Unfortunately for shareholders, when Sixty Six Capital Inc. (CSE:SIX) reported results for the period to December 2020, its auditors, Davidson & Company, expressed uncertainty about whether it can continue as a going concern. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

Check out our latest analysis for Sixty Six Capital

How Much Debt Does Sixty Six Capital Carry?

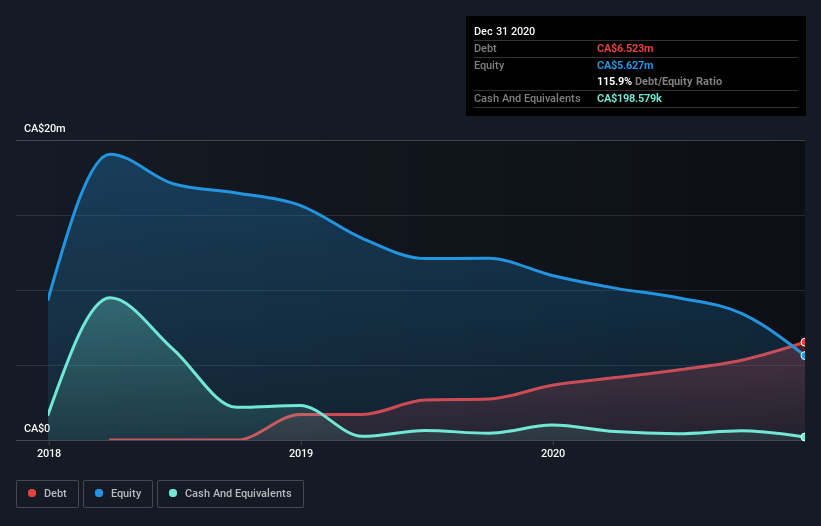

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Sixty Six Capital had CA$6.52m of debt, an increase on CA$3.65m, over one year. However, it does have CA$198.6k in cash offsetting this, leading to net debt of about CA$6.32m.

A Look At Sixty Six Capital's Liabilities

We can see from the most recent balance sheet that Sixty Six Capital had liabilities of CA$3.73m falling due within a year, and liabilities of CA$9.94m due beyond that. Offsetting this, it had CA$198.6k in cash and CA$1.21m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$12.3m.

Sixty Six Capital has a market capitalization of CA$23.5m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. There's no doubt that we learn most about debt from the balance sheet. But it is Sixty Six Capital's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Sixty Six Capital had a loss before interest and tax, and actually shrunk its revenue by 15%, to CA$3.6m. We would much prefer see growth.

Caveat Emptor

While Sixty Six Capital's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable CA$4.2m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled CA$5.8m in negative free cash flow over the last twelve months. So in short it's a really risky stock. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 6 warning signs with Sixty Six Capital (at least 3 which make us uncomfortable) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:SIX

Moderate risk with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026