- Canada

- /

- Metals and Mining

- /

- TSX:IVN

3 TSX Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Canadian market has experienced notable fluctuations recently, with bond yields rising sharply before retreating due to encouraging inflation data. Amidst this backdrop of economic strength and policy uncertainty, investors are increasingly focusing on companies with strong fundamentals. In such an environment, growth stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Robex Resources (TSXV:RBX) | 28.2% | 130.7% |

| West Red Lake Gold Mines (TSXV:WRLG) | 13.4% | 77.6% |

| Almonty Industries (TSX:AII) | 17.2% | 43.9% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 33% |

| Aritzia (TSX:ATZ) | 18.6% | 45.1% |

| Enterprise Group (TSX:E) | 32.3% | 56.3% |

| Colliers International Group (TSX:CIGI) | 14.1% | 24.1% |

| Profound Medical (TSX:PRN) | 10.2% | 54.6% |

| CHAR Technologies (TSXV:YES) | 10.8% | 58.3% |

We'll examine a selection from our screener results.

First National Financial (TSX:FN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: First National Financial Corporation, with a market cap of CA$2.44 billion, operates in Canada where it originates, underwrites, and services commercial and residential mortgages through its subsidiaries.

Operations: The company generates revenue through its commercial mortgage segment, which accounts for CA$215.53 million, and its residential mortgage segment, contributing CA$423.75 million.

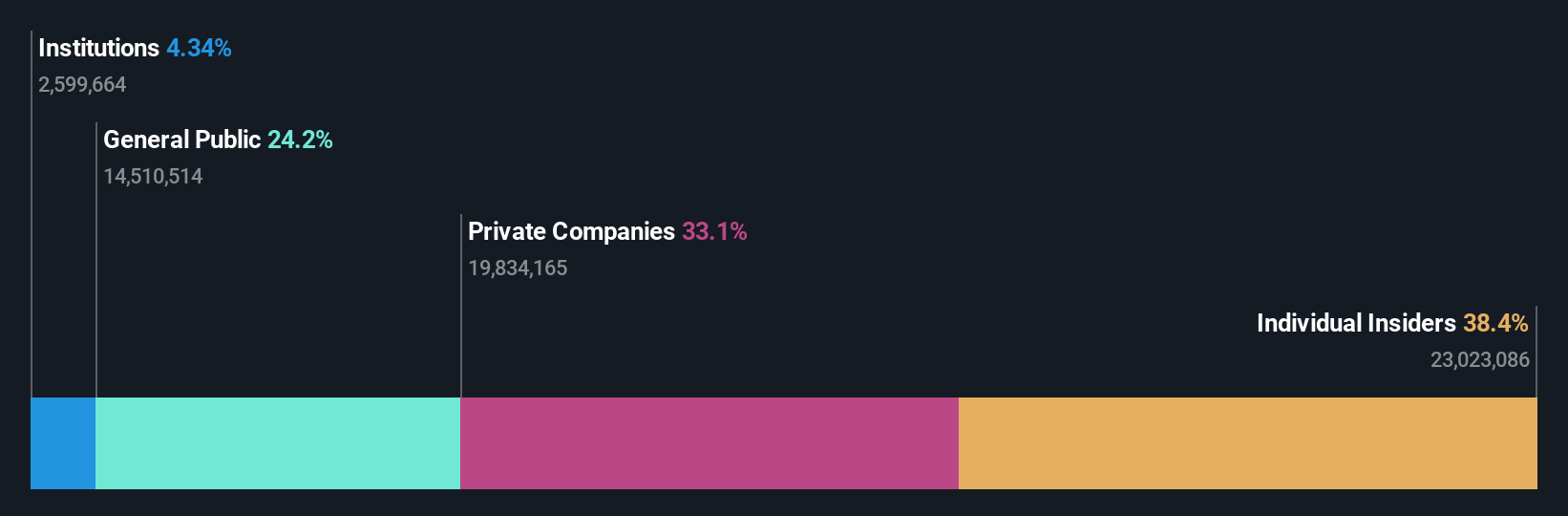

Insider Ownership: 38.4%

Revenue Growth Forecast: 14.2% p.a.

