As we move into 2025, the Canadian market continues to navigate a landscape of both opportunities and challenges, buoyed by the strong performance seen in 2024. For investors looking beyond established giants, penny stocks offer intriguing possibilities; these smaller or newer companies can surprise with their potential for growth and value. Despite their vintage name, penny stocks remain relevant today, especially when backed by solid financials that suggest resilience and potential long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.14 | CA$384.09M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$123.03M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$957.27M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.485 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$601.94M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$236.24M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.05 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.48M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.95 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 945 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cannabix Technologies (CNSX:BLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cannabix Technologies Inc. is a technology company that develops marijuana and alcohol breathalyzers for employers, law enforcement, workplaces, and laboratories in the United States, with a market cap of CA$33.39 million.

Operations: Cannabix Technologies Inc. does not report specific revenue segments.

Market Cap: CA$33.39M

Cannabix Technologies Inc., with a market cap of CA$33.39 million, is pre-revenue and focuses on developing marijuana and alcohol breathalyzers. Recent updates to its Cannabix Marijuana Breathalyzer technology align with emerging regulatory requirements, enhancing its potential market readiness. The company has also achieved a positive certification for its Breath Logix device in Australia, paving the way for broader sales opportunities. Despite being unprofitable, Cannabix has managed to reduce losses over the past five years and maintains sufficient cash runway for over a year without debt concerns. However, it experiences high share price volatility compared to other Canadian stocks.

- Unlock comprehensive insights into our analysis of Cannabix Technologies stock in this financial health report.

- Gain insights into Cannabix Technologies' historical outcomes by reviewing our past performance report.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies as alternatives to synthetic, petrochemical-based adhesives and related products globally, with a market cap of CA$247.34 million.

Operations: The company's revenue is derived entirely from its Biopolymer Nanosphere Technology Platform, amounting to $15.95 million.

Market Cap: CA$247.34M

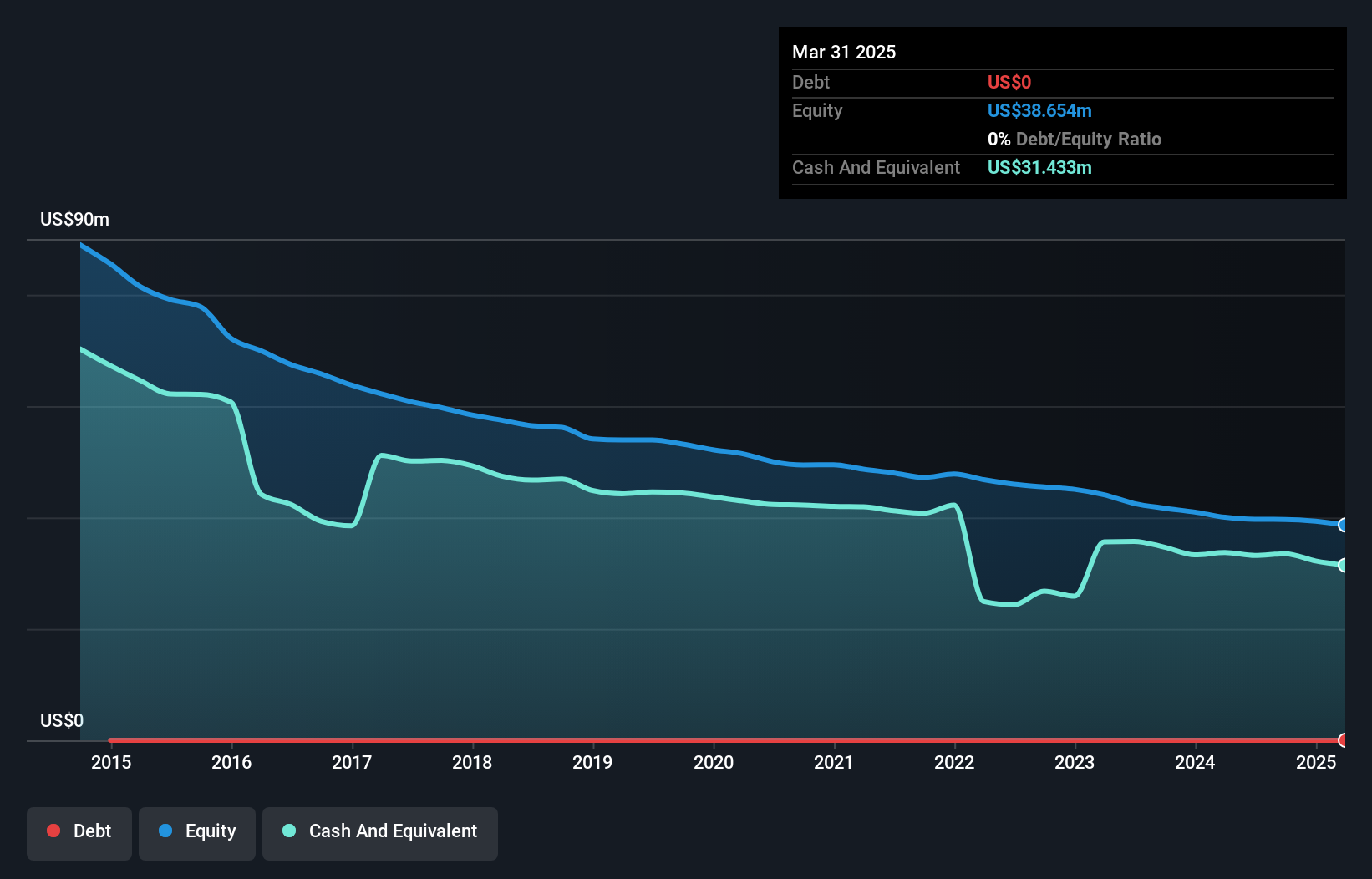

EcoSynthetix Inc., with a market cap of CA$247.34 million, focuses on bio-based technologies and reported third-quarter sales of US$5.23 million, up from US$3.8 million the previous year, marking a return to profitability with net income of US$0.14 million compared to a loss previously. Despite being unprofitable in recent years, the company has no debt and sufficient cash runway for over three years, indicating financial stability amidst its growth phase. Recent share buybacks further reflect management's confidence in its business prospects while maintaining stable weekly volatility levels over the past year.

- Click here to discover the nuances of EcoSynthetix with our detailed analytical financial health report.

- Review our historical performance report to gain insights into EcoSynthetix's track record.

Aurora Spine (TSXV:ASG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aurora Spine Corporation, operating through its subsidiary Aurora Spine, Inc., focuses on developing and distributing minimally invasive interspinous fusion systems and devices in Canada, with a market cap of CA$37.16 million.

Operations: The company generates its revenue of $16.90 million from its medical products segment.

