opportunities as they often offer growth potential that can be overlooked in more turbulent times. Identifying promising small-cap companies involves looking at factors such as strong fundamentals and recent insider activity, which may indicate confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 16.7x | 4.1x | 20.58% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 30.31% | ★★★★★☆ |

| Senior | 24.9x | 0.8x | 26.26% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.02% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.6x | 1.7x | 21.58% | ★★★★☆☆ |

| Eastnine | 15.8x | 8.3x | 35.42% | ★★★★☆☆ |

| Sagicor Financial | 7.1x | 0.4x | -71.06% | ★★★★☆☆ |

| Bumitama Agri | 11.1x | 1.6x | 45.71% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -431.88% | ★★★☆☆☆ |

| GDI Integrated Facility Services | 19.0x | 0.3x | -0.31% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

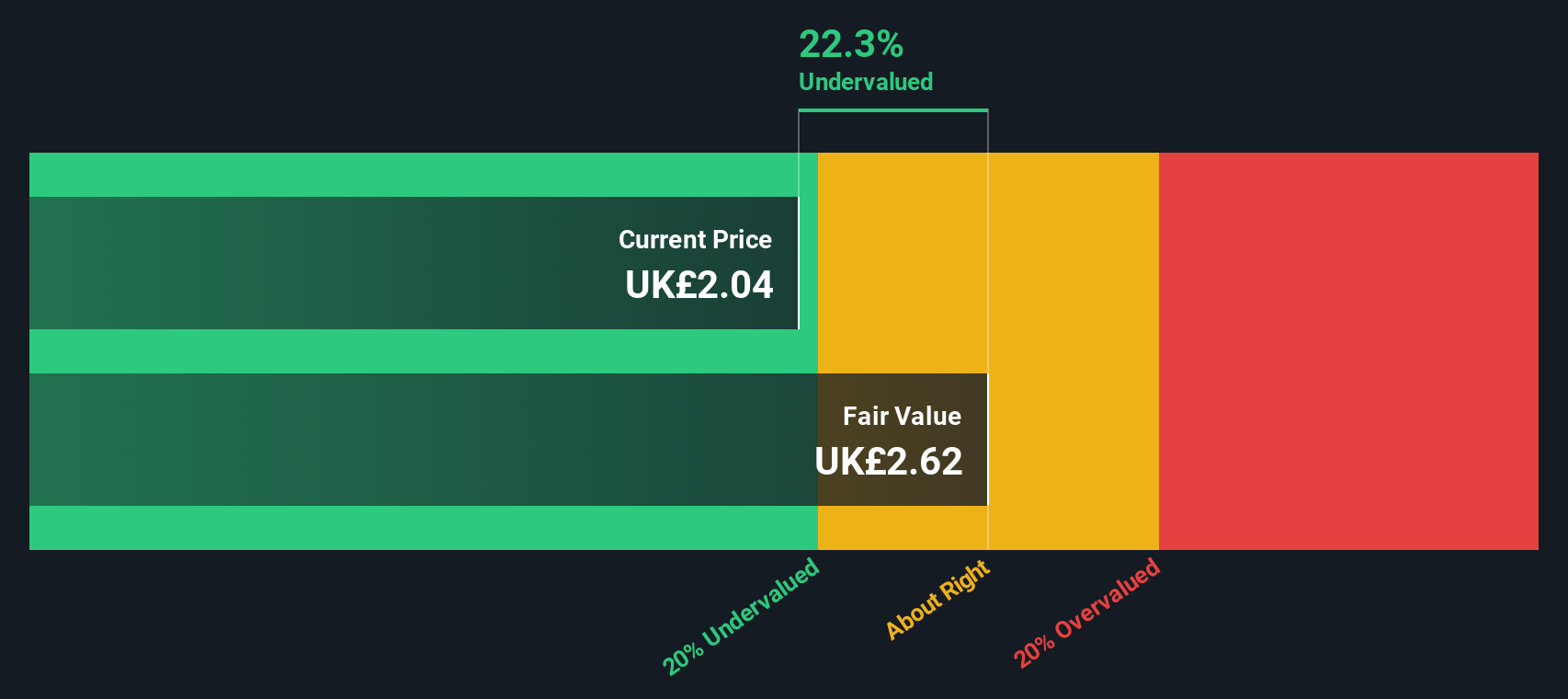

International Personal Finance (LSE:IPF)

Simply Wall St Value Rating: ★★★★★☆

Overview: International Personal Finance operates in the consumer credit sector, offering digital and home credit services across various regions, with a market cap of £0.53 billion.

Operations: The company generates revenue primarily from its three segments: IPF Digital, Mexico Home Credit, and European Home Credit. Over the years, the gross profit margin has shown fluctuations, with a notable peak at 89.76% in December 2021 before experiencing a decline to 77.94% by December 2023. Operating expenses have consistently been a significant cost component, impacting net income margins which have varied over time but reached as high as 10.28% in June 2025.

PE: 6.3x

International Personal Finance, a company recently added to the FTSE 250 and 350 indices, has been in the spotlight due to ongoing acquisition talks with BasePoint Capital. The proposed offer values IPF shares at £2.238 each, including dividends, reflecting a premium over recent trading prices. Despite a dip in sales to £347.8 million for H1 2025 from the previous year, net income rose significantly to £31 million. Insider confidence is evident as key stakeholders engage in strategic discussions about potential buyouts and future growth prospects remain under evaluation amidst these developments.

GDI Integrated Facility Services (TSX:GDI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: GDI Integrated Facility Services provides comprehensive facility management and maintenance services across North America, with a market cap of approximately CA$1.15 billion.

Operations: The company generates revenue primarily from Technical Services, Business Services USA, and Business Services Canada. Gross profit margin has shown variability over time, with recent figures around 18.61%. Operating expenses are a significant component of the cost structure, especially General & Administrative Expenses which have consistently been substantial across periods.

PE: 19.0x

GDI Integrated Facility Services, a smaller company in its sector, shows potential despite some financial challenges. Earnings are expected to grow by 11.77% annually, although interest payments aren't fully covered by earnings and funding relies entirely on external borrowing. Recent results for the second quarter ending June 30, 2025, showed sales of CAD 610 million with a net loss of CAD 1 million compared to the previous year's profit. However, insider confidence is evident as insiders have been purchasing shares over recent months.

Mullen Group (TSX:MTL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mullen Group is a leading Canadian logistics company specializing in transportation and oilfield services, with a market capitalization of approximately CA$1.38 billion.

Operations: Mullen Group's revenue is primarily derived from its operations, with a significant portion allocated to cost of goods sold (COGS), which consistently exceeds CA$1 billion. The company's gross profit margin has fluctuated over the years, reaching 30.10% in September 2025. Operating expenses are substantial, often exceeding CA$400 million, impacting net income margins that have varied notably over time.

PE: 13.1x

Mullen Group, a smaller company with potential for growth, is actively seeking acquisitions to diversify its revenue streams. Despite reporting CAD 561.72 million in Q3 sales, net income dipped to CAD 33.21 million from the previous year's CAD 38.35 million. The company's strategy focuses on expanding into new verticals as economic conditions improve, leveraging record cash flows and a strong balance sheet for future investments. A consistent monthly dividend of CAD 0.07 per share underscores their financial commitment to shareholders amidst these strategic moves.

- Click here to discover the nuances of Mullen Group with our detailed analytical valuation report.

Review our historical performance report to gain insights into Mullen Group's's past performance.

Turning Ideas Into Actions

- Gain an insight into the universe of 114 Undervalued Global Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IPF

International Personal Finance

Engages in financial services business in Europe and Mexico.

Undervalued with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)