- Canada

- /

- Metals and Mining

- /

- TSXV:LIT

TSX Penny Stocks To Consider In December 2025

Reviewed by Simply Wall St

As we approach the end of 2025, Canadian markets have shown strong performance with the TSX delivering double-digit gains. Amidst this backdrop, investors are closely monitoring central bank meetings and employment data while anticipating a potential Santa Claus rally. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can offer substantial growth opportunities when they boast solid financials and fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.34 | CA$252.72M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.27 | CA$137.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.48 | CA$3.88M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.34 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.17 | CA$811.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.24 | CA$164.34M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.12 | CA$201.55M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

American Eagle Gold (TSXV:AE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: American Eagle Gold Corp. focuses on acquiring and exploring mineral properties, with a market cap of CA$86.44 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$86.44M

American Eagle Gold Corp., with a market cap of CA$86.44 million, is a pre-revenue entity focused on mineral exploration. Recent drilling results at its NAK copper-gold porphyry project in British Columbia have shown promising high-grade intercepts, expanding both the South and North Zones significantly. Despite these positive exploration outcomes, the company remains unprofitable with increasing losses over recent years. However, it maintains a strong financial position with short-term assets exceeding liabilities and no debt burden. The management team is experienced, providing stability as they continue to explore and potentially expand their mineral footprint.

- Dive into the specifics of American Eagle Gold here with our thorough balance sheet health report.

- Gain insights into American Eagle Gold's historical outcomes by reviewing our past performance report.

CVW Sustainable Royalties (TSXV:CVW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CVW Sustainable Royalties Inc. focuses on developing technology to recover bitumen, solvents, minerals, and water from oil sands froth treatment tailings and has a market cap of CA$119.69 million.

Operations: CVW Sustainable Royalties Inc. has not reported any revenue segments.

Market Cap: CA$119.69M

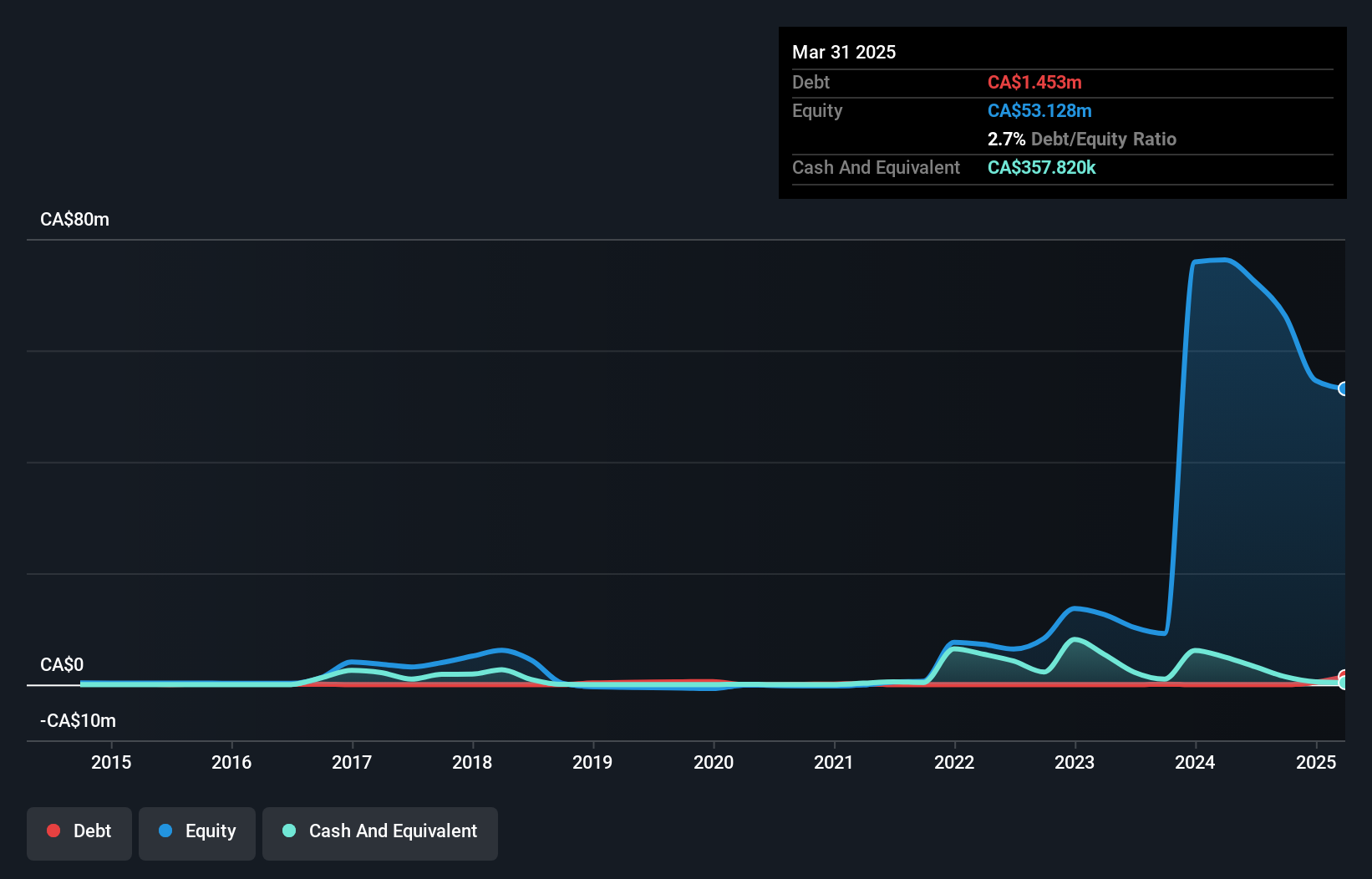

CVW Sustainable Royalties Inc., with a market cap of CA$119.69 million, is pre-revenue, focused on developing technology for oil sands tailings recovery. The company reported a net loss of CA$1.03 million for Q3 2025, reflecting increased losses compared to the previous year. Despite being unprofitable and having less than a year of cash runway, CVW is debt-free and its short-term assets exceed both short- and long-term liabilities. Management's average tenure of 2.9 years suggests experience in navigating these challenges, while shareholders have not faced significant dilution recently amidst stable weekly volatility.

- Unlock comprehensive insights into our analysis of CVW Sustainable Royalties stock in this financial health report.

- Understand CVW Sustainable Royalties' track record by examining our performance history report.

Argentina Lithium & Energy (TSXV:LIT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argentina Lithium & Energy Corp. is a junior mineral exploration company focused on acquiring, exploring, and evaluating natural resource properties in the Americas and Argentina, with a market cap of CA$17.88 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$17.88M

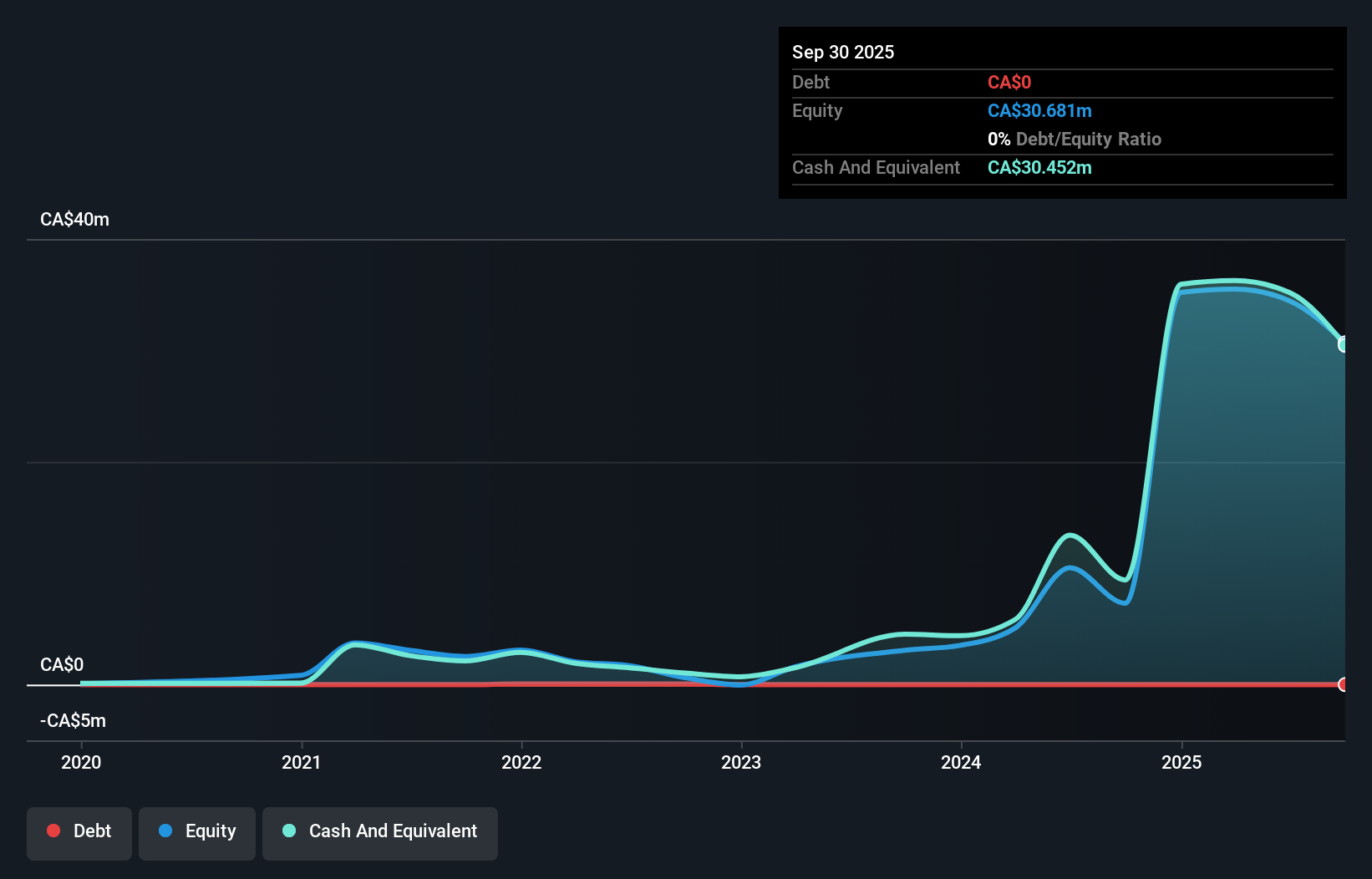

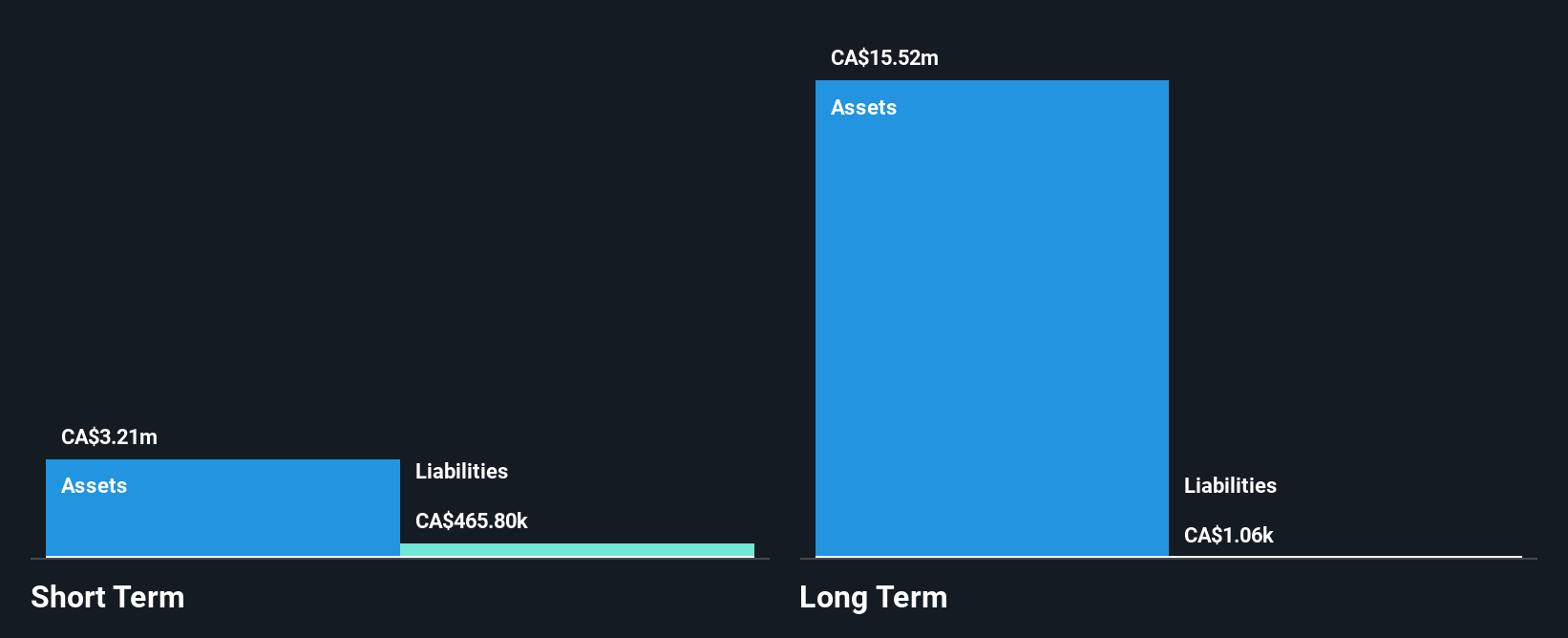

Argentina Lithium & Energy Corp., with a market cap of CA$17.88 million, is pre-revenue and focused on lithium exploration in Argentina. The company reported a reduced net loss of CA$1.17 million for Q3 2025 compared to the previous year, indicating some improvement despite ongoing unprofitability. Recent announcements highlighted its first Mineral Resource estimate for the Rincon West project, revealing significant measured and indicated resources. While the stock has experienced high volatility, it benefits from an experienced management team and board, sufficient cash runway over a year, no long-term liabilities, and stable shareholder dilution levels.

- Get an in-depth perspective on Argentina Lithium & Energy's performance by reading our balance sheet health report here.

- Explore historical data to track Argentina Lithium & Energy's performance over time in our past results report.

Taking Advantage

- Dive into all 394 of the TSX Penny Stocks we have identified here.

- Seeking Other Investments? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LIT

Argentina Lithium & Energy

A junior mineral exploration company, engages in the acquisition, exploration, and evaluation of natural resource properties in the Americas and Argentina.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026