3 Canadian Penny Stocks On TSX With Market Cap Under CA$600M

Reviewed by Simply Wall St

As the Canadian market reflects on a stellar 2024, with the TSX gaining 18%, investors are now considering how to navigate potential headwinds and tailwinds in 2025. For those looking beyond large-cap stocks, penny stocks—often representing smaller or newer companies—remain an intriguing area of investment. Despite being an older term, penny stocks continue to offer opportunities for growth at lower price points when they possess strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.14 | CA$384.09M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$123.03M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$957.27M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.485 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$601.94M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$236.24M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.05 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.48M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.95 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 945 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BeWhere Holdings (TSXV:BEW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BeWhere Holdings Inc. is an industrial Internet of Things (IIoT) solutions company that designs, manufactures, and sells hardware with sensors and software applications for tracking real-time information on fixed and movable assets, with a market cap of CA$61.20 million.

Operations: The company generates revenue of CA$16.07 million from its Software & Programming segment.

Market Cap: CA$61.2M

BeWhere Holdings Inc., with a market cap of CA$61.20 million, has shown consistent revenue growth in its Software & Programming segment, reaching CA$16.07 million. Despite a decline in net profit margins to 7.1% from 19.5% last year, the company remains profitable and its debt is well-covered by operating cash flow at 257.7%. Recent earnings reports highlight increased sales and net income compared to the previous year, while insider selling poses some concern. The appointment of Peter Wilcox to the board brings valuable expertise that could enhance strategic direction and innovation within BeWhere's IoT solutions framework.

- Click here and access our complete financial health analysis report to understand the dynamics of BeWhere Holdings.

- Learn about BeWhere Holdings' historical performance here.

New Found Gold (TSXV:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New Found Gold Corp. is a mineral exploration company focused on identifying, evaluating, acquiring, and exploring mineral properties in Newfoundland and Labrador, and Ontario with a market cap of CA$539.04 million.

Operations: New Found Gold Corp. has not reported any revenue segments.

Market Cap: CA$539.04M

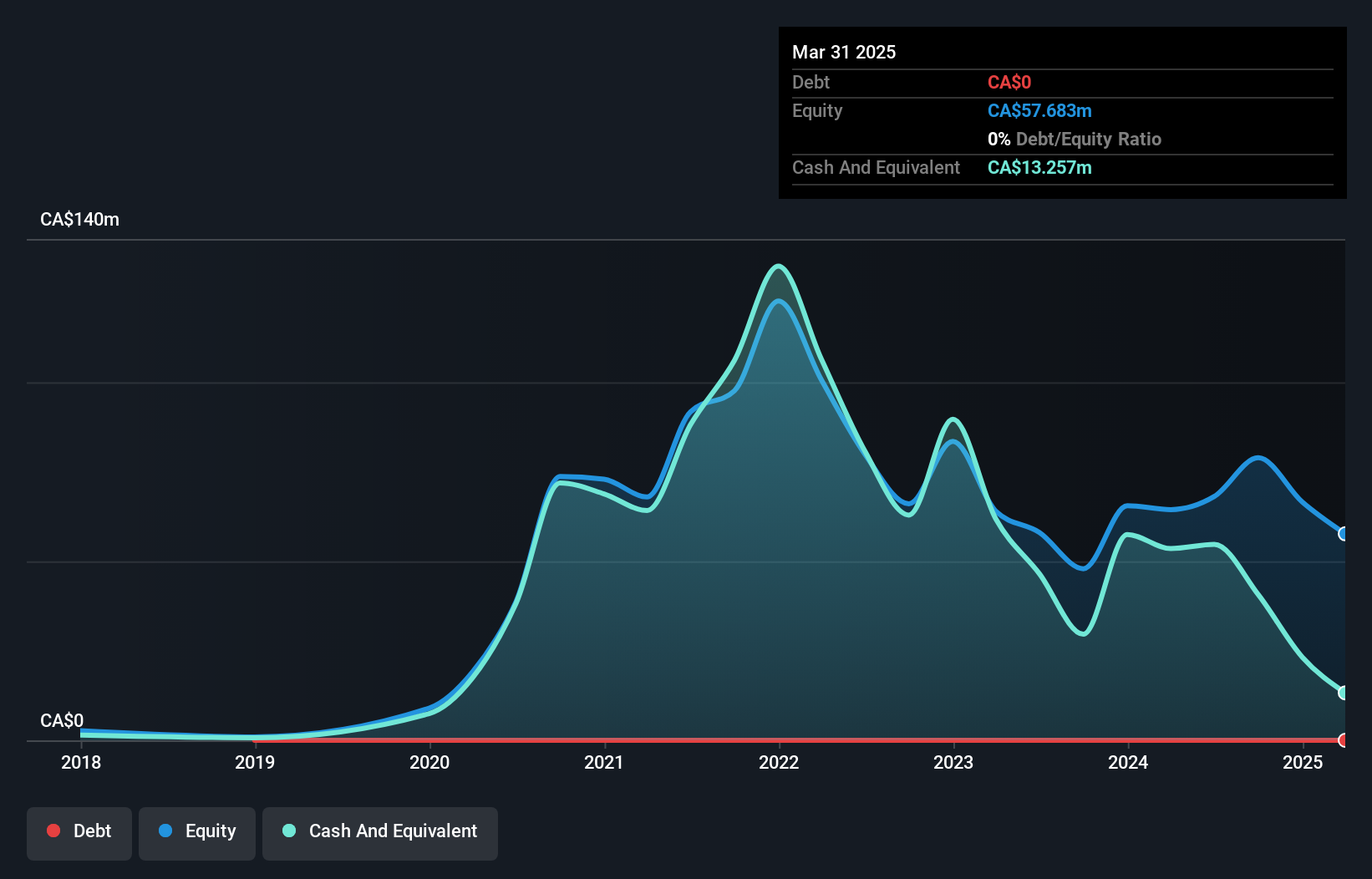

New Found Gold Corp., with a market cap of CA$539.04 million, is pre-revenue and remains unprofitable, facing a forecasted earnings decline. Despite this, the company holds CA$46.6 million in short-term assets against minimal liabilities and is debt-free. Recent board appointments bring seasoned industry expertise to guide strategic decisions as the firm advances its Queensway Project in Newfoundland. The ongoing 650,000m drill program has yielded promising high-grade gold discoveries, and work towards a maiden resource estimate and preliminary economic assessment marks significant progress for potential project development scenarios despite shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in New Found Gold's financial health report.

- Review our growth performance report to gain insights into New Found Gold's future.

RE Royalties (TSXV:RE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: RE Royalties Ltd. acquires revenue-based royalties from renewable energy and clean technology companies, offering non-dilutive royalty financing solutions, with a market cap of CA$19.47 million.

Operations: The company's revenue is derived from its Financial Services - Commercial segment, generating CA$3.25 million.

Market Cap: CA$19.47M

RE Royalties Ltd., with a market cap of CA$19.47 million, offers non-dilutive financing solutions through royalty acquisitions in renewable energy. Despite generating CA$3.25 million in revenue, the company remains unprofitable and has seen earnings decline over the past five years. Recent debt financing initiatives have raised significant capital via green bonds to support sustainable projects, though the company's net debt to equity ratio is high at 142.5%. While short-term assets cover both short and long-term liabilities comfortably, its dividend sustainability is questionable given its current financial performance and cash flow constraints.

- Click here to discover the nuances of RE Royalties with our detailed analytical financial health report.

- Assess RE Royalties' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 945 TSX Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade BeWhere Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BeWhere Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BEW

BeWhere Holdings

An industrial Internet of Things (IIoT) solutions company, designs, manufactures, and sells hardware with sensors and software applications to track real-time information on equipment, tools, and inventory in-transit, and at facilities.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives