### 3 TSX Growth Stocks With High Insider Ownership And Up To 78% Earnings Growth ###

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has dropped 1.6%, but it has risen by 13% over the past year with earnings forecast to grow by 15% annually. In this context, growth companies with high insider ownership can be particularly attractive as they often indicate strong confidence from those closest to the business and potential for significant earnings growth.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.5% | 70.7% |

| Allied Gold (TSX:AAUC) | 22.5% | 73.6% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.3% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Propel Holdings (TSX:PRL) | 40% | 37.2% |

| Ivanhoe Mines (TSX:IVN) | 12.4% | 72.4% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17.9% | 69.5% |

| ROK Resources (TSXV:ROK) | 16.6% | 161.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Curaleaf Holdings (TSX:CURA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Curaleaf Holdings, Inc. operates as a cannabis company in the United States with a market cap of CA$2.99 billion.

Operations: The company generates $1.36 billion from the cultivation, production, distribution, and sale of cannabis.

Insider Ownership: 19.9%

Earnings Growth Forecast: 78.2% p.a.

Curaleaf Holdings is a growth company with high insider ownership, expected to become profitable within three years and forecasted to grow revenue at 12.6% annually, outpacing the Canadian market's 6.8%. Despite recent shareholder dilution and trading at 88.5% below estimated fair value, Curaleaf has expanded its footprint with new dispensaries in Florida and Ohio. The company reported Q2 revenue of US$342.29 million but continues to operate at a net loss, albeit reduced from the previous year.

- Delve into the full analysis future growth report here for a deeper understanding of Curaleaf Holdings.

- According our valuation report, there's an indication that Curaleaf Holdings' share price might be on the cheaper side.

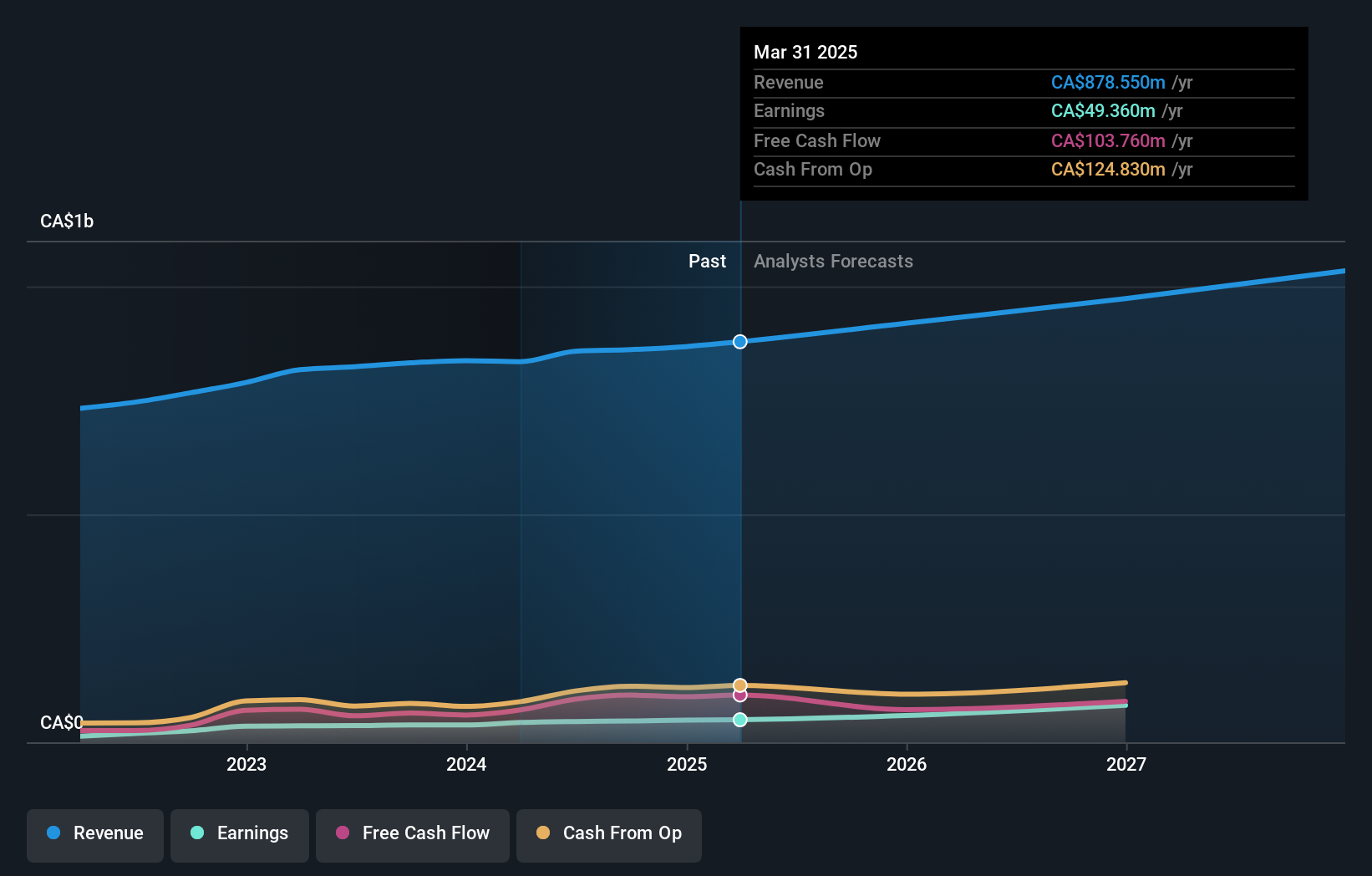

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation, with a market cap of CA$1.43 billion, provides accessibility solutions for the elderly and physically challenged in Canada, the United States, Europe, and internationally.

Operations: The company generates revenue primarily from Patient Care (CA$183.98 million) and Segment Adjustment (CA$673.74 million).

Insider Ownership: 19.6%

Earnings Growth Forecast: 21.5% p.a.

Savaria Corporation, with strong insider ownership, has seen its earnings grow by 22.8% over the past year and is forecasted to increase profits by 21.5% annually, outpacing the Canadian market's growth rate. Recent Q2 results showed a revenue of C$221.34 million and net income of C$10.96 million, both up from last year. Despite some shareholder dilution and large one-off items impacting financials, Savaria trades significantly below its estimated fair value and maintains a reliable dividend policy.

- Click here and access our complete growth analysis report to understand the dynamics of Savaria.

- In light of our recent valuation report, it seems possible that Savaria is trading behind its estimated value.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. and its subsidiaries offer technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally; it has a market cap of CA$405.81 million.

Operations: The company generates CA$58.32 million in revenue from its healthcare software segment.

Insider Ownership: 15.1%

Earnings Growth Forecast: 65.9% p.a.

Vitalhub, a growth company with substantial insider ownership, reported Q2 2024 revenue of C$16.24 million, up from C$13.09 million last year, but experienced a net loss of C$0.34 million compared to a net income of C$0.62 million previously. Despite this setback, its earnings are forecasted to grow significantly at 65.9% annually, well above the Canadian market average. Analysts agree the stock price could rise by 22%, though shareholders have faced dilution recently and large one-off items have impacted financial results.

- Take a closer look at Vitalhub's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Vitalhub is priced lower than what may be justified by its financials.

Next Steps

- Get an in-depth perspective on all 38 Fast Growing TSX Companies With High Insider Ownership by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Undervalued with mediocre balance sheet.