- Canada

- /

- Metals and Mining

- /

- TSXV:CKG

TSX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The Canadian market is navigating a complex landscape as uncertainties around U.S. tariffs and domestic political developments weigh on investor sentiment, with the TSX showing modest gains amidst this cautious backdrop. Despite the challenges, penny stocks—often representing smaller or newer companies—continue to capture attention due to their affordability and potential for growth when backed by strong financials. In light of current market conditions, we explore three penny stocks that stand out for their financial resilience and growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.84 | CA$450.76M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$4.62 | CA$168.17M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.86 | CA$86.42M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$577.33M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.58 | CA$79.37M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.08 | CA$39.87M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.01 | CA$3.28B | ★★★★★☆ |

| ACT Energy Technologies (TSX:ACX) | CA$4.97 | CA$180.04M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

INX Digital Company (NEOE:INXD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The INX Digital Company, Inc. operates a trading platform for cryptocurrencies and digital securities with a market cap of CA$10.70 million.

Operations: The company generates revenue from its Digital Assets segment, amounting to $0.93 million.

Market Cap: CA$10.7M

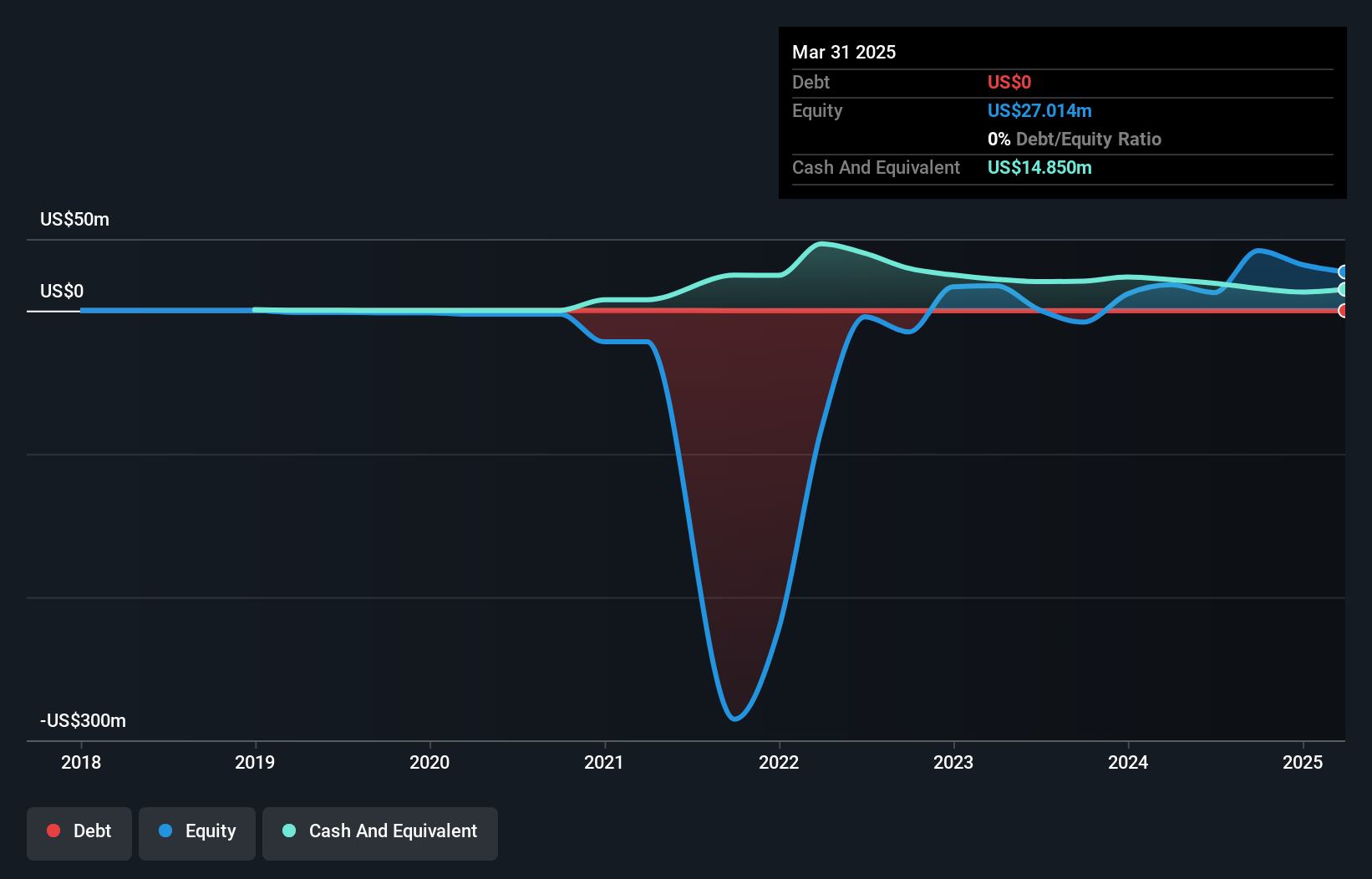

INX Digital Company, Inc. presents a mixed opportunity within the penny stock landscape in Canada. With a market cap of CA$10.70 million, it recently transitioned to profitability and boasts an outstanding Return on Equity at 115%. The company is debt-free, with short-term assets of $58.3 million exceeding both its short-term and long-term liabilities, indicating solid financial health despite being pre-revenue with minimal income from its Digital Assets segment ($0.93 million). However, investors should be cautious due to the high volatility in its share price over the past three months and increased weekly volatility from 31% to 38%.

- Click to explore a detailed breakdown of our findings in INX Digital Company's financial health report.

- Explore historical data to track INX Digital Company's performance over time in our past results report.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$80.70 million.

Operations: Chesapeake Gold Corp. has not reported any revenue segments.

Market Cap: CA$80.7M

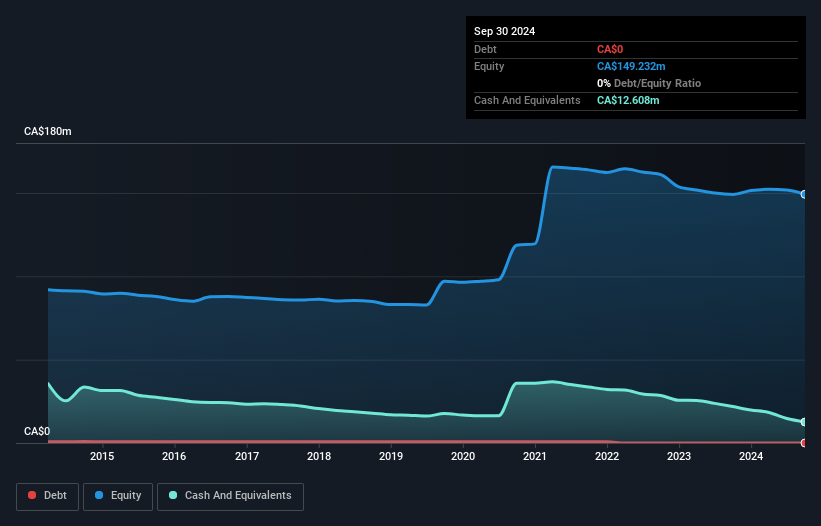

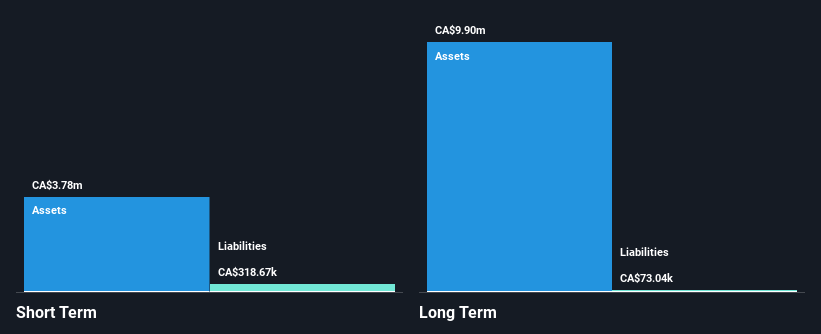

Chesapeake Gold Corp., with a market cap of CA$80.70 million, is pre-revenue and primarily focused on mineral exploration. The company has managed to remain debt-free and maintains sufficient cash runway for over a year, suggesting financial stability despite its lack of revenue. Its experienced board contrasts with a relatively new management team, which could impact strategic execution. Recent executive changes include the appointment of Mr. Justin Black as Chief Metallurgical Officer, adding significant expertise in mining processes. However, Chesapeake's removal from the S&P/TSX Venture Composite Index may reflect challenges in meeting certain market criteria or investor expectations.

- Unlock comprehensive insights into our analysis of Chesapeake Gold stock in this financial health report.

- Learn about Chesapeake Gold's historical performance here.

New Age Metals (TSXV:NAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: New Age Metals Inc. is a mineral exploration company focused on acquiring, exploring, and developing platinum group metals, precious metals, and base metals properties in Canada and the United States, with a market cap of CA$6.94 million.

Operations: No revenue segments have been reported for this mineral exploration company.

Market Cap: CA$6.94M

New Age Metals Inc., with a market cap of CA$6.94 million, is pre-revenue and focused on mineral exploration, recently expanding its business into Newfoundland and Labrador to pursue new strategic metal projects. Despite being unprofitable, the company benefits from a strong financial position with no debt and sufficient cash runway for over two years at current expenditure rates. Its experienced management team and board offer stability in navigating volatile market conditions. However, high share price volatility remains a concern for investors seeking stable returns in the penny stock sector.

- Click here and access our complete financial health analysis report to understand the dynamics of New Age Metals.

- Understand New Age Metals' track record by examining our performance history report.

Taking Advantage

- Click this link to deep-dive into the 938 companies within our TSX Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CKG

Chesapeake Gold

A mineral exploration and evaluation company, focuses on acquisition, evaluation, and development of precious metal deposits in North and Central America.

Flawless balance sheet low.

Market Insights

Community Narratives