- Canada

- /

- Metals and Mining

- /

- TSXV:LME

TSX Penny Stocks Worth Watching In April 2025

Reviewed by Simply Wall St

As the Canadian market navigates potential economic headwinds from U.S. tariffs, investors are keeping a close eye on how these factors might impact growth and inflation. Amidst this backdrop, penny stocks—often representing smaller or newer companies—continue to capture interest for their unique investment opportunities. In this article, we explore three penny stocks that demonstrate financial strength and potential resilience in the current market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.55 | CA$65.34M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$1.02B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.79 | CA$407.32M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$280.75M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$181.35M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.58 | CA$531.27M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.75 | CA$74.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.55 | CA$15.76M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.00 | CA$36.92M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Findev (TSXV:FDI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Findev Inc. is a real estate finance company offering secured financing for investment properties and developments in the Greater Toronto Area, with a market cap of CA$15.76 million.

Operations: No revenue segments have been reported for Findev.

Market Cap: CA$15.76M

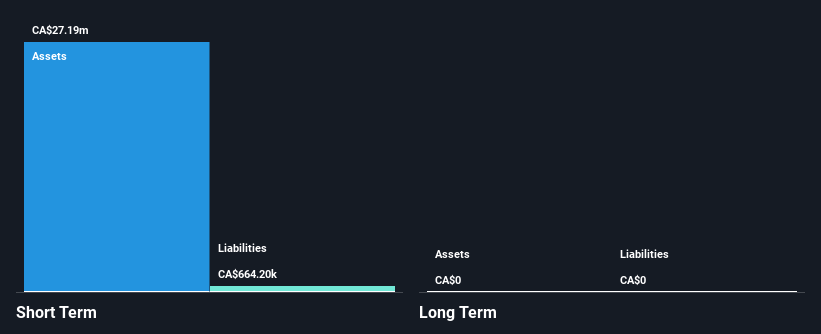

Findev Inc., with a market cap of CA$15.76 million, operates debt-free and has stable weekly volatility at 12%. Despite having no significant revenue streams, the company reported net income of CA$2.6 million for 2024, up from CA$2 million in 2023. Its return on equity is low at 9.8%, but profit margins improved to 71.9%. Earnings grew by 30% last year, outpacing industry growth significantly. The dividend yield stands at 5.45%, though it's not well covered by free cash flow. Findev's short-term assets comfortably cover its liabilities, and it trades below estimated fair value by a large margin.

- Click here and access our complete financial health analysis report to understand the dynamics of Findev.

- Gain insights into Findev's past trends and performance with our report on the company's historical track record.

Labrador Gold (TSXV:LAB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Labrador Gold Corp. focuses on acquiring and exploring gold properties in the Americas, with a market cap of CA$12.75 million.

Operations: Labrador Gold Corp. has not reported any revenue segments as it is focused on the acquisition and exploration of gold properties in the Americas.

Market Cap: CA$12.75M

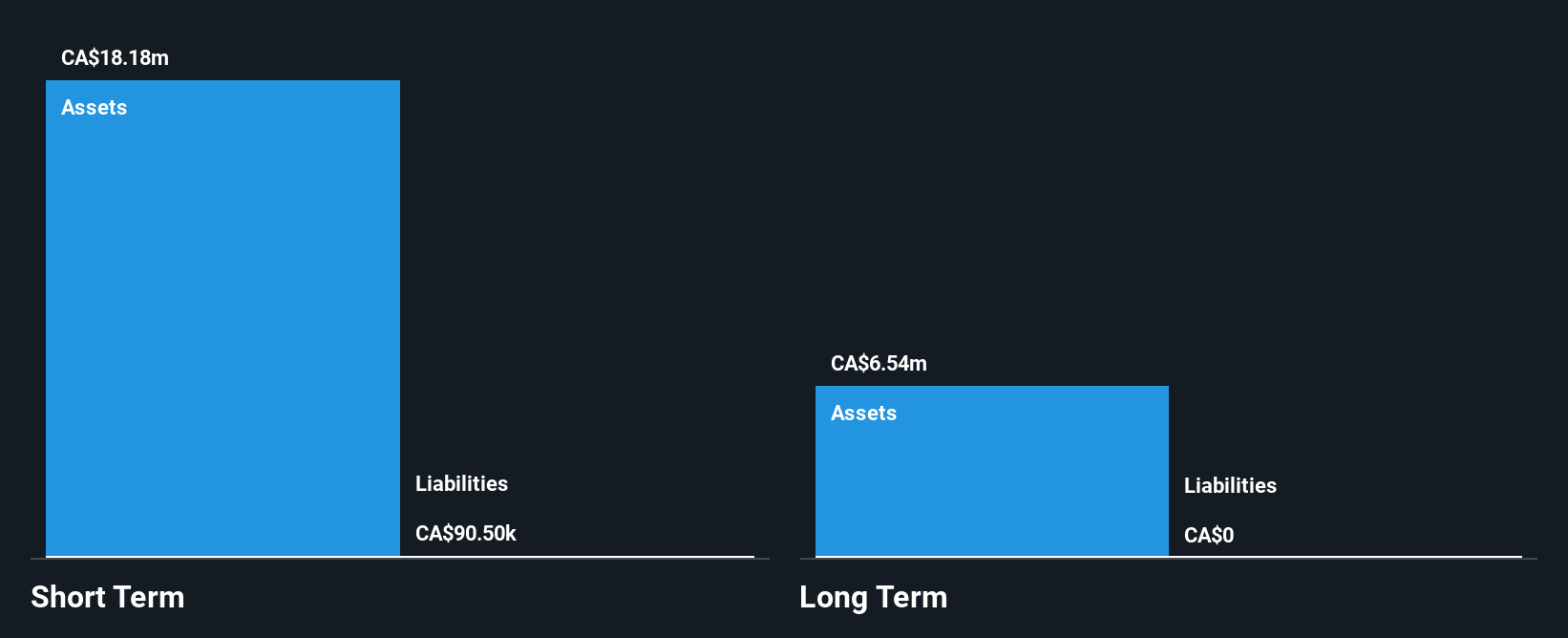

Labrador Gold Corp., with a market cap of CA$12.75 million, operates debt-free and is pre-revenue, focusing on gold exploration in the Americas. The company has a stable cash runway exceeding three years, supported by CA$19.6 million in short-term assets surpassing its liabilities. Despite high weekly volatility at 15%, Labrador Gold's management and board are experienced, with average tenures of 4.9 and 8.3 years respectively. Recent announcements highlight ambitious exploration programs for its Hopedale and Borden Lake projects to refine drill targets and extend gold trends, leveraging advanced geochemical methods due to challenging terrain conditions.

- Get an in-depth perspective on Labrador Gold's performance by reading our balance sheet health report here.

- Evaluate Labrador Gold's historical performance by accessing our past performance report.

Laurion Mineral Exploration (TSXV:LME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Laurion Mineral Exploration Inc. focuses on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$95.72 million.

Operations: Laurion Mineral Exploration Inc. currently does not report any revenue segments.