First National Financial demonstrates a compelling profile as a growth company with high insider ownership, as insiders have been net buyers in the past three months. While its earnings are forecast to grow at 15.86% annually, outpacing the Canadian market's 15.5%, revenue growth is slower at 14.2%. Despite this, it trades below fair value and offers an attractive dividend yield of 6.06%. However, debt coverage by operating cash flow remains a concern.

- Delve into the full analysis future growth report here for a deeper understanding of First National Financial.

- Our valuation report unveils the possibility First National Financial's shares may be trading at a discount.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market cap of CA$2.94 billion.

Operations: The company's revenue is derived from its Easyhome segment, contributing CA$153.68 million, and its Easyfinancial segment, generating CA$1.30 billion.

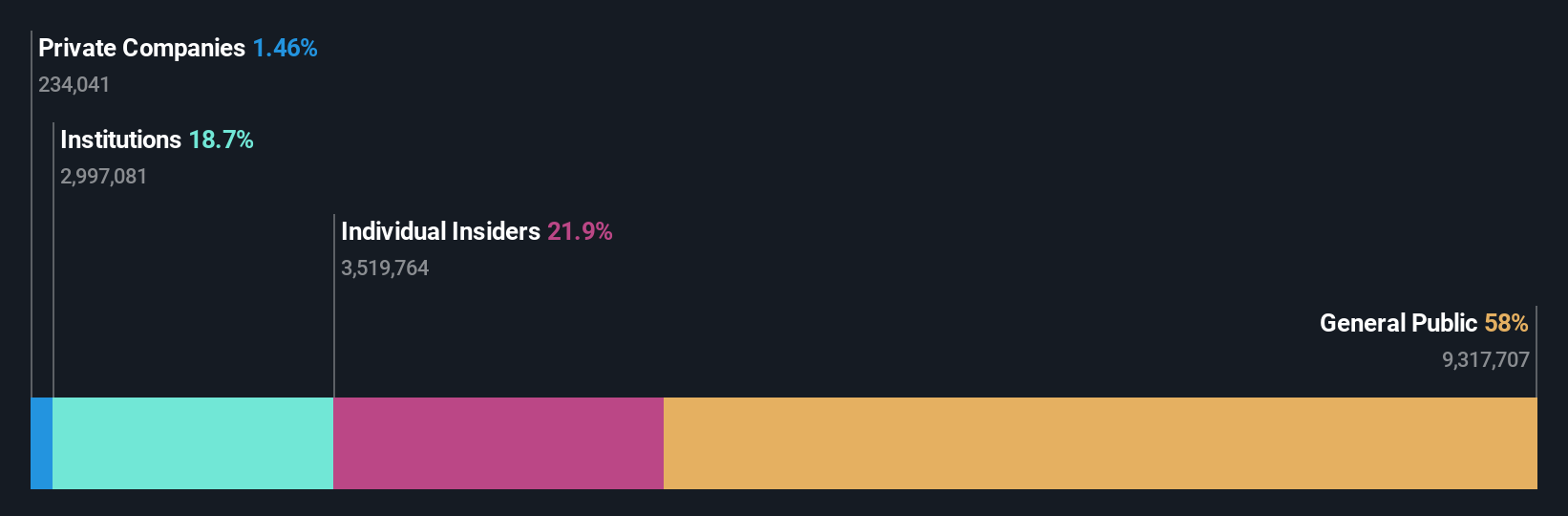

Insider Ownership: 21.1%

Revenue Growth Forecast: 24.1% p.a.

goeasy's insider ownership is notable, with more shares bought than sold recently. Despite slower earnings growth forecasts of 15% annually compared to the Canadian market, revenue is expected to grow significantly at 24.1%. The company trades at a substantial discount to its estimated fair value and has initiated a share buyback program. However, debt coverage by operating cash flow and dividend sustainability remain concerns amidst recent executive changes and financial activities.

- Click here to discover the nuances of goeasy with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, goeasy's share price might be too pessimistic.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals mainly in Africa, with a market cap of CA$22.70 billion.

Operations: Ivanhoe Mines Ltd. generates its revenue through the mining, development, and exploration of minerals and precious metals, primarily in Africa.

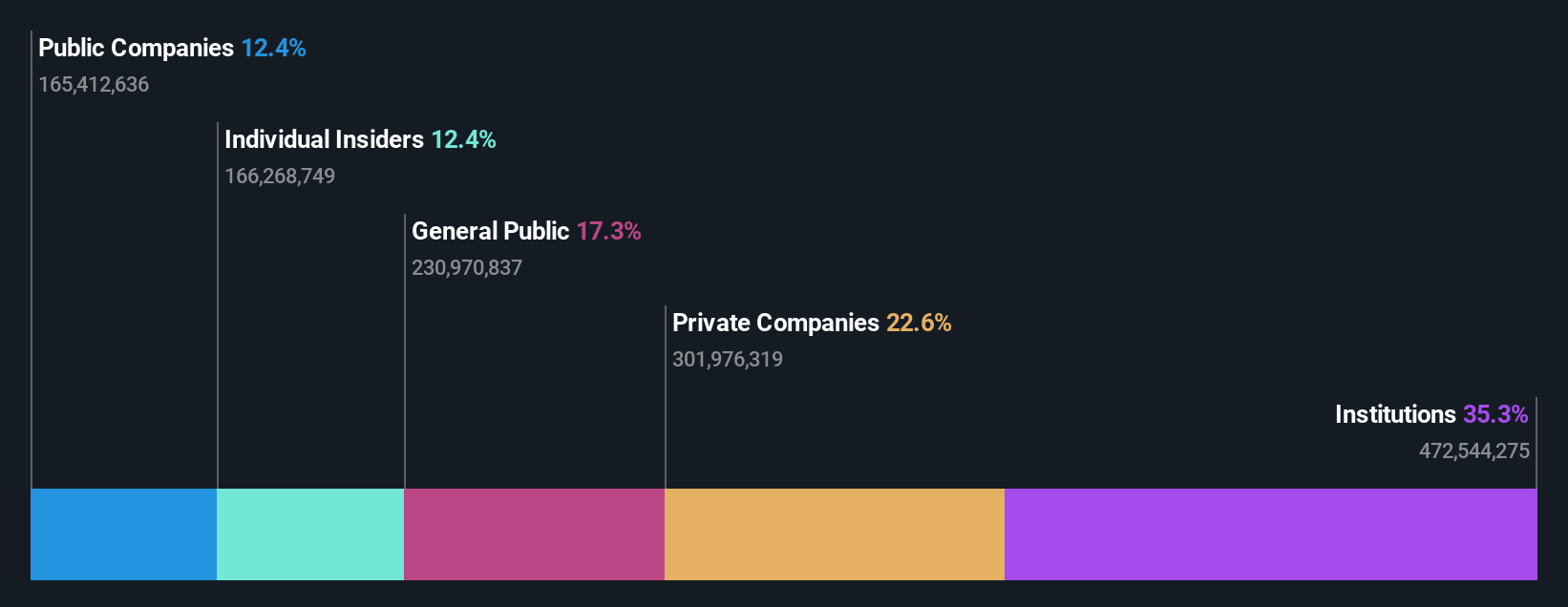

Insider Ownership: 12.5%

Revenue Growth Forecast: 54.9% p.a.

Ivanhoe Mines demonstrates strong growth potential with forecasted annual earnings and revenue growth rates of 42.5% and 54.9%, respectively, surpassing the Canadian market averages. Despite significant insider selling recently, analysts anticipate a stock price increase of 41.2%. The company has initiated a US$600 million debt financing to support project expansions, enhancing its production capabilities at Kamoa-Kakula and Kipushi mines. However, low projected return on equity remains a concern for investors seeking high returns.

- Get an in-depth perspective on Ivanhoe Mines' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Ivanhoe Mines shares in the market.

Taking Advantage

- Embark on your investment journey to our 33 Fast Growing TSX Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives