- Canada

- /

- Metals and Mining

- /

- TSX:NG

The NovaGold Resources (TSE:NG) Share Price Is Down 22% So Some Shareholders Are Getting Worried

NovaGold Resources Inc. (TSE:NG) shareholders should be happy to see the share price up 15% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 22% in the last three years, falling well short of the market return.

Check out our latest analysis for NovaGold Resources

With zero revenue generated over twelve months, we NovaGold Resources has proved its business plan yet. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that NovaGold Resources finds some valuable resources, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. The is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

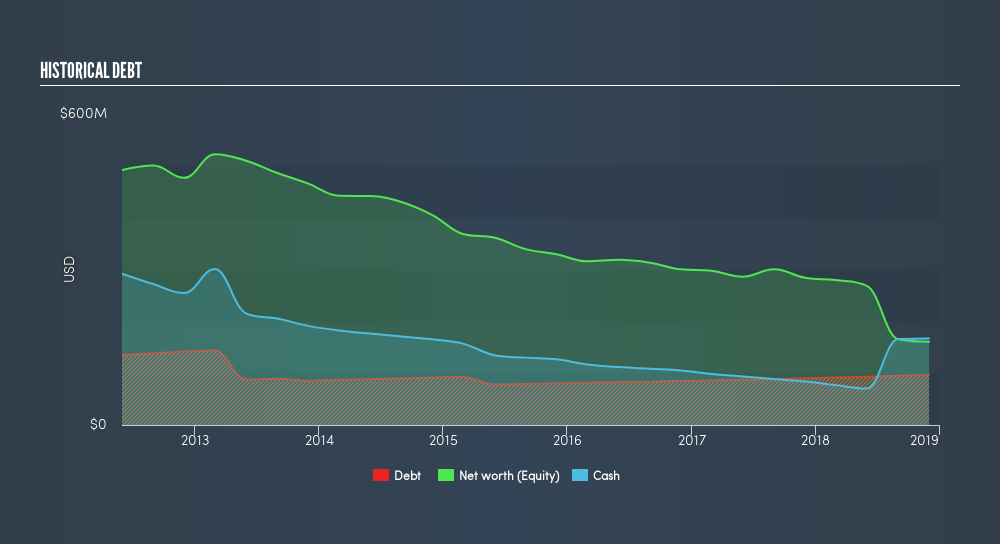

When it last reported its balance sheet in November 2018, NovaGold Resources could boast a strong position, with net cash of US$67m. This gives management the flexibility to drive business growth, without worrying too much about cash reserves. But with the share price diving 7.8% per year, over 3 years, it could be that the price was previously too hyped up. You can click on the image below to see (in greater detail) how NovaGold Resources's cash and debt levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

We're pleased to report that NovaGold Resources shareholders have received a total shareholder return of 8.0% over one year. That's better than the annualised return of 4.0% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on NovaGold Resources it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:NG

NovaGold Resources

Explores and develops gold mineral properties in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)