The Canadian market has been riding a bull wave since October 2022, with the TSX gaining an impressive 67% as inflation cools and interest rates are poised for potential cuts. In such a vibrant market, investors often look beyond the well-trodden paths of large-cap stocks to explore opportunities in smaller companies. While the term "penny stocks" might seem outdated, these investments still hold relevance today by offering affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.68 | CA$68M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.32 | CA$251.87M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.37 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.09 | CA$718.52M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.97 | CA$19.62M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.02 | CA$155.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.18 | CA$204.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Kenorland Minerals (TSXV:KLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kenorland Minerals Ltd. focuses on acquiring and exploring mineral properties in North America, with a market capitalization of CA$147.51 million.

Operations: The company generates revenue of CA$3.02 million from its exploration of mineral properties.

Market Cap: CA$147.51M

Kenorland Minerals Ltd., with a market capitalization of CA$147.51 million, is actively expanding its exploration footprint in North America. Recent developments include the commencement of Phase 2 drilling at the South Uchi Project and acquisition of mineral claims at the KSZ Project, highlighting its strategic focus on untapped gold-bearing regions. Despite generating CA$3.02 million in revenue, Kenorland remains pre-revenue and unprofitable, with increased losses reported over five years. However, it benefits from a debt-free balance sheet and strong asset coverage for liabilities, positioning it for potential growth as exploration progresses in promising geological settings.

- Dive into the specifics of Kenorland Minerals here with our thorough balance sheet health report.

- Explore historical data to track Kenorland Minerals' performance over time in our past results report.

RenoWorks Software (TSXV:RW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RenoWorks Software Inc. develops and distributes digital visualization software for the renovation and new home construction sectors across the United States, Canada, and internationally, with a market cap of CA$21.63 million.

Operations: The company generates CA$7.64 million in revenue from its software and programming segment.

Market Cap: CA$21.63M

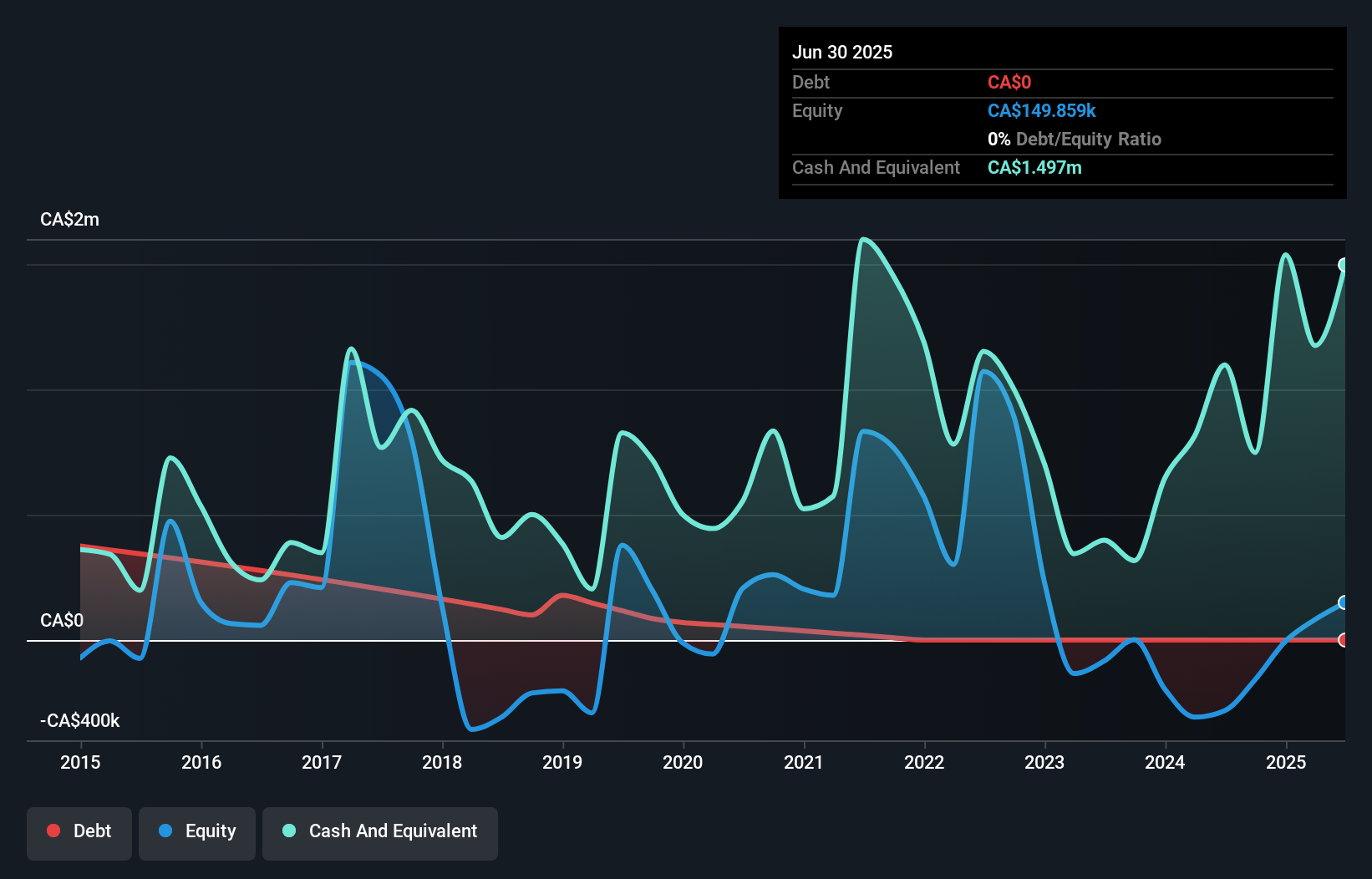

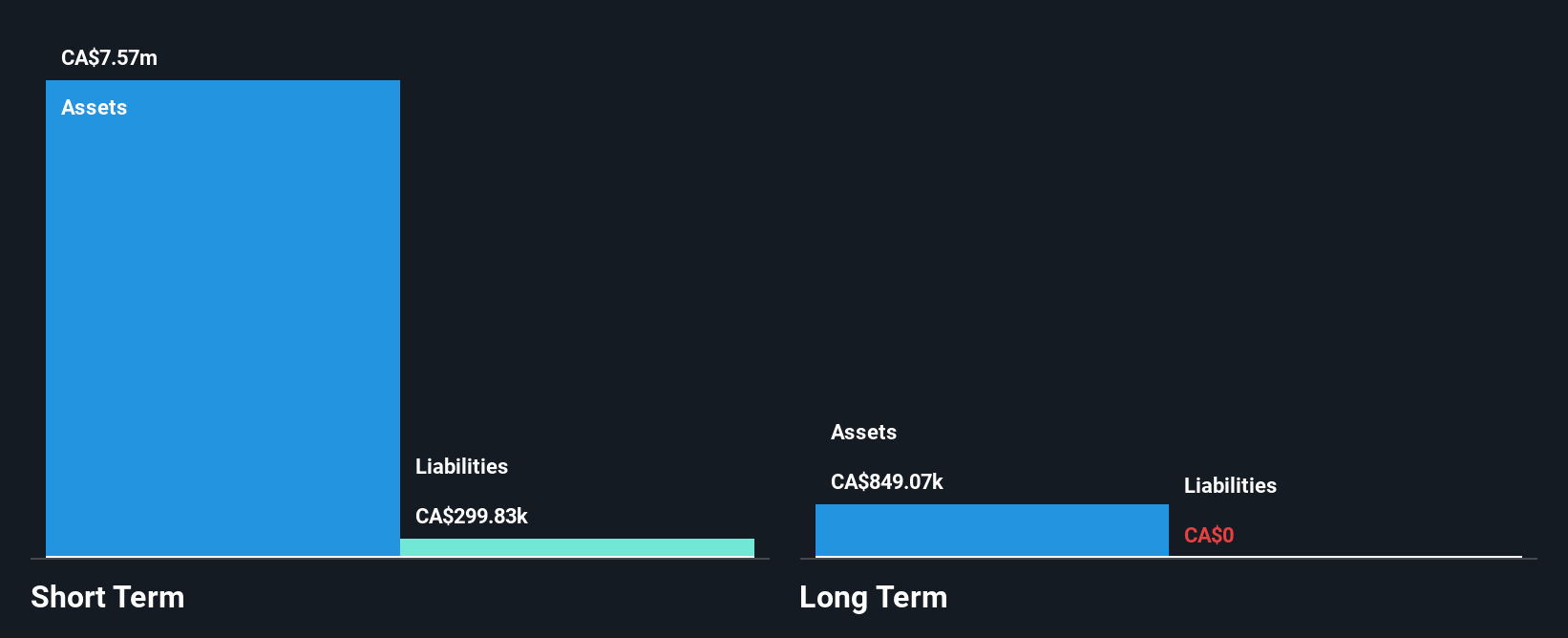

RenoWorks Software Inc., with a market cap of CA$21.63 million, is gaining traction in the digital visualization sector, evidenced by its recent collaboration with Owens Corning Roofing to launch the Design EyeQ® Roofing Visualizer. This partnership underscores RenoWorks' expanding influence in AI-driven solutions for the building-products industry. The company reported CA$7.64 million in revenue and has achieved profitability, showcasing high-quality earnings and an outstanding return on equity of 225.9%. With no debt burden and stable volatility, RenoWorks presents a financially sound profile amidst its growth trajectory within this niche market segment.

- Click here to discover the nuances of RenoWorks Software with our detailed analytical financial health report.

- Gain insights into RenoWorks Software's historical outcomes by reviewing our past performance report.

Royal Road Minerals (TSXV:RYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Royal Road Minerals Limited focuses on the exploration and development of mineral properties across the Kingdom of Saudi Arabia, Morocco, Jersey, and South America, with a market cap of CA$49.15 million.

Operations: Royal Road Minerals Limited does not report specific revenue segments.

Market Cap: CA$49.15M

Royal Road Minerals Limited, with a market cap of CA$49.15 million, is pre-revenue and focuses on mineral exploration in diverse regions including Saudi Arabia and Colombia. Recent exploratory drilling at the Jabal Sahabiyah project in Saudi Arabia revealed promising skarn-style zinc and gold occurrences. The company remains debt-free with sufficient cash runway for over a year, although it has experienced increased losses over the past five years. Despite management's seasoned tenure averaging 2.3 years, Royal Road's share price volatility is high compared to Canadian stocks, reflecting both potential opportunities and inherent risks typical of penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Royal Road Minerals.

- Evaluate Royal Road Minerals' historical performance by accessing our past performance report.

Where To Now?

- Jump into our full catalog of 412 TSX Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RW

RenoWorks Software

Develops and distributes digital visualization software for the renovation and new home construction sectors in the United States, Canada, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)