- Canada

- /

- Metals and Mining

- /

- TSX:IVN

3 TSX Stocks Estimated To Be Trading At Up To 39.6% Below Intrinsic Value

Reviewed by Simply Wall St

The Canadian market has experienced a positive trajectory, rising 1.2% over the last week and an impressive 28% over the past year, with earnings projected to grow by 16% annually. In this context, identifying stocks trading below their intrinsic value can present opportunities for investors seeking to capitalize on potential growth while navigating current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$12.14 | CA$21.87 | 44.5% |

| Trisura Group (TSX:TSU) | CA$44.08 | CA$87.73 | 49.8% |

| Kinaxis (TSX:KXS) | CA$157.05 | CA$284.85 | 44.9% |

| Aya Gold & Silver (TSX:AYA) | CA$19.23 | CA$33.60 | 42.8% |

| Endeavour Mining (TSX:EDV) | CA$33.92 | CA$56.18 | 39.6% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Kraken Robotics (TSXV:PNG) | CA$1.63 | CA$3.17 | 48.6% |

| Sandstorm Gold (TSX:SSL) | CA$8.96 | CA$14.50 | 38.2% |

| Blackline Safety (TSX:BLN) | CA$6.35 | CA$10.98 | 42.2% |

| Boyd Group Services (TSX:BYD) | CA$215.50 | CA$345.73 | 37.7% |

We're going to check out a few of the best picks from our screener tool.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, along with its subsidiaries, operates as a gold mining company in West Africa and has a market cap of approximately CA$8.32 billion.

Operations: The company's revenue segments include $612.70 million from the Houndé Mine, $509.60 million from the Sabodala Massawa Mine, $308.40 million from the Mana Mine in Burkina Faso, and $708.10 million from the Ity Mine in Côte D’Ivoire.

Estimated Discount To Fair Value: 39.6%

Endeavour Mining is trading at CA$33.92, significantly below its estimated fair value of CA$56.18, suggesting it may be undervalued based on cash flows. Despite recent net losses, the company is expected to become profitable within three years and achieve high annual profit growth of 63.11%. Recent operational successes include achieving commercial production at new sites in Senegal and Côte d'Ivoire, potentially enhancing future cash flow generation and supporting its undervaluation thesis.

- Our earnings growth report unveils the potential for significant increases in Endeavour Mining's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Endeavour Mining.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$26.19 billion.

Operations: Ivanhoe Mines Ltd. generates its revenue through the mining, development, and exploration of minerals and precious metals in Africa.

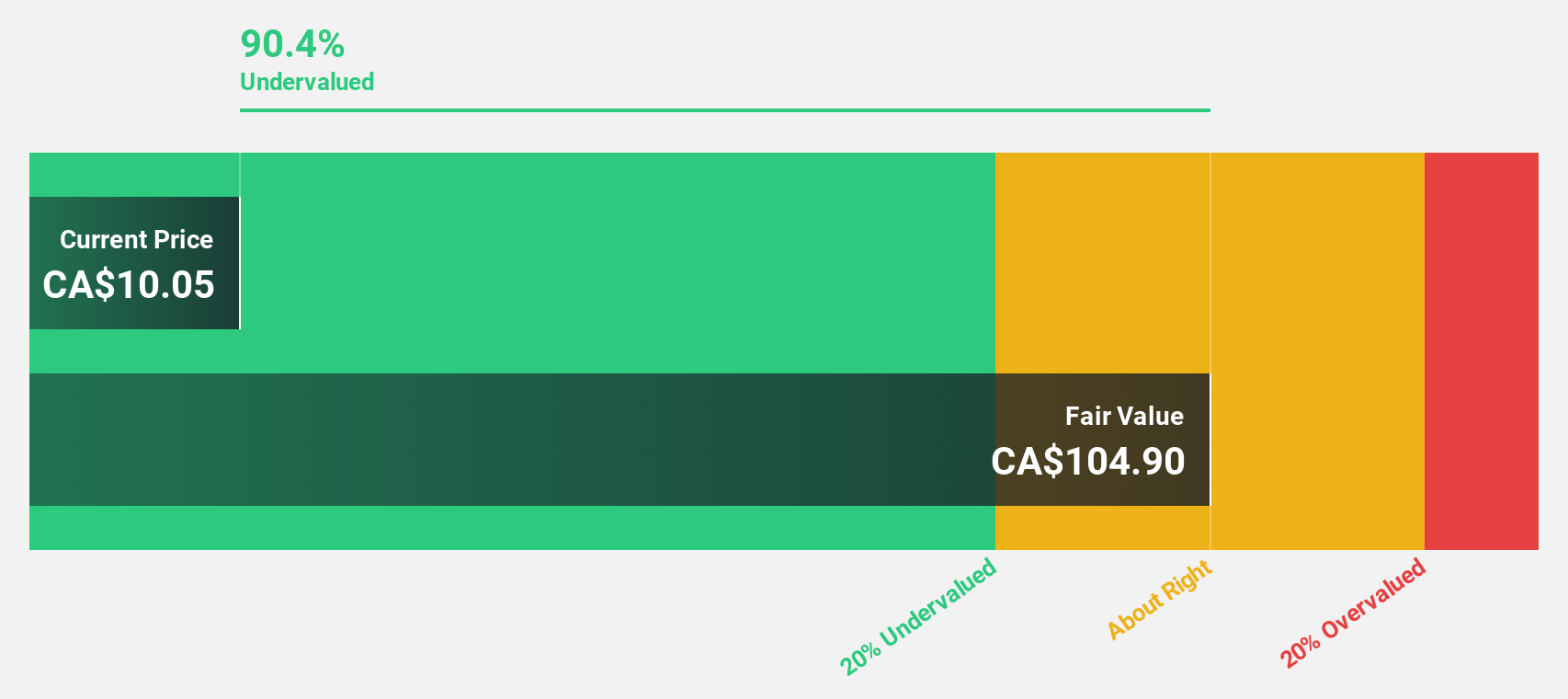

Estimated Discount To Fair Value: 18.2%

Ivanhoe Mines is trading at CA$19.78, below its estimated fair value of CA$24.17, reflecting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 69.8% annually, outpacing the Canadian market average. Despite recent shareholder dilution and low return on equity forecasts, Ivanhoe's strong production figures from the Kamoa-Kakula Copper Complex and strategic expansion into Zambia underscore its growth potential amidst ongoing operational advancements.

- According our earnings growth report, there's an indication that Ivanhoe Mines might be ready to expand.

- Unlock comprehensive insights into our analysis of Ivanhoe Mines stock in this financial health report.

Paramount Resources (TSX:POU)

Overview: Paramount Resources Ltd. is engaged in the exploration and development of conventional and unconventional petroleum and natural gas reserves in Canada, with a market cap of CA$3.92 billion.

Operations: Revenue Segments (in millions of CA$):

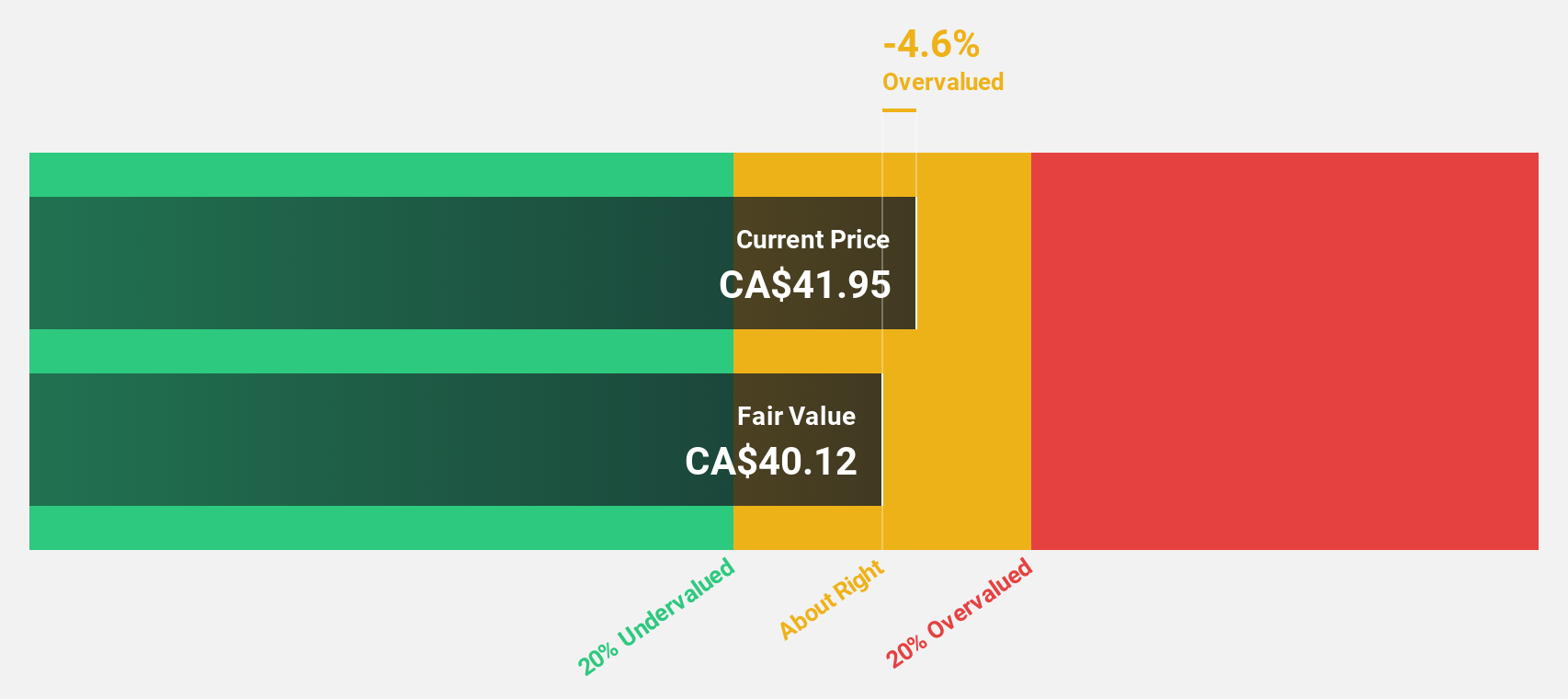

Estimated Discount To Fair Value: 17%

Paramount Resources, trading at CA$26.94, is undervalued relative to its fair value estimate of CA$32.45 based on cash flows. Despite recent shareholder dilution and a dividend yield of 6.68% not fully covered by free cash flows, the company shows promising earnings growth forecasts of 27.5% annually, surpassing the Canadian market average. Recent revenue growth and consistent dividend declarations further highlight its potential for investors seeking undervalued opportunities in the energy sector.

- The growth report we've compiled suggests that Paramount Resources' future prospects could be on the up.

- Navigate through the intricacies of Paramount Resources with our comprehensive financial health report here.

Seize The Opportunity

- Get an in-depth perspective on all 26 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives