- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

Undervalued Small Caps In Canada With Insider Buying

Reviewed by Simply Wall St

The Canadian market has experienced increased volatility recently, driven by concerns over a slowing economy and persistent inflation. Despite these swings, stocks have shown strong gains overall, suggesting opportunities for discerning investors. In this environment, identifying undervalued small-cap stocks with insider buying can be particularly rewarding as they often signal confidence from those closest to the company's operations.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Vermilion Energy | NA | 1.1x | 47.30% | ★★★★★★ |

| Trican Well Service | 7.4x | 0.9x | 16.46% | ★★★★★☆ |

| Flagship Communities Real Estate Investment Trust | 3.7x | 3.9x | 44.69% | ★★★★★☆ |

| Foraco International | 5.2x | 0.5x | -18.05% | ★★★★☆☆ |

| Nexus Industrial REIT | 3.8x | 3.8x | 19.77% | ★★★★☆☆ |

| Rogers Sugar | 15.6x | 0.6x | 47.63% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -57.92% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -35.11% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.5x | 3.3x | 40.10% | ★★★★☆☆ |

| Hemisphere Energy | 5.9x | 2.3x | -203.55% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates in the healthcare real estate industry, managing a portfolio of properties with a market cap of approximately CA$2.80 billion.

Operations: The primary revenue stream is derived from the healthcare real estate industry, with a recent quarterly revenue of CA$523.85 million. The gross profit margin has shown variability, recently at 77.81%. Operating expenses and significant non-operating expenses impact net income, resulting in a net loss of CA$394.40 million for the latest quarter.

PE: -3.4x

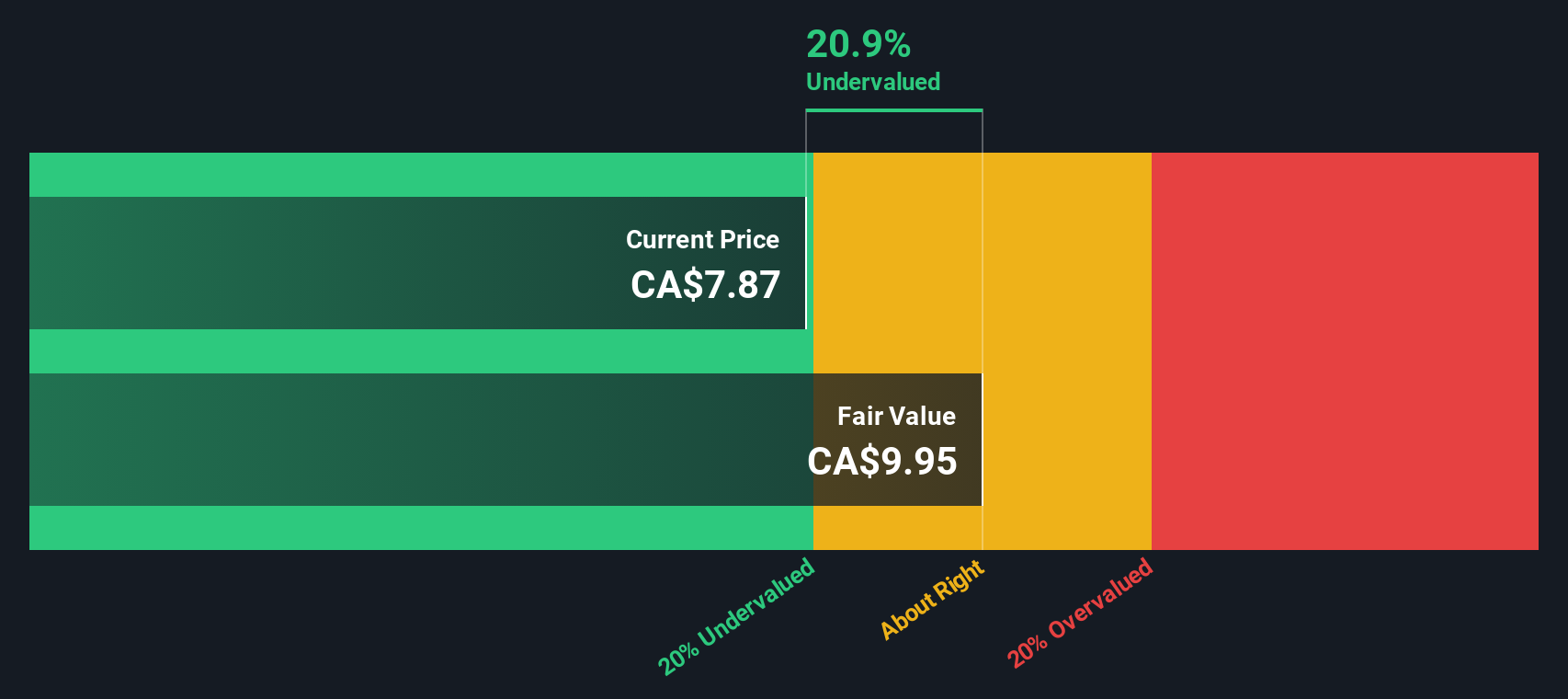

NorthWest Healthcare Properties Real Estate Investment Trust, a smaller Canadian REIT, recently saw insider confidence with Peter Aghar purchasing 100,000 shares for approximately C$477,861. Despite reporting a net loss of C$122 million in Q2 2024 and reduced sales compared to last year, the company continues to declare monthly distributions of C$0.03 per unit. Earnings are forecasted to grow by 117.9% annually, indicating potential future value despite current challenges.

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nexus Industrial REIT focuses on owning and managing a diversified portfolio of industrial properties with a market cap of approximately CA$1.02 billion.

Operations: Nexus Industrial REIT generates revenue primarily from investment properties, with a gross profit margin of 71.56%. The company incurs costs of goods sold (COGS) amounting to CA$47.55 million and operating expenses totaling CA$8.65 million.

PE: 3.8x

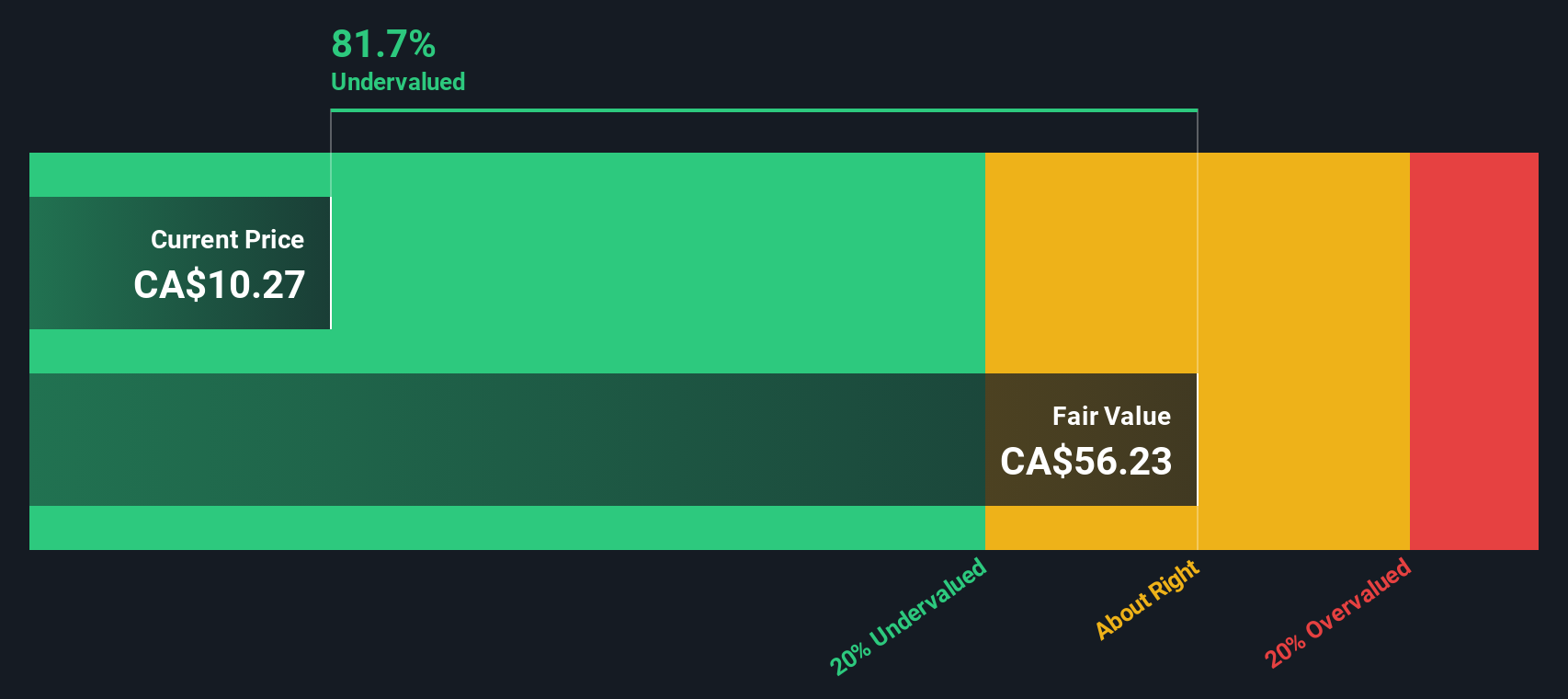

Nexus Industrial REIT, a smaller Canadian stock, has shown mixed financial results. For the second quarter of 2024, sales rose to C$43.91 million from C$38.42 million a year ago, but net income dropped to C$43.53 million from C$77.22 million. Despite this volatility, insider confidence is evident with recent share purchases over the past six months. The company also declared consistent monthly distributions of $0.05333 per unit through November 2024, signaling steady cash flow to investors amidst market fluctuations.

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★★★

Overview: Vermilion Energy is an international oil and gas exploration and production company with a market cap of CA$3.25 billion.

Operations: The company generates revenue primarily from oil and gas exploration and production, totaling CA$1.81 billion. The gross profit margin has shown variability, with the most recent figure at 65.72%.

PE: -2.4x

Vermilion Energy, a Canadian small-cap stock, has recently shown promising developments. In Germany, they completed testing on their first deep gas well at 5,000 meters with flow rates of 17 mmcf/d and high wellhead pressure. Additionally, insider confidence is evident with recent share purchases. Despite reporting a net loss of CAD 82 million in Q2 2024 compared to net income last year, the company continues to repurchase shares and maintain production guidance between 83,000-86,000 boe/d for the year.

- Click here to discover the nuances of Vermilion Energy with our detailed analytical valuation report.

Assess Vermilion Energy's past performance with our detailed historical performance reports.

Summing It All Up

- Access the full spectrum of 18 Undervalued TSX Small Caps With Insider Buying by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest Healthcare Properties Real Estate Investment Trust (TSX: NWH.UN) (Northwest) is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario.

Undervalued with moderate growth potential.