3 TSX Stocks That May Be Trading Below Intrinsic Value By Up To 45.2%

Reviewed by Simply Wall St

The Canadian market has been experiencing sideways consolidation in recent months, which may act as a corrective force amidst policy uncertainty and trade worries that keep volatility elevated. In this environment, identifying stocks that are potentially trading below their intrinsic value can be an effective strategy for investors looking to fortify their portfolios against short-term market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Peyto Exploration & Development (TSX:PEY) | CA$15.24 | CA$28.72 | 46.9% |

| Docebo (TSX:DCBO) | CA$48.05 | CA$87.19 | 44.9% |

| Decisive Dividend (TSXV:DE) | CA$6.10 | CA$11.33 | 46.2% |

| Major Drilling Group International (TSX:MDI) | CA$8.07 | CA$14.72 | 45.2% |

| Groupe Dynamite (TSX:GRGD) | CA$15.20 | CA$27.53 | 44.8% |

| Thunderbird Entertainment Group (TSXV:TBRD) | CA$1.85 | CA$3.33 | 44.4% |

| Electrovaya (TSX:ELVA) | CA$3.02 | CA$5.83 | 48.2% |

| Quisitive Technology Solutions (TSXV:QUIS) | CA$0.565 | CA$1.06 | 46.7% |

| NuVista Energy (TSX:NVA) | CA$11.18 | CA$20.00 | 44.1% |

| Condor Energies (TSX:CDR) | CA$1.76 | CA$3.45 | 49% |

We're going to check out a few of the best picks from our screener tool.

Major Drilling Group International (TSX:MDI)

Overview: Major Drilling Group International Inc. offers contract drilling services to mining and mineral exploration companies across multiple continents, with a market cap of CA$672.76 million.

Operations: The company's revenue from its contract drilling services amounts to CA$680.16 million.

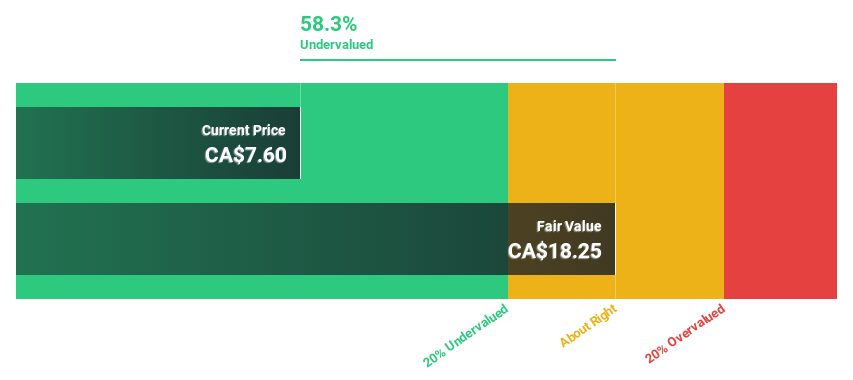

Estimated Discount To Fair Value: 45.2%

Major Drilling Group International is trading at CA$8.07, significantly below its estimated fair value of CA$14.72, indicating potential undervaluation based on cash flows. Forecasted earnings growth of 47.4% per year surpasses the Canadian market's growth rate of 15.8%. Despite a recent decline in profit margins from 9.8% to 6.1%, the company is implementing strategic leadership changes to enhance operational efficiency and support organic growth, reinforcing its position in the specialized drilling market.

- Upon reviewing our latest growth report, Major Drilling Group International's projected financial performance appears quite optimistic.

- Take a closer look at Major Drilling Group International's balance sheet health here in our report.

Propel Holdings (TSX:PRL)

Overview: Propel Holdings Inc. is a financial technology company with a market capitalization of CA$1.13 billion.

Operations: The company generates revenue of $416.43 million by providing lending-related services to borrowers, banks, and other institutions.

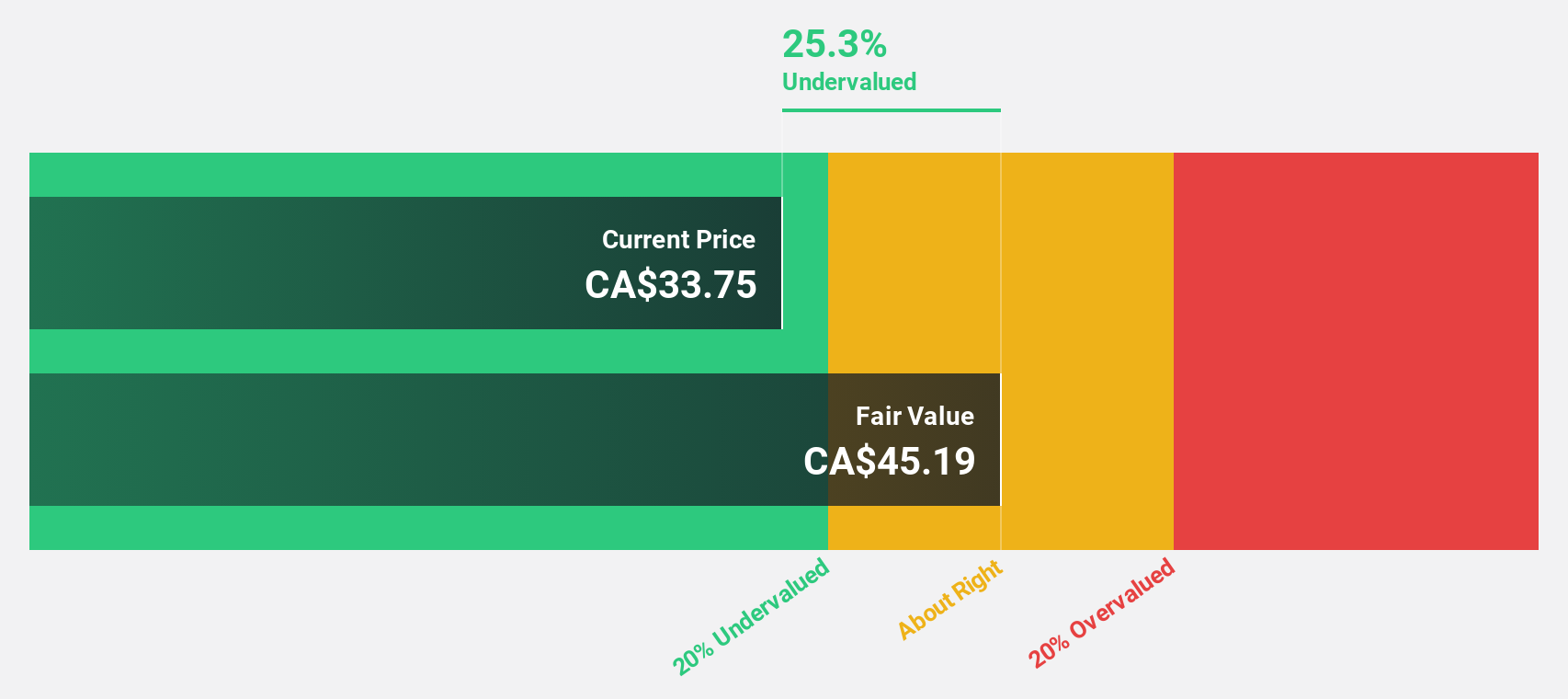

Estimated Discount To Fair Value: 16.8%

Propel Holdings, trading at CA$27.19, is undervalued compared to its estimated fair value of CA$32.7. Its revenue is projected to grow 25.3% annually, outpacing the Canadian market's 5.1%. Earnings are expected to rise significantly at 36.2% per year over the next three years, despite high non-cash earnings and significant insider selling recently. Moreover, analysts anticipate a price increase of 68%, while dividends have been increased by 10%, reflecting ongoing financial strength and growth potential.

- Insights from our recent growth report point to a promising forecast for Propel Holdings' business outlook.

- Navigate through the intricacies of Propel Holdings with our comprehensive financial health report here.

Kraken Robotics (TSXV:PNG)

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally; it has a market cap of CA$596.51 million.

Operations: Kraken Robotics generates revenue through its Products segment, which accounts for CA$67.40 million, and its Services segment, contributing CA$23.79 million.

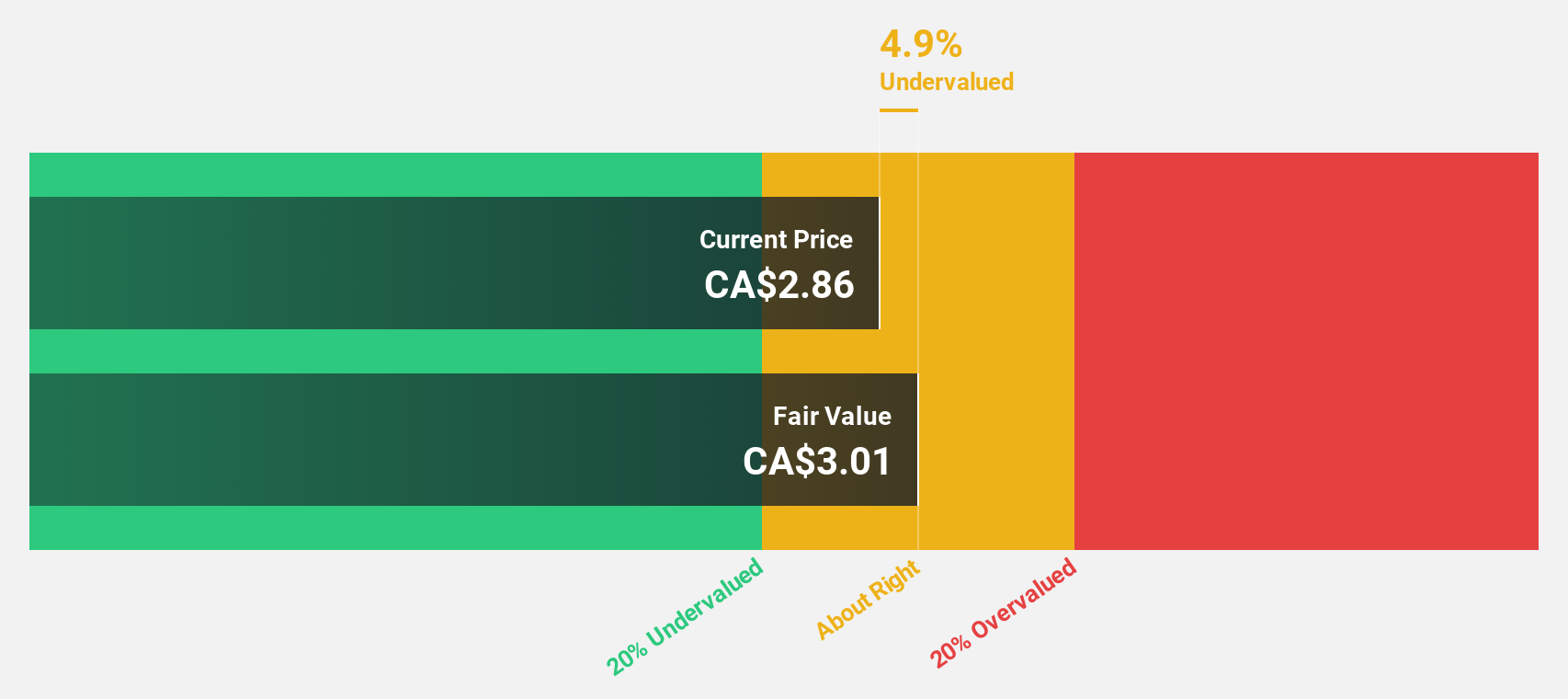

Estimated Discount To Fair Value: 12.6%

Kraken Robotics, trading at CA$2.14, is undervalued relative to its fair value of CA$2.45. Earnings are forecast to grow significantly at 43.65% annually, surpassing the Canadian market's growth rate of 15.8%. Despite past shareholder dilution, analysts expect a price increase of 58.4%. Recent orders totaling $34 million for SeaPower batteries and plans for a new production facility highlight rising demand in defense markets, supporting future cash flow potential and operational expansion.

- The growth report we've compiled suggests that Kraken Robotics' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Kraken Robotics stock in this financial health report.

Next Steps

- Embark on your investment journey to our 28 Undervalued TSX Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraken Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives