- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

3 Top Undervalued Small Caps In Canada With Insider Action

Reviewed by Simply Wall St

The Canadian market, much like its U.S. counterpart, has experienced a recent downturn amid softening labor market data and economic uncertainties. With the TSX down about 3% from recent highs, investors are increasingly looking at undervalued small-cap stocks that may offer potential growth opportunities despite broader market volatility. In this context, identifying small-cap companies with insider action can be particularly insightful for those seeking to capitalize on potentially overlooked investments in the current economic climate.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.4x | 0.9x | 16.39% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.7x | 20.66% | ★★★★★☆ |

| Flagship Communities Real Estate Investment Trust | 3.6x | 3.8x | 44.29% | ★★★★★☆ |

| VersaBank | 9.8x | 4.0x | 13.71% | ★★★★☆☆ |

| Rogers Sugar | 15.2x | 0.6x | 48.73% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -40.00% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -58.27% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.3x | 3.3x | 40.66% | ★★★★☆☆ |

| BTB Real Estate Investment Trust | 9.7x | 2.4x | 34.32% | ★★★★☆☆ |

| Hemisphere Energy | 5.6x | 2.2x | -190.62% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

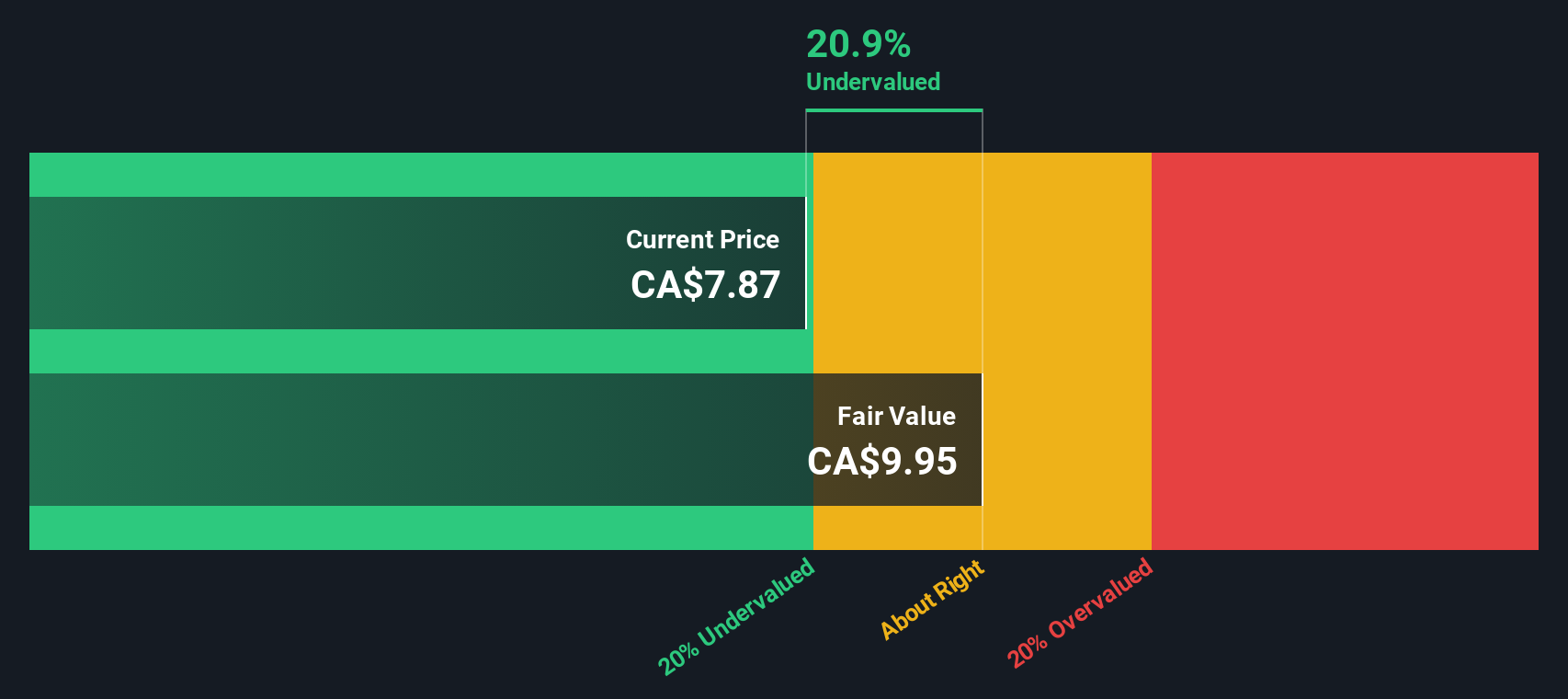

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centerra Gold is a mining company engaged in the exploration, development, and operation of gold and copper properties with a market cap of approximately C$2.34 billion.

Operations: Centerra Gold generates revenue primarily from its Öksüt, Molybdenum, and Mount Milligan segments. The company has experienced fluctuations in its gross profit margin, with recent figures showing a range between 0.14% and 0.44%. Operating expenses have varied significantly over time, impacting net income margins which have ranged from -34.71% to 49.65%.

PE: 10.4x

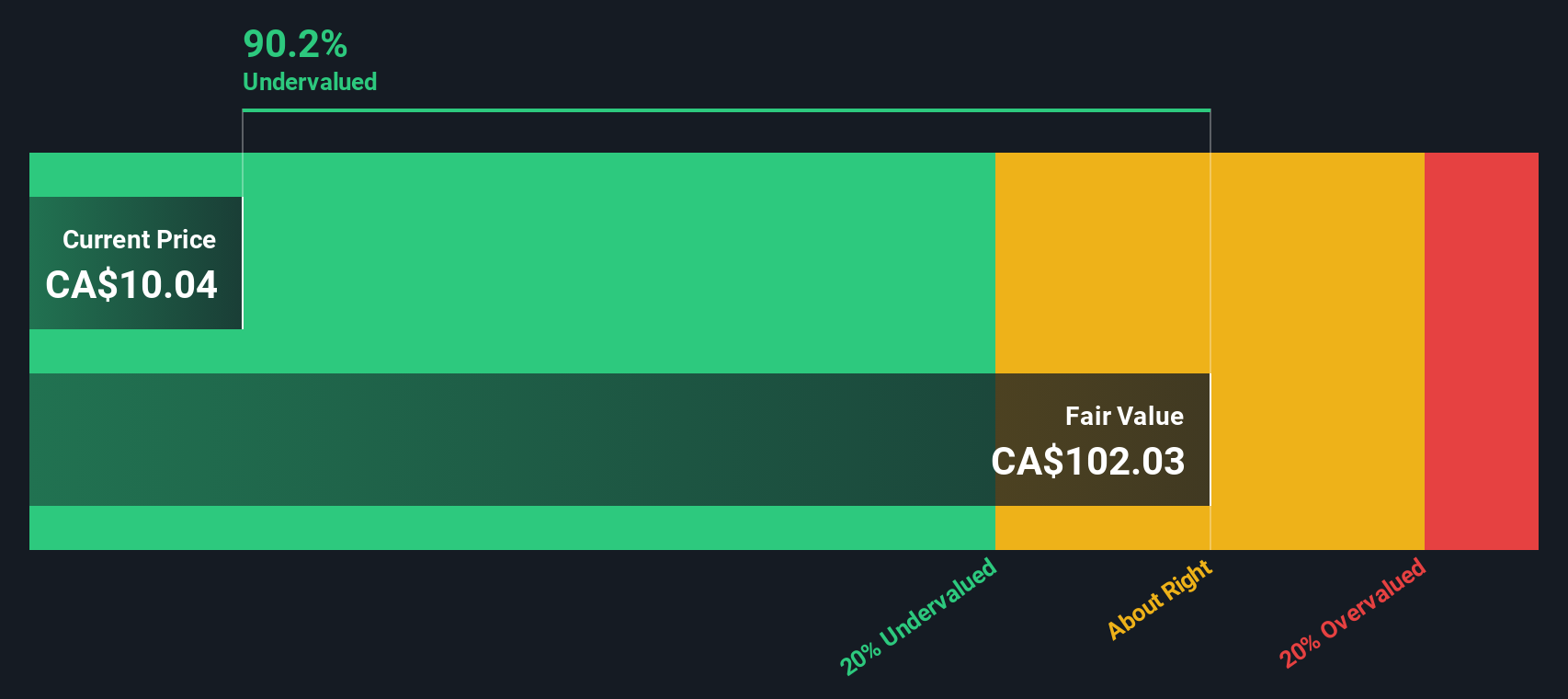

Centerra Gold, a small-cap Canadian miner, reported significant improvements in Q2 2024 earnings with sales of US$282.31 million and net income of US$37.67 million compared to a net loss last year. The company repurchased 1,439,700 shares for $9.8 million from April to June 2024 and announced a quarterly dividend of CAD 0.07 per share payable on August 29, 2024. Insider confidence is evident with recent purchases by executives throughout the year.

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates in the healthcare real estate industry, managing a portfolio of medical office buildings, clinics, and hospitals with a market cap of CA$2.79 billion.

Operations: The company generates revenue primarily from the healthcare real estate industry, with a recent figure of CA$523.85 million. Its gross profit margin has varied, with a notable 0.7781% in the latest period ending June 30, 2024. Operating expenses and non-operating expenses significantly impact net income, resulting in a net loss of CA$394.40 million for the same period.

PE: -3.3x

NorthWest Healthcare Properties Real Estate Investment Trust has seen insider confidence with Peter Aghar purchasing 100,000 shares for C$477,861. Despite reporting a net loss of C$122.34 million in Q2 2024, compared to a smaller loss last year, the company continues to distribute monthly dividends of C$0.03 per unit. With earnings forecasted to grow by 117.9% annually and no customer deposits but relying on external borrowing for funding, NorthWest presents both opportunities and risks for investors seeking undervalued stocks in Canada’s healthcare real estate sector.

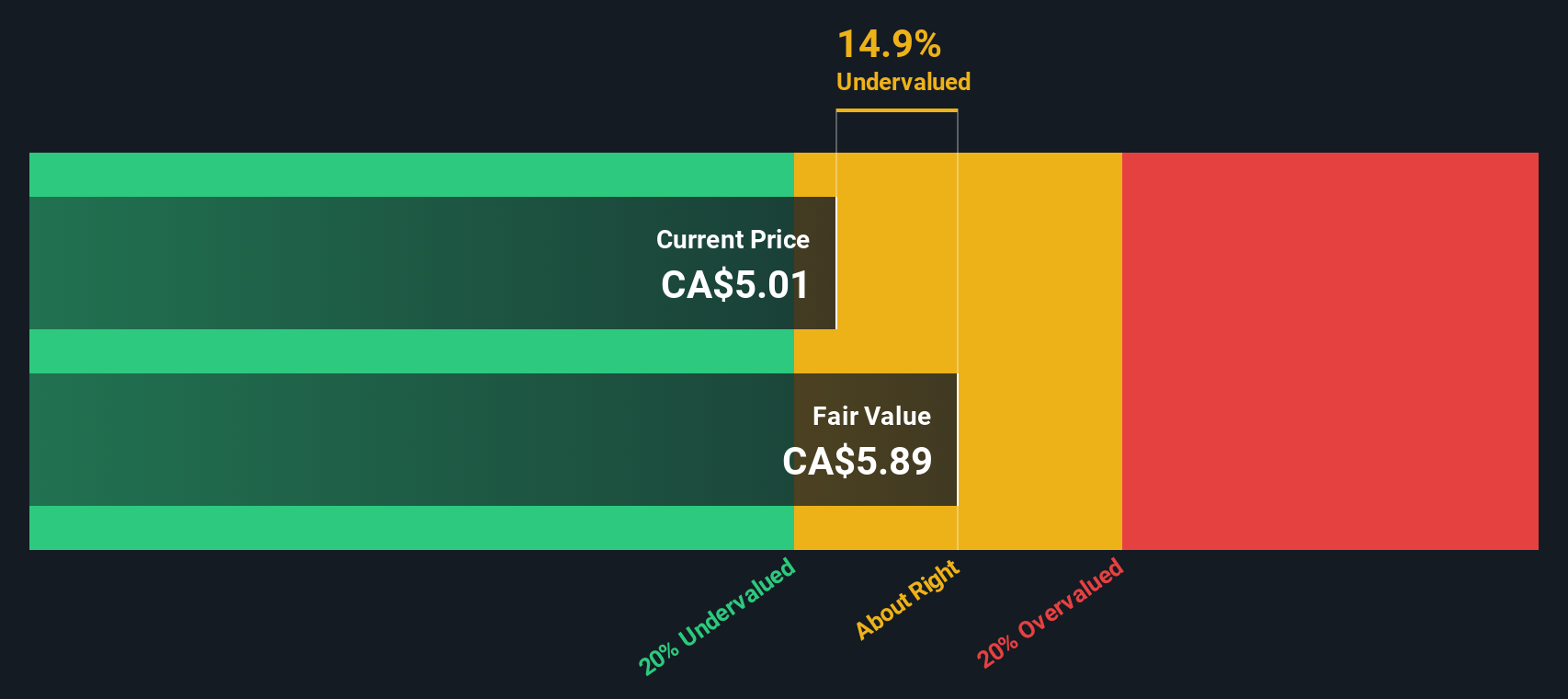

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nexus Industrial REIT is a Canadian real estate investment trust focused on owning and managing industrial properties, with a market cap of approximately CA$1.03 billion.

Operations: Nexus Industrial REIT generates revenue primarily from investment properties, with a recent quarterly revenue of CA$167.21 million and a gross profit margin of 71.56%. The company's cost structure includes COGS at CA$47.55 million and operating expenses at CA$8.65 million, contributing to a net income margin of 99.45%.

PE: 3.7x

Nexus Industrial REIT, a small cap in Canada, has shown insider confidence with significant share purchases over the past six months. Despite earnings forecasted to decline by 46.2% annually for the next three years, recent financials reveal a rise in sales to C$43.91 million for Q2 2024 from C$38.42 million year-over-year. The REIT declared cash distributions of C$0.05333 per unit payable in October and November 2024, maintaining an annualized payout of C$0.64 per unit.

- Click here and access our complete valuation analysis report to understand the dynamics of Nexus Industrial REIT.

Understand Nexus Industrial REIT's track record by examining our Past report.

Summing It All Up

- Embark on your investment journey to our 19 Undervalued TSX Small Caps With Insider Buying selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest Healthcare Properties Real Estate Investment Trust (TSX: NWH.UN) (Northwest) is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario.

Undervalued with moderate growth potential.