- Canada

- /

- Metals and Mining

- /

- TSX:AGI

3 TSX Stocks Estimated To Be Priced Below Intrinsic Value By Up To 27.4%

Reviewed by Simply Wall St

Amid the current climate of tariff uncertainties and political shifts, Canadian markets have shown resilience, with the TSX experiencing modest gains despite broader global concerns. In this environment, identifying stocks that are potentially undervalued can be particularly appealing for investors seeking opportunities that may offer intrinsic value below their current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Savaria (TSX:SIS) | CA$16.39 | CA$30.39 | 46.1% |

| Peyto Exploration & Development (TSX:PEY) | CA$15.64 | CA$27.44 | 43% |

| Computer Modelling Group (TSX:CMG) | CA$7.34 | CA$11.63 | 36.9% |

| OceanaGold (TSX:OGC) | CA$3.85 | CA$7.25 | 46.9% |

| Decisive Dividend (TSXV:DE) | CA$6.18 | CA$11.33 | 45.5% |

| Thunderbird Entertainment Group (TSXV:TBRD) | CA$1.70 | CA$3.33 | 49% |

| Quisitive Technology Solutions (TSXV:QUIS) | CA$0.56 | CA$1.04 | 46.4% |

| Electrovaya (TSX:ELVA) | CA$3.37 | CA$5.94 | 43.3% |

| GURU Organic Energy (TSX:GURU) | CA$1.62 | CA$3.12 | 48.1% |

| Sylogist (TSX:SYZ) | CA$8.89 | CA$15.61 | 43.1% |

We're going to check out a few of the best picks from our screener tool.

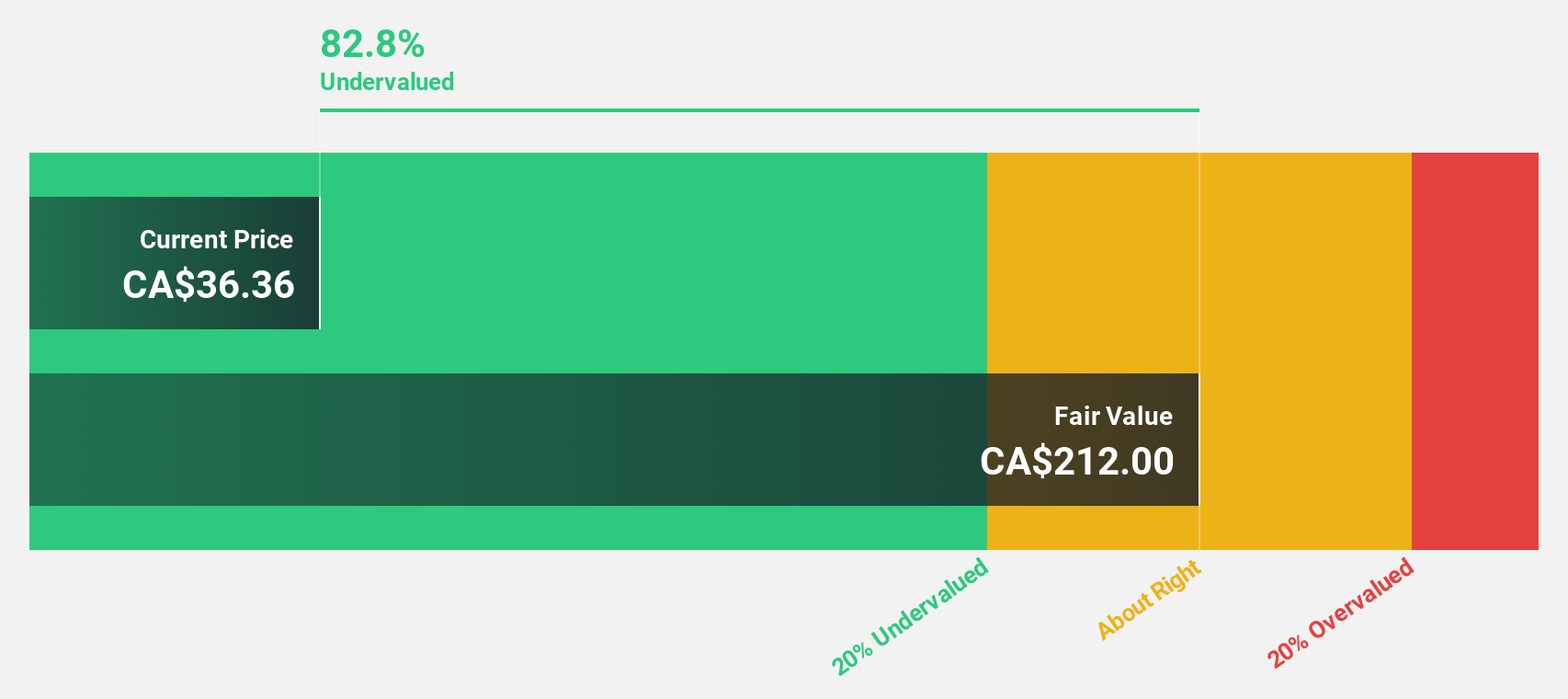

Alamos Gold (TSX:AGI)

Overview: Alamos Gold Inc. is a gold producer with operations in Canada, Mexico, and the United States, and has a market cap of CA$13.99 billion.

Operations: The company's revenue is derived from its operations at Magino ($81.20 million), Mulatos ($487.30 million), Island Gold ($363.10 million), and Young-Davidson ($415.30 million).

Estimated Discount To Fair Value: 21.5%

Alamos Gold Inc. appears undervalued, trading at CA$34.55 against a fair value estimate of CA$44.03, reflecting over 20% below its estimated worth based on discounted cash flows. The company reported strong financials with 2024 sales reaching US$1.35 billion and net income of US$284.3 million, alongside consistent dividend payments and robust production guidance for 2025, indicating potential for sustained revenue growth above the Canadian market average of 5.3% annually.

- In light of our recent growth report, it seems possible that Alamos Gold's financial performance will exceed current levels.

- Navigate through the intricacies of Alamos Gold with our comprehensive financial health report here.

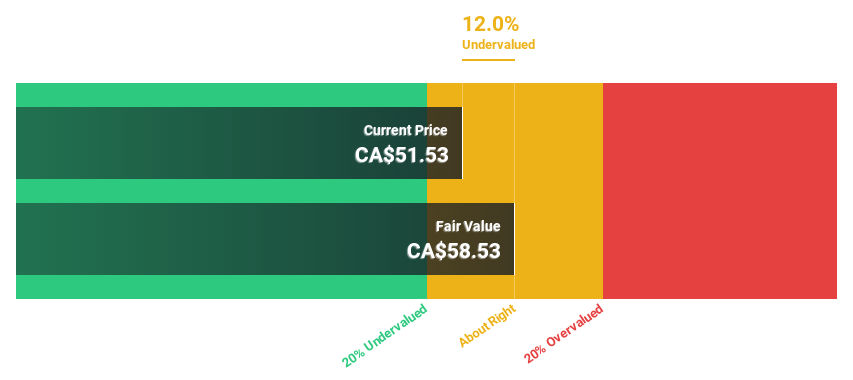

Altus Group (TSX:AIF)

Overview: Altus Group Limited offers asset and funds intelligence solutions for commercial real estate across various regions including Canada, the United States, and Europe, with a market cap of CA$2.39 billion.

Operations: The company generates revenue primarily from its Analytics segment, which accounts for CA$411.28 million, and its Appraisals and Development Advisory segment, contributing CA$109.21 million.

Estimated Discount To Fair Value: 11.8%

Altus Group, trading at CA$51.64, is undervalued relative to its fair value estimate of CA$58.55. The company's 2024 earnings report showed sales of CA$519.73 million and net income of CA$13.42 million, with improved loss per share figures from the previous year. Despite flat short-term revenue expectations, Altus anticipates modest growth for 2025 and continues shareholder returns through dividends and a completed buyback program worth CA$17.33 million for 318,700 shares repurchased.

- Our earnings growth report unveils the potential for significant increases in Altus Group's future results.

- Take a closer look at Altus Group's balance sheet health here in our report.

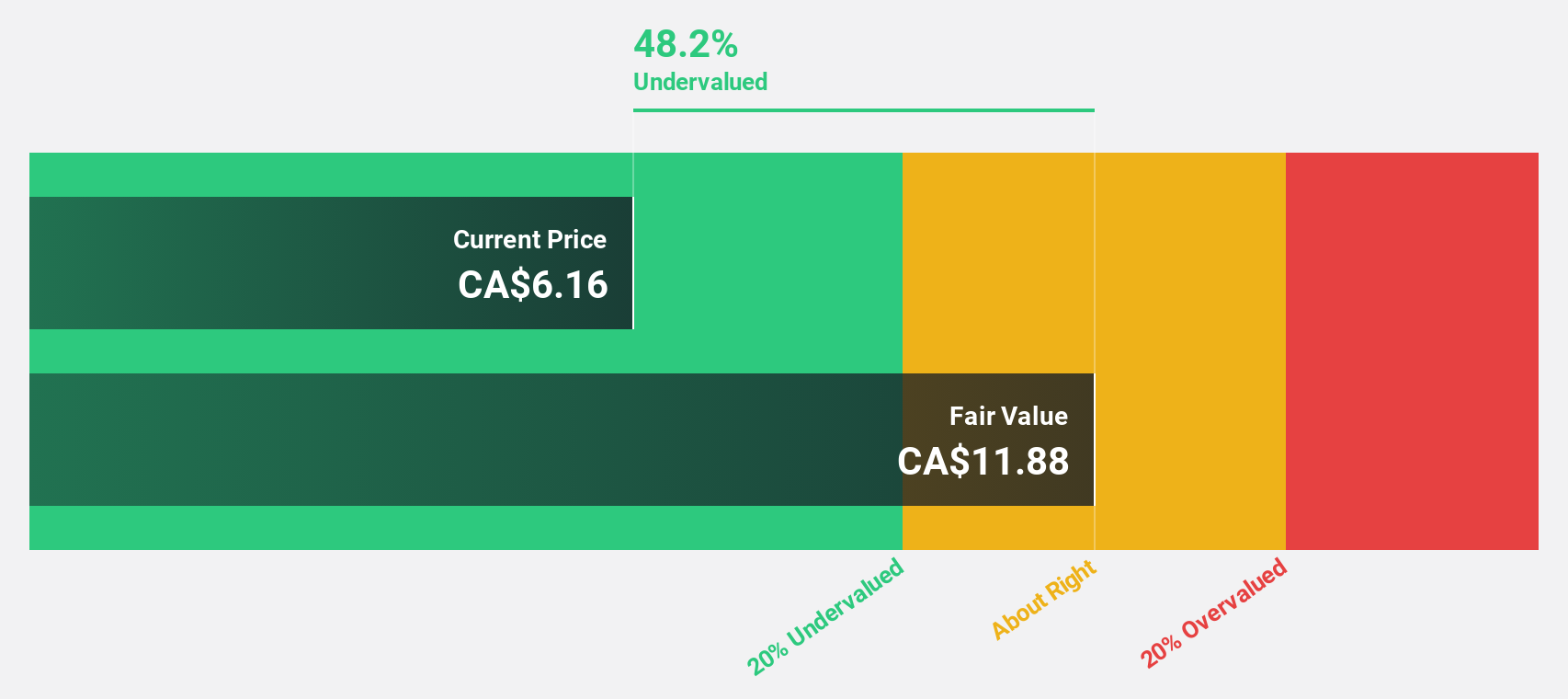

Endeavour Silver (TSX:EDR)

Overview: Endeavour Silver Corp. is a silver mining company involved in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Chile and the United States with a market cap of CA$1.37 billion.

Operations: Endeavour Silver Corp. generates revenue through its operations in acquiring, exploring, developing, extracting, processing, refining, and reclaiming mineral properties located in Chile and the United States.

Estimated Discount To Fair Value: 27.4%

Endeavour Silver is trading at CA$6.52, significantly below its fair value estimate of CA$8.98, indicating potential undervaluation based on cash flows. Despite a net loss of US$31.48 million for 2024, the company forecasts profitability and revenue growth surpassing the Canadian market over the next three years. Recent positive drill results at Bolañitos Mine and substantial progress at Terronera Project further support future operational expansion and resource replacement, enhancing long-term prospects despite current financial setbacks.

- Our comprehensive growth report raises the possibility that Endeavour Silver is poised for substantial financial growth.

- Get an in-depth perspective on Endeavour Silver's balance sheet by reading our health report here.

Seize The Opportunity

- Click this link to deep-dive into the 26 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AGI

Alamos Gold

Operates as a gold producer in Canada, Mexico, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)