Market Cap: CA$37.16M

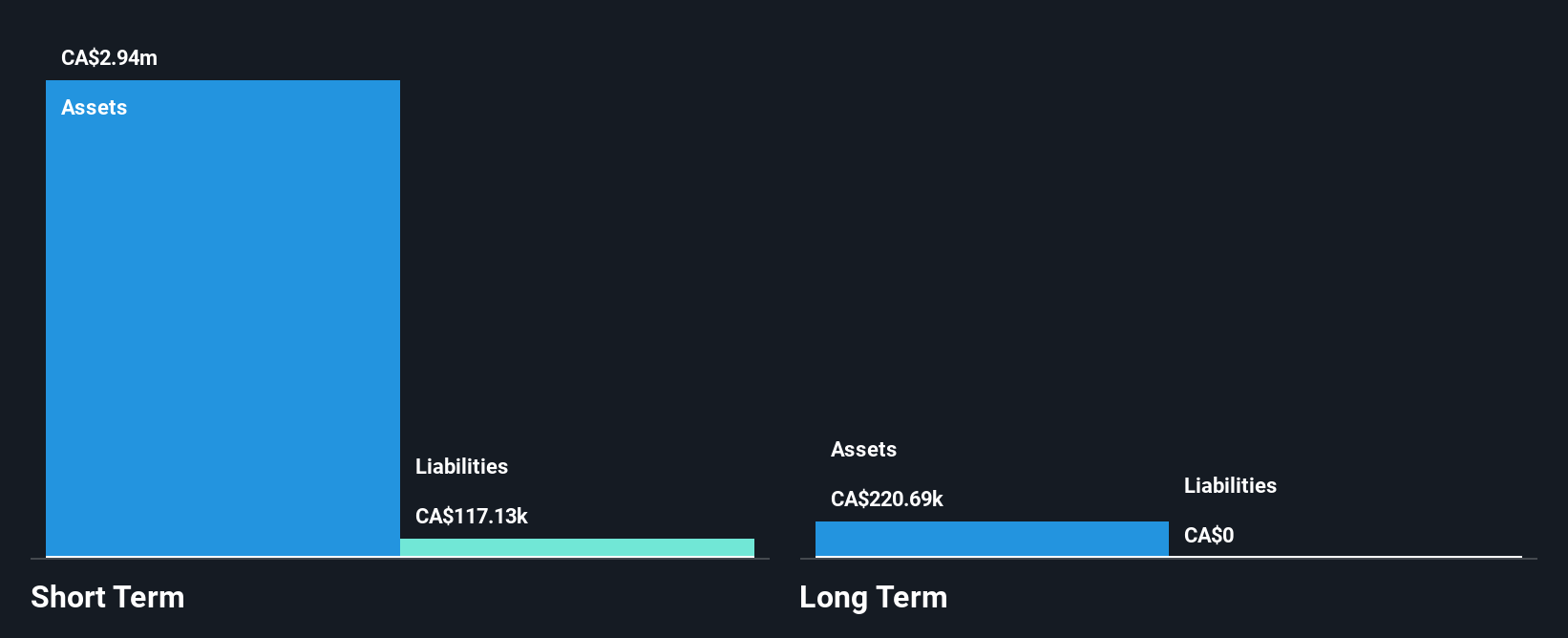

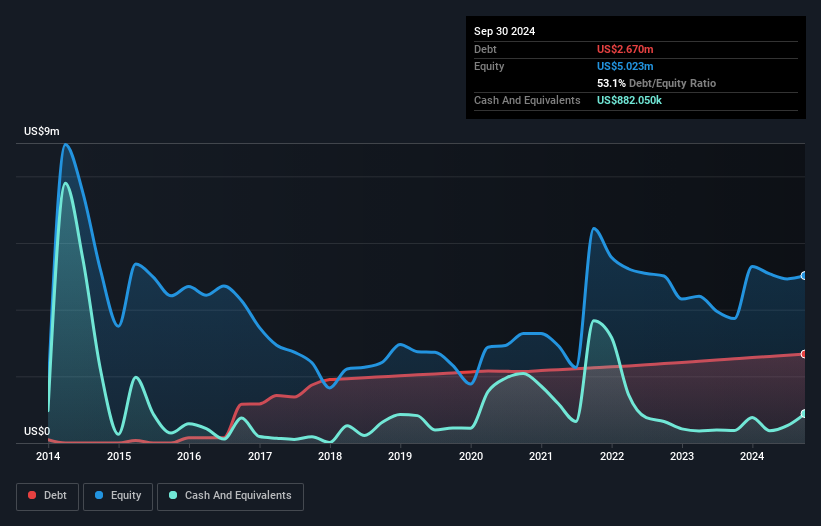

Aurora Spine Corporation, with a market cap of CA$37.16 million, reported third-quarter revenue growth to US$4.77 million from US$3.95 million year-on-year, achieving a net income of US$0.07112 million compared to a previous loss. Despite being unprofitable over the past five years with increasing losses and negative return on equity, its short-term assets cover both short and long-term liabilities adequately. The company has reduced its debt-to-equity ratio significantly over five years and launched the OSTEO ONYX™ lumbar fusion system recently, potentially enhancing patient outcomes in osteopenia or osteoporosis treatments through innovative Rough Surface Technology.

- Navigate through the intricacies of Aurora Spine with our comprehensive balance sheet health report here.

- Understand Aurora Spine's track record by examining our performance history report.

Seize The Opportunity

- Unlock our comprehensive list of 945 TSX Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EcoSynthetix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ECO

EcoSynthetix

A renewable chemicals company, develops and commercializes bio-based technologies that are used as replacement solutions for synthetic, petrochemical-based adhesives, and other related products worldwide.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives