As the Canadian market continues its impressive recovery, with the TSX gaining 67% since October 2022, investors are closely watching how ongoing trade tensions and interest rate policies might influence future growth. In this environment, dividend stocks stand out as a compelling option for those seeking steady income and potential resilience amid economic uncertainties.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.09% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.01% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.01% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 15.56% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.81% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.32% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.04% | ★★★★★☆ |

| Magna International (TSX:MG) | 4.26% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.36% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.71% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our Top TSX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Sun Life Financial (TSX:SLF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a financial services company offering asset management, wealth, insurance, and health solutions to individual and institutional customers across various countries including Canada, the US, and several Asian markets with a market cap of CA$48.54 billion.

Operations: Sun Life Financial Inc. generates revenue from various segments including Asia (CA$2.16 billion), Canada (CA$11.63 billion), Asset Management (CA$6.80 billion), and the United States (CA$13.85 billion).

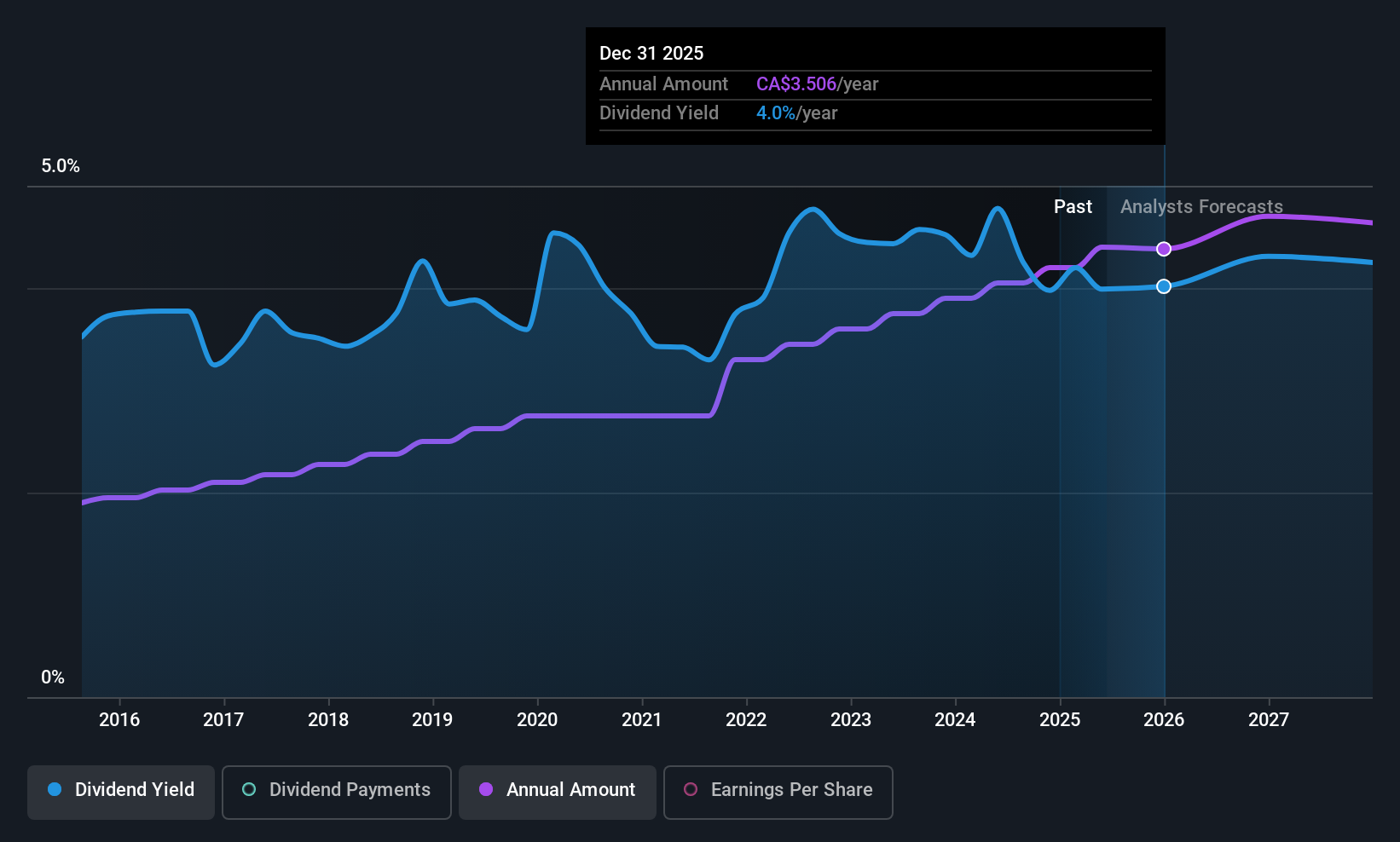

Dividend Yield: 4.1%

Sun Life Financial provides a reliable dividend yield of 4.09%, supported by a sustainable payout ratio of 59.7% and cash flow coverage at 47.5%. Recent strategic moves, including expanding Family Leave Insurance in the U.S., enhance its market position and potentially support future earnings growth, which has been stable with a recent increase of 4.7%. While not among the highest-yielding stocks in Canada, Sun Life's consistent dividend history adds appeal for income-focused investors.

- Get an in-depth perspective on Sun Life Financial's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Sun Life Financial is trading behind its estimated value.

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$67.03 billion.

Operations: Suncor Energy Inc.'s revenue is primarily generated from its Oil Sands segment at CA$25.21 billion, Refining and Marketing at CA$30.61 billion, and Exploration and Production at CA$2.12 billion.

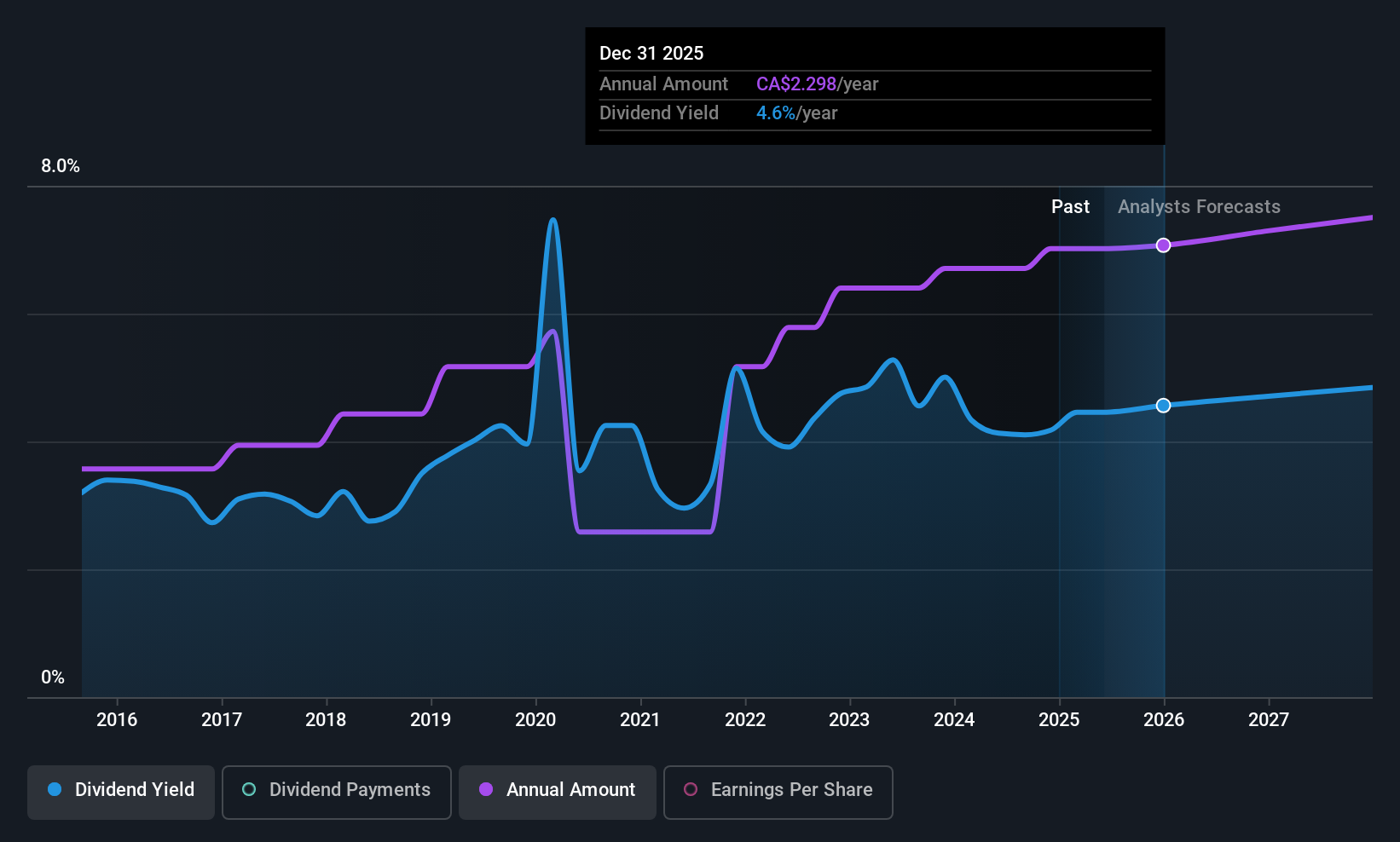

Dividend Yield: 4.1%

Suncor Energy's dividend yield of 4.09% is below the top 25% of Canadian dividend payers, with a history of volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 49.5% and 32.8%, respectively. Recent executive changes and share buybacks totaling CAD 1.25 billion demonstrate ongoing strategic adjustments, while recent earnings showed a decline in revenue and net income compared to last year.

- Unlock comprehensive insights into our analysis of Suncor Energy stock in this dividend report.

- Our valuation report here indicates Suncor Energy may be undervalued.

Alphamin Resources (TSXV:AFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alphamin Resources Corp., along with its subsidiaries, is involved in the production and sale of tin concentrate, with a market cap of CA$1.34 billion.

Operations: The company's revenue is primarily derived from the production and sale of tin from its Bisie Tin Mine, amounting to $579.49 million.

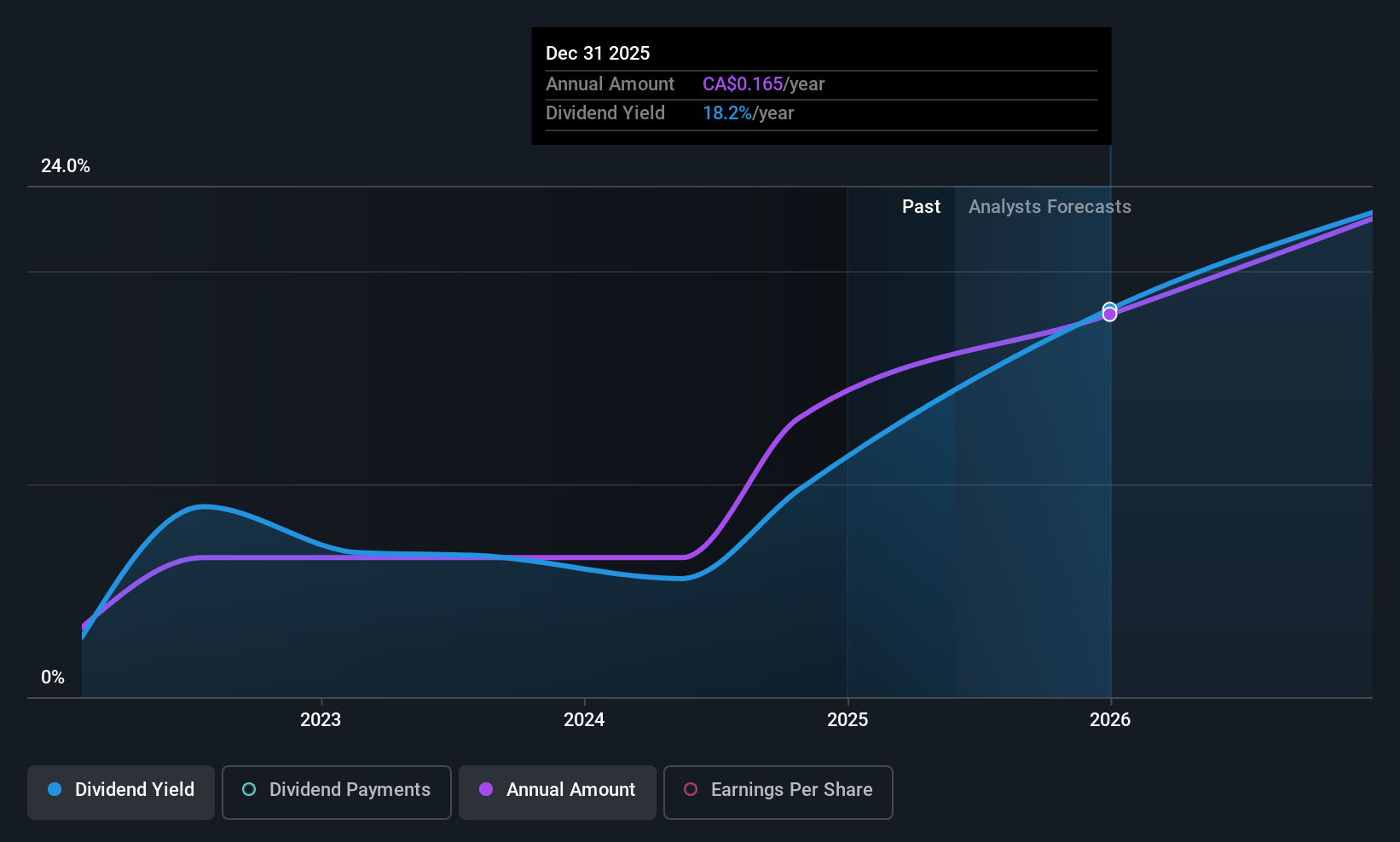

Dividend Yield: 8.3%

Alphamin Resources offers a dividend yield of 8.35%, placing it in the top 25% of Canadian dividend payers. Its dividends are covered by earnings and cash flows, with payout ratios of 76.2% and 50.9%, respectively, but have been volatile over its short payment history. Recent production results showed increased tin output following operational disruptions, while board changes reflect strategic shifts under new majority ownership by International Resources Holding's subsidiary, Alpha Mining Ltd.

- Navigate through the intricacies of Alphamin Resources with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Alphamin Resources shares in the market.

Taking Advantage

- Get an in-depth perspective on all 22 Top TSX Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)