- Canada

- /

- Communications

- /

- TSX:ET

Three Undiscovered Canadian Gems with Strong Potential

Reviewed by Simply Wall St

The Canadian market has experienced notable volatility recently, with a near 5% pullback in August followed by an impressive recovery, buoyed by positive earnings growth and a resilient economy. As the focus shifts from tech heavyweights to broader market opportunities, investors are increasingly looking at small-cap stocks that could benefit from the evolving conditions. In this context, we explore three undiscovered Canadian gems with strong potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Jaguar Mining | 1.19% | 5.49% | 5.12% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally with a market cap of CA$1.05 billion.

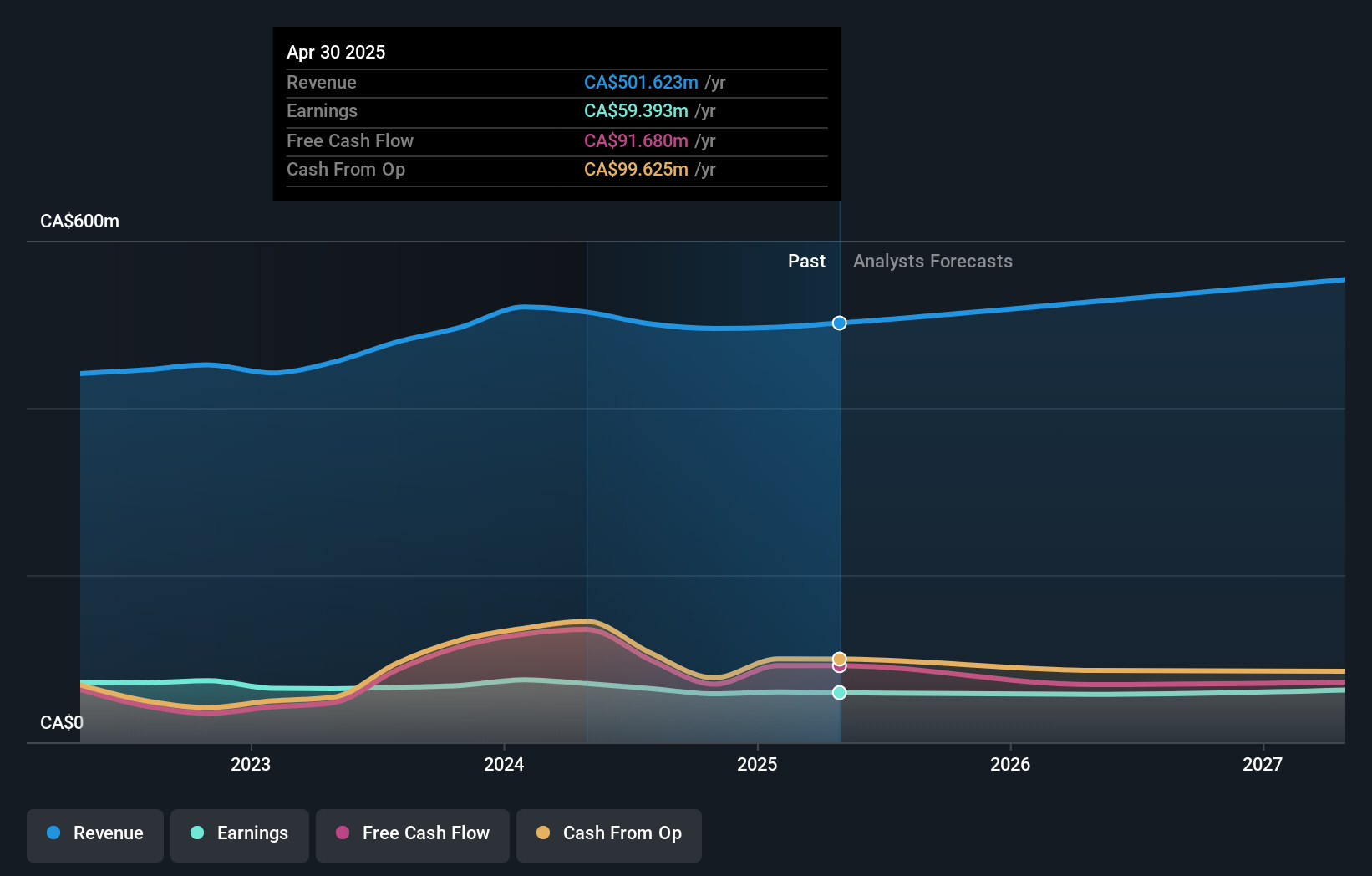

Operations: Evertz Technologies generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$514.62 million. The company's financial performance includes a detailed breakdown of costs and revenue streams.

Evertz Technologies, a noteworthy player in the communications sector, boasts no debt and solid earnings growth of 9.6% over the past year, outperforming its industry’s -4.3%. Trading at 50.6% below its estimated fair value and with high-quality past earnings, ET is profitable with free cash flow positive status. Despite a dip in Q4 sales to C$122.77 million from C$128.92 million last year, full-year sales rose to C$514.62 million from C$454.58 million previously.

- Navigate through the intricacies of Evertz Technologies with our comprehensive health report here.

Explore historical data to track Evertz Technologies' performance over time in our Past section.

Jaguar Mining (TSX:JAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Jaguar Mining Inc. is a junior gold mining company focused on the acquisition, exploration, development, and operation of gold mineral properties in Brazil with a market cap of CA$405.23 million.

Operations: Jaguar Mining generates revenue primarily from its gold-producing properties, amounting to $144.85 million. The company has a market cap of CA$405.23 million.

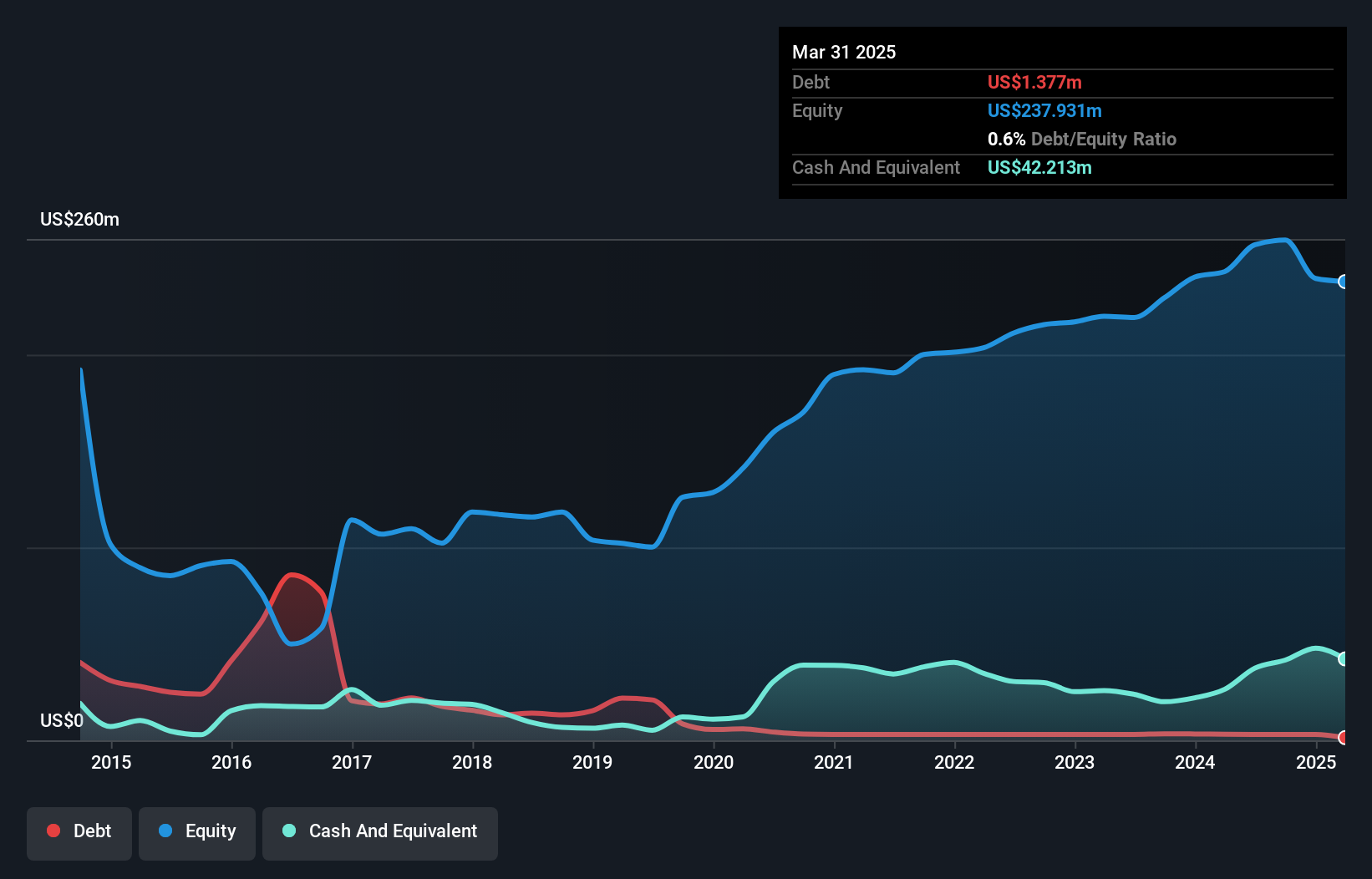

Jaguar Mining has shown impressive earnings growth of 58.9% over the past year, outpacing the Metals and Mining industry’s 1.2%. The company’s price-to-earnings ratio of 9.6x is notably lower than the Canadian market average of 15.1x, indicating potential value for investors. Recent developments include higher-grade production from its BA zone at Pilar mine, contributing to a net income of US$13.47 million in Q2 2024 compared to a net loss last year.

- Delve into the full analysis health report here for a deeper understanding of Jaguar Mining.

Examine Jaguar Mining's past performance report to understand how it has performed in the past.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.18 billion.

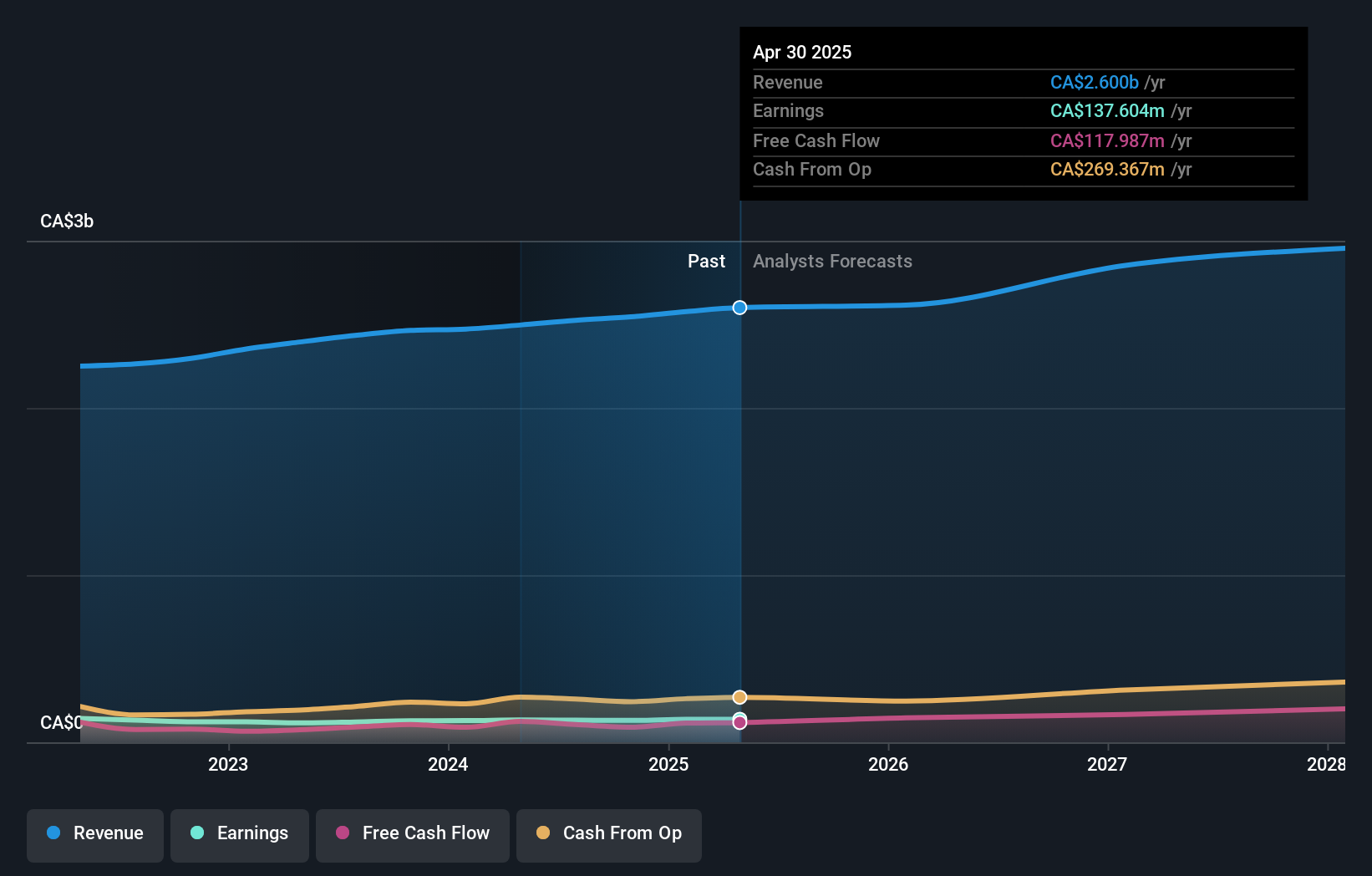

Operations: North West generates CA$2.52 billion in revenue from retailing food and everyday products and services. The company operates with a market cap of CA$2.18 billion.

North West's recent earnings report shows sales at CAD 646.49 million for Q2, up from CAD 618.1 million a year ago, while net income was slightly lower at CAD 35.3 million compared to CAD 36.78 million previously. The company also announced a quarterly dividend increase to $0.40 per share. Trading at 41.9% below its estimated fair value and with high-quality earnings, North West has reduced its debt to equity ratio from 96.7% to 43.2% over the past five years and maintains an EBIT coverage of interest payments by 10.9x.

- Dive into the specifics of North West here with our thorough health report.

Understand North West's track record by examining our Past report.

Seize The Opportunity

- Investigate our full lineup of 46 TSX Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet and undervalued.