Market Cap: CA$95.72M

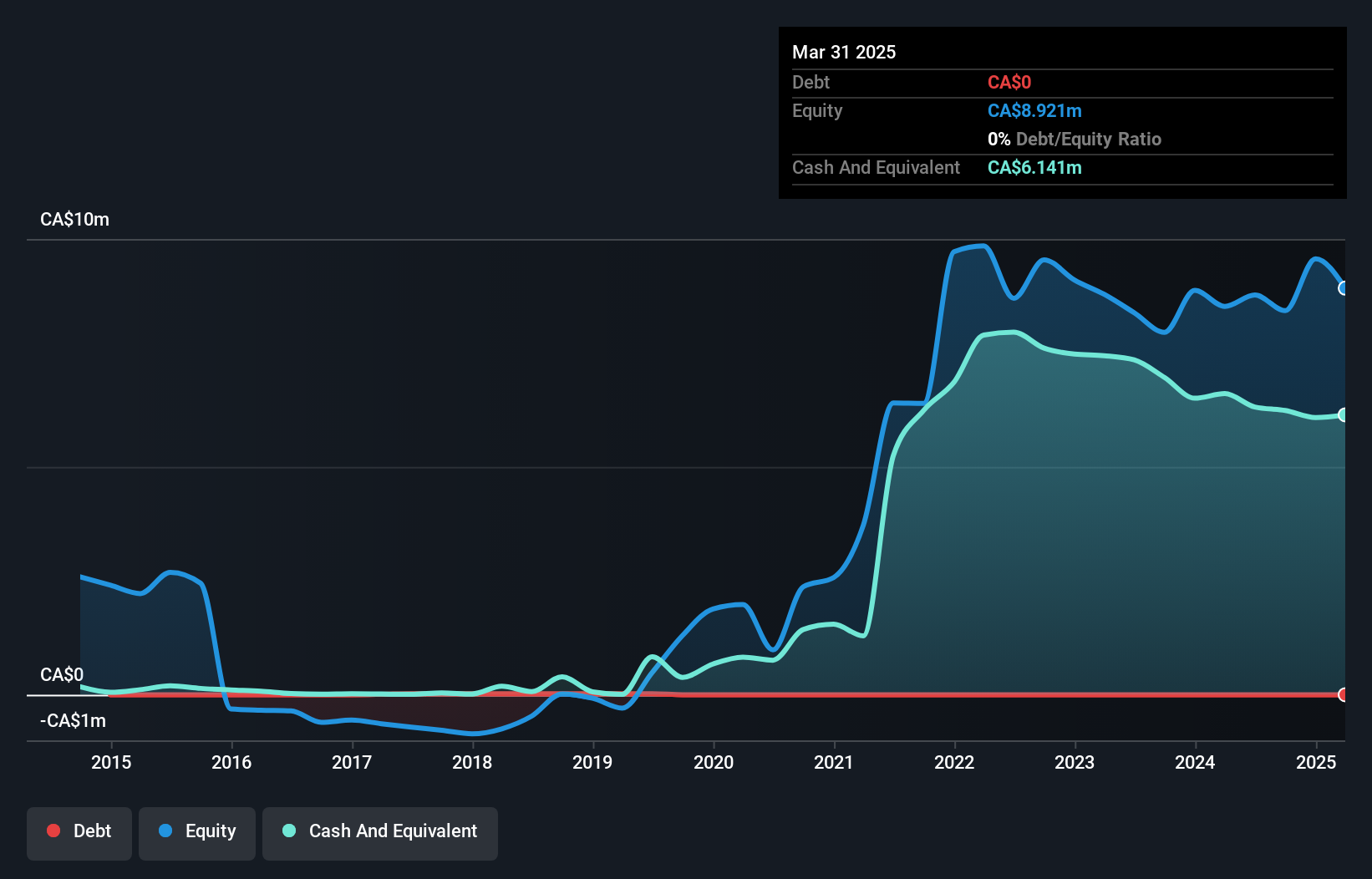

Laurion Mineral Exploration, with a market cap of CA$95.72 million, is pre-revenue and operates debt-free, focusing on mineral exploration in Canada. The company has a stable cash runway exceeding one year with short-term assets of CA$8.9 million significantly covering its liabilities. Recent drilling at the Ishkõday Project expanded the Sturgeon River Mine Corridor's strike length and uncovered high-grade mineralized veins, enhancing Laurion's understanding of the project's potential. Despite being unprofitable with negative return on equity, Laurion’s experienced board supports its strategic exploration efforts without shareholder dilution over the past year.

- Jump into the full analysis health report here for a deeper understanding of Laurion Mineral Exploration.

- Assess Laurion Mineral Exploration's previous results with our detailed historical performance reports.

Key Takeaways

- Click through to start exploring the rest of the 933 TSX Penny Stocks now.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LME

Laurion Mineral Exploration

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Flawless balance sheet low.

Market Insights

Community Narratives