- Canada

- /

- Energy Services

- /

- TSX:TVK

3 TSX Growth Stocks With Up To 22% Insider Ownership

Reviewed by Simply Wall St

As we approach the end of 2025, Canadian markets have shown robust performance, with the TSX climbing by 27% year-to-date amid a backdrop of central bank decisions and labor market surprises. In this environment, growth companies with significant insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, making them worth considering for investors seeking alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.9% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 30.4% | 30.6% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 34.2% | 33.8% |

| CEMATRIX (TSX:CEMX) | 10.6% | 58.3% |

| California Nanotechnologies (TSXV:CNO) | 18.2% | 153% |

| Almonty Industries (TSX:AII) | 11.3% | 63.4% |

We'll examine a selection from our screener results.

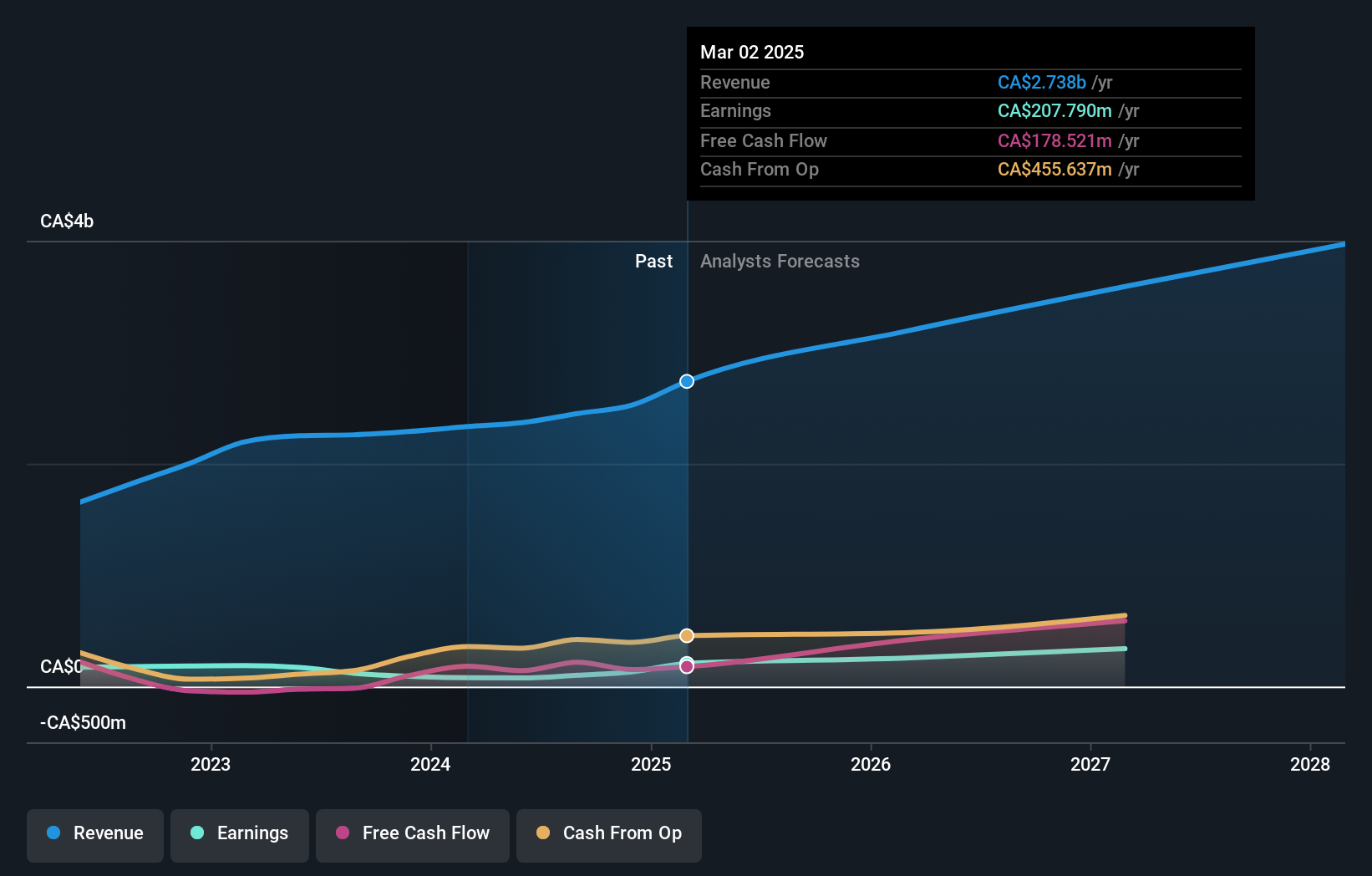

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market cap of CA$13.36 billion.

Operations: The company's revenue is primarily derived from its apparel segment, which generated CA$3.10 billion.

Insider Ownership: 17.2%

Aritzia demonstrates robust growth potential, with a forecasted annual earnings increase of 19.4%, surpassing the Canadian market average. Recent results showed significant profit growth, with net income rising to CAD 66.3 million in Q2 2025 from CAD 18.25 million a year earlier. The company anticipates strong revenue performance, projecting up to $900 million for Q3 2026 and raising full-year forecasts to $3.35 billion due to continued U.S. and Canadian strength.

- Delve into the full analysis future growth report here for a deeper understanding of Aritzia.

- Our valuation report unveils the possibility Aritzia's shares may be trading at a premium.

