- Canada

- /

- Metals and Mining

- /

- TSX:KNT

Trade Alert: The Independent Director Of K92 Mining Inc. (CVE:KNT), Graham Wheelock, Has Sold Some Shares Recently

Anyone interested in K92 Mining Inc. (CVE:KNT) should probably be aware that the Independent Director, Graham Wheelock, recently divested CA$458k worth of shares in the company, at an average price of CA$2.51 each. In particular, we note that the sale equated to a 100% reduction in their position size, which doesn't exactly instill confidence.

See our latest analysis for K92 Mining

K92 Mining Insider Transactions Over The Last Year

Notably, that recent sale by Graham Wheelock is the biggest insider sale of K92 Mining shares that we've seen in the last year. That means that an insider was selling shares at slightly below the current price (CA$2.63). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. It is worth noting that this sale was 100% of Graham Wheelock's holding.

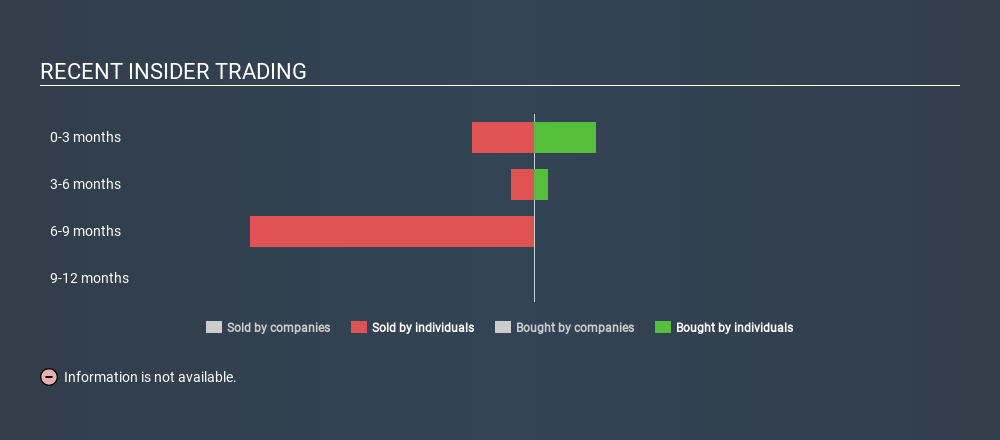

All up, insiders sold more shares in K92 Mining than they bought, over the last year. They sold for an average price of about US$1.98. It's not particularly great to see insiders were selling shares at below recent prices. Of course, the sales could be motivated for a multitude of reasons, so we shouldn't jump to conclusions. You can see the insider transactions (by individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like K92 Mining better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 1.7% of K92 Mining shares, worth about CA$9.5m, according to our data. We do generally prefer see higher levels of insider ownership.

So What Do The K92 Mining Insider Transactions Indicate?

The stark truth for K92 Mining is that there has been more insider selling than insider buying in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. But it is good to see that K92 Mining is growing earnings. Insiders own relatively few shares in the company, and when you consider the sales, we're not particularly excited about the stock. As the saying goes, only fools rush in. Therefore, you should should definitely take a look at this FREE report showing analyst forecasts for K92 Mining.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:KNT

K92 Mining

Engages in the mining, exploration, and development of mineral deposits in Papua New Guinea.

Flawless balance sheet with high growth potential.