- Canada

- /

- Metals and Mining

- /

- TSX:RTG

Insiders Rewarded With US$1.3m Addition To Investment As RTG Mining Stock Hits CA$67m

Insiders who bought RTG Mining Inc. (TSE:RTG) stock in the last 12 months were richly rewarded last week. The company's market value increased by CA$9.6m as a result of the stock's 17% gain over the same period. In other words, the original US$5.50m purchase is now worth US$6.77m.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

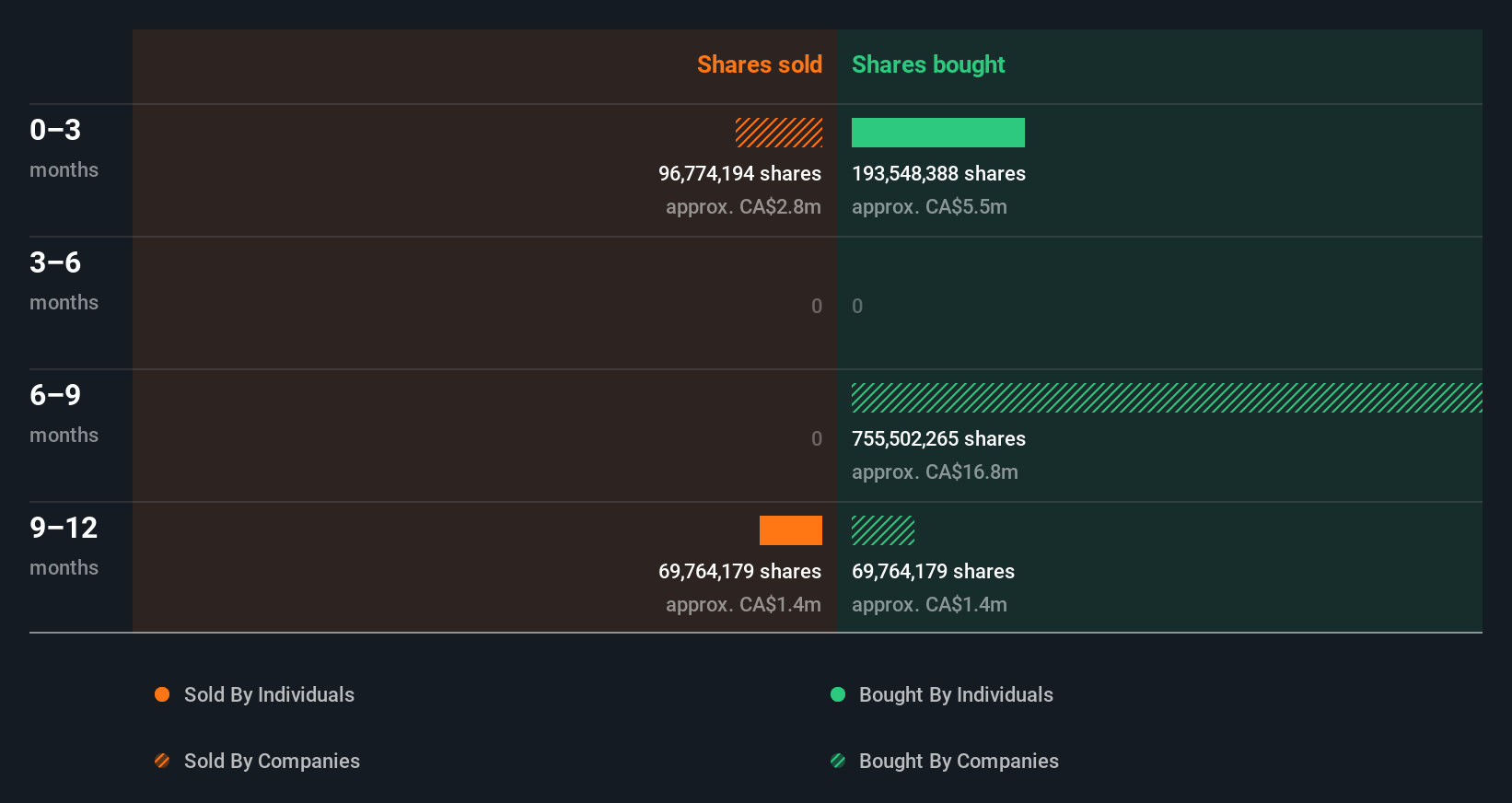

RTG Mining Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by insider Richard Hains for CA$2.7m worth of shares, at about CA$0.028 per share. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of CA$0.035. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

Richard Hains bought 193.55m shares over the last 12 months at an average price of CA$0.028. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

See our latest analysis for RTG Mining

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Does RTG Mining Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 8.1% of RTG Mining shares, worth about CA$5.4m, according to our data. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. Whilst better than nothing, we're not overly impressed by these holdings.

So What Do The RTG Mining Insider Transactions Indicate?

It is good to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. While the overall levels of insider ownership are below what we'd like to see, the history of transactions imply that RTG Mining insiders are reasonably well aligned, and optimistic for the future. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Be aware that RTG Mining is showing 4 warning signs in our investment analysis, and 3 of those are a bit concerning...

Of course RTG Mining may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:RTG

RTG Mining

Engages in the exploration and development of mineral properties.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)