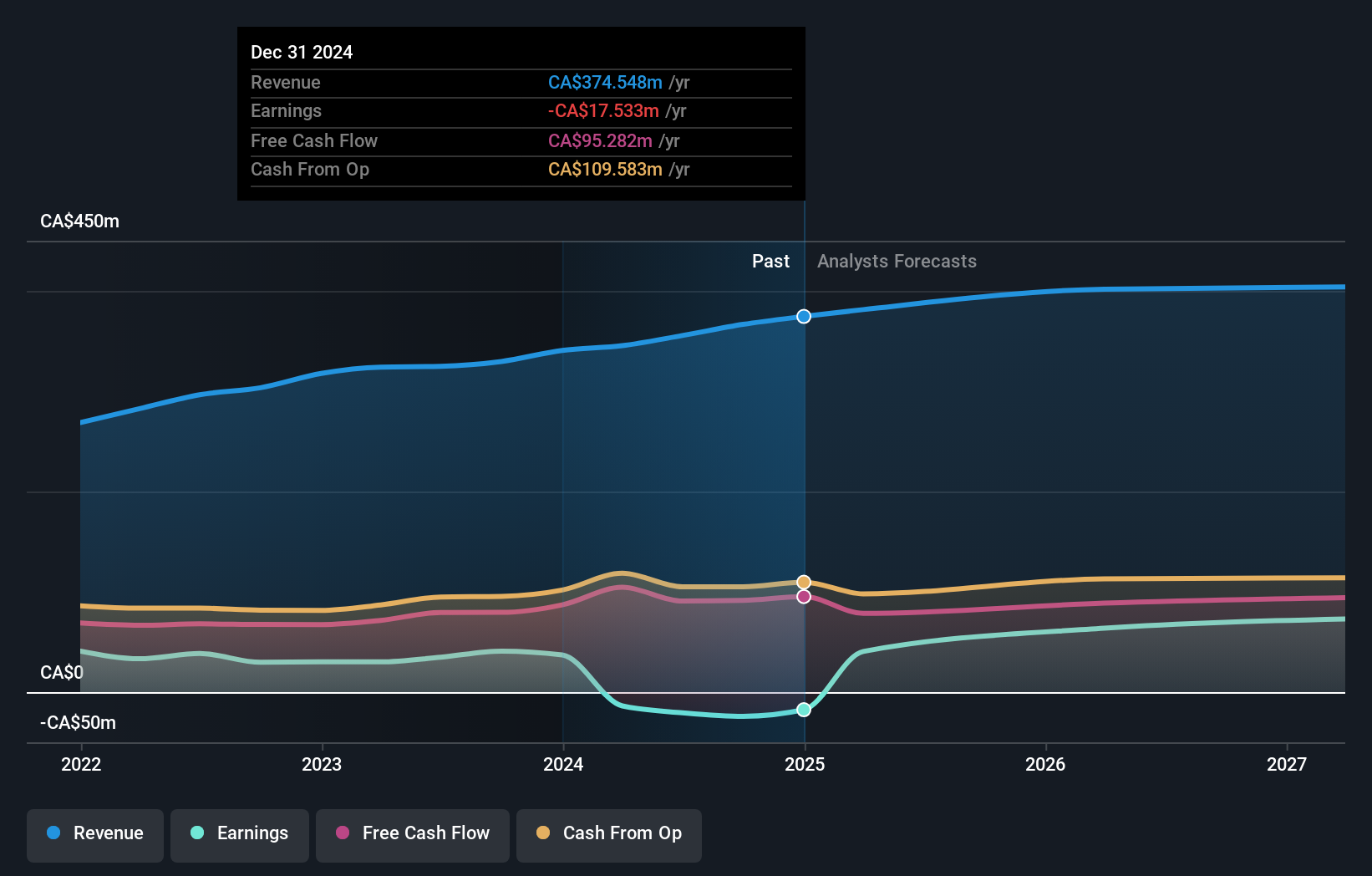

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★★★

Overview: Stingray Group Inc. is a music, media, and technology company operating in Canada, the United States, and internationally with a market cap of CA$939.55 million.

Operations: Stingray Group's revenue is derived from two main segments: Radio, contributing CA$134.06 million, and Broadcasting and Commercial Music, generating CA$279.08 million.

Insider Ownership: 22.9%

Stingray Group, poised for substantial growth, has forecasted annual earnings and revenue increases of 33.9% and 22.6%, respectively, outpacing the Canadian market. Recent Q2 results showed sales rising to C$113.26 million from C$93.59 million year-over-year, with net income doubling to C$11.77 million. Insider ownership remains stable with minimal buying or selling activity recently observed. Strategic partnerships like BYD Audio enhance Stingray's position in automotive infotainment solutions globally, supporting its growth trajectory despite high debt levels.

- Dive into the specifics of Stingray Group here with our thorough growth forecast report.

- Our valuation report here indicates Stingray Group may be undervalued.

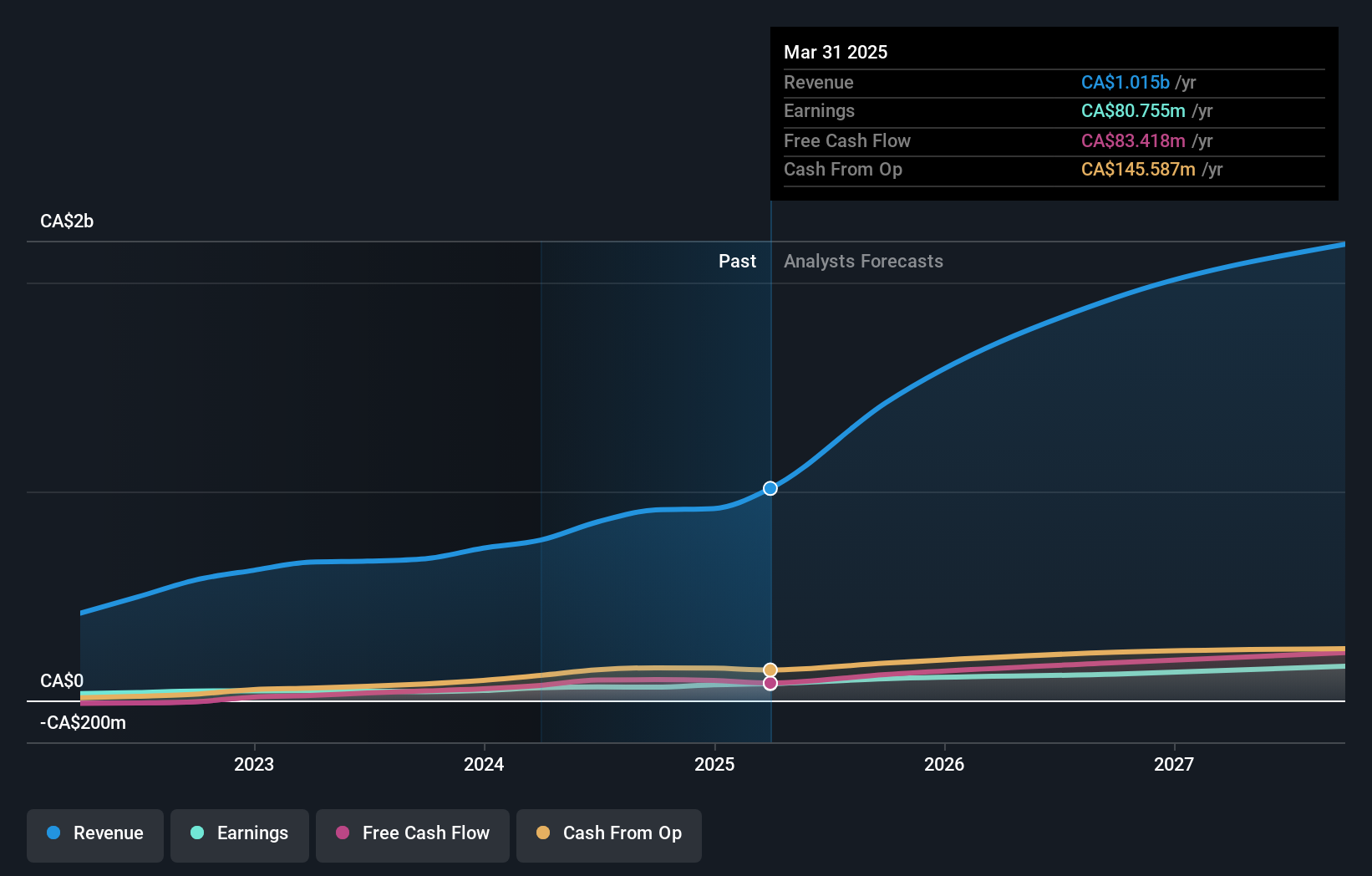

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TerraVest Industries Inc. manufactures and sells goods and services across various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction in Canada, the United States, and internationally with a market cap of CA$2.78 billion.

Operations: TerraVest Industries generates revenue by providing products and services to sectors such as agriculture, mining, energy production and distribution, chemicals, utilities, transportation, and construction across Canada, the United States, and international markets.

Insider Ownership: 18.9%

TerraVest Industries demonstrates robust growth potential with forecasted annual earnings and revenue increases of 30.9% and 19.8%, respectively, surpassing Canadian market averages. Recent full-year results show substantial improvements, with revenue reaching C$1.37 billion and net income rising to C$86.65 million. Despite interest payments not being well covered by earnings, the company trades at a significant discount to its estimated fair value, while maintaining stable insider ownership without recent substantial trading activity.

- Get an in-depth perspective on TerraVest Industries' performance by reading our analyst estimates report here.

- The analysis detailed in our TerraVest Industries valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Access the full spectrum of 44 Fast Growing TSX Companies With High Insider Ownership by clicking on this link.

- Ready To Venture Into Other Investment Styles? Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Reasonable growth potential with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion