- Canada

- /

- Metals and Mining

- /

- TSX:FVI

Assessing Fortuna Mining (TSX:FVI) After Diamba Sud Drilling Results and Expanding Mineralization Potential

Reviewed by Simply Wall St

Fortuna Mining (TSX:FVI) just reported fresh exploration drilling results from the Southern Arc deposit at its Diamba Sud Gold Project in Senegal, confirming expanded mineralization that moves the project closer to a full resource update.

See our latest analysis for Fortuna Mining.

That optimism is showing up in the tape, with a roughly 15% one-month share price return and a year-to-date share price gain of around 105%, suggesting momentum is building rather than fading, backed by a three-year total shareholder return near 168%.

If Diamba Sud has you rethinking gold exposure, it could be worth scanning other precious metals names and beyond, starting with fast growing stocks with high insider ownership.

With the share price already near analyst targets after a powerful run, the key question now is simple: is Fortuna Mining still trading below its true potential, or are investors already paying up for tomorrow’s growth?

Most Popular Narrative: 6.1% Overvalued

With Fortuna Mining’s last close above the narrative fair value of CA$12.71, the story now hinges on whether earnings and margins can truly keep up.

Analysts expect earnings to reach $235.3 million (and earnings per share of $0.72) by about September 2028, up from $171.2 million today. The analysts are largely in agreement about this estimate.

Curious how shrinking revenues can still support rising earnings, fatter margins, and a lower future earnings multiple than the wider sector, all at once? The narrative leans on a specific blend of cost cuts, asset mix and valuation reset to bridge that gap, but the exact trade offs only become clear when you see the full set of forecast assumptions laid out together.

Result: Fair Value of $12.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to a handful of higher cost assets, along with potential permitting or project delays, could quickly undermine those upbeat margin and growth assumptions.

Find out about the key risks to this Fortuna Mining narrative.

Another Lens on Value

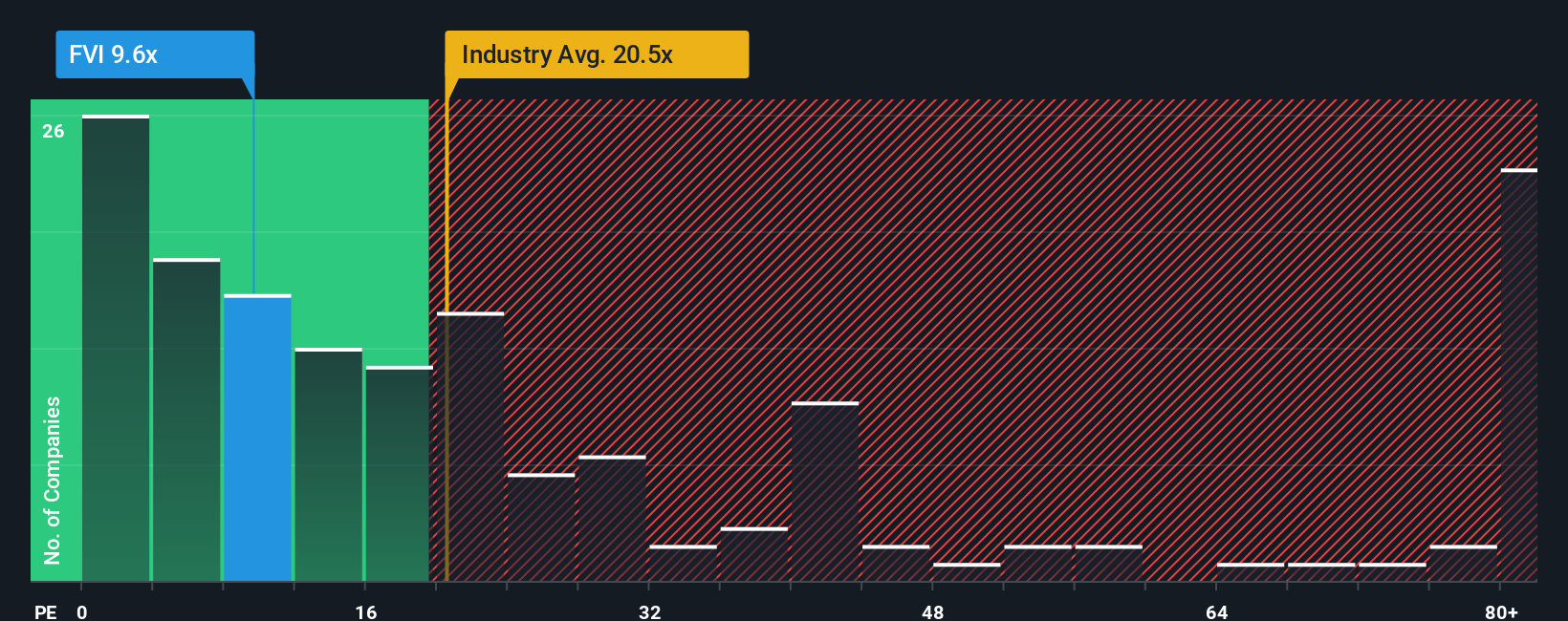

On earnings, Fortuna looks far cheaper than peers, trading on a price to earnings ratio of 11.5x versus 20.9x for the Canadian metals and mining group and a 19x fair ratio. If sentiment shifts toward these benchmarks, is today’s multiple underestimating future upside or just pricing in real risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortuna Mining Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Fortuna Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Raise your standards for what goes into your portfolio and use the Simply Wall St Screener to uncover opportunities you would almost certainly miss on your own.

- Capitalize on powerful price swings by targeting high potential names through these 3609 penny stocks with strong financials that pair speculative upside with real underlying strength.

- Position yourself ahead of the next productivity boom by focusing on automation breakthroughs and smart diagnostics using these 30 healthcare AI stocks.

- Lock in stronger income streams for the long haul by prioritizing reliable payouts with these 12 dividend stocks with yields > 3% that exceed 3% yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026