- Canada

- /

- Metals and Mining

- /

- TSX:WPM

Here's Why Wheaton Precious Metals (TSE:WPM) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Wheaton Precious Metals (TSE:WPM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Wheaton Precious Metals with the means to add long-term value to shareholders.

View our latest analysis for Wheaton Precious Metals

Wheaton Precious Metals' Improving Profits

Wheaton Precious Metals has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Wheaton Precious Metals' EPS soared from US$1.38 to US$1.76, over the last year. That's a impressive gain of 27%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. We note that while EBIT margins have improved from 51% to 63%, the company has actually reported a fall in revenue by 8.5%. That falls short of ideal.

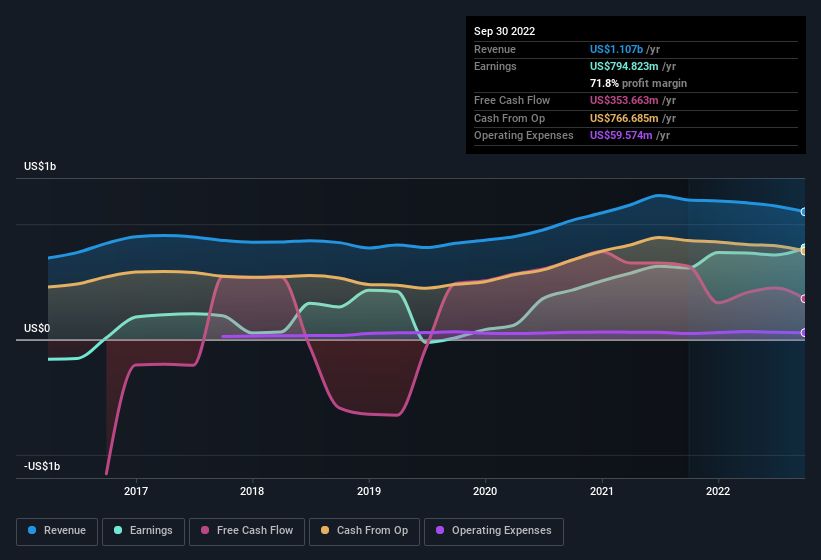

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Wheaton Precious Metals' future EPS 100% free.

Are Wheaton Precious Metals Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a CA$24b company like Wheaton Precious Metals. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they hold US$32m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Wheaton Precious Metals, with market caps over US$8.0b, is around US$7.2m.

Wheaton Precious Metals offered total compensation worth US$5.0m to its CEO in the year to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Wheaton Precious Metals To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Wheaton Precious Metals' strong EPS growth. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. Everyone has their own preferences when it comes to investing but it definitely makes Wheaton Precious Metals look rather interesting indeed. You should always think about risks though. Case in point, we've spotted 1 warning sign for Wheaton Precious Metals you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wheaton Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WPM

Wheaton Precious Metals

Sells precious metals in North America, Europe, Africa, and South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026