- Canada

- /

- Metals and Mining

- /

- TSX:CG

Three Top Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

Global markets have recently experienced a surge, driven by the Federal Reserve's first rate cut in over four years. While large-cap indexes reached new highs, small-cap indexes like the Russell 2000 also showed strong performance, though still below their previous peaks. In this environment, identifying undervalued small-cap stocks with insider action can be particularly rewarding. These stocks often present unique opportunities for growth and value appreciation in a market buoyed by favorable economic indicators and monetary policy shifts.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 21.3x | 1.0x | 41.88% | ★★★★★★ |

| Trican Well Service | 7.7x | 1.0x | 12.77% | ★★★★★☆ |

| Genus | 158.0x | 1.9x | 3.84% | ★★★★★☆ |

| Citizens & Northern | 13.0x | 2.9x | 43.38% | ★★★★☆☆ |

| MYR Group | 33.1x | 0.5x | 44.32% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -58.86% | ★★★★☆☆ |

| Essentra | 700.7x | 1.4x | 39.49% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.6x | 3.4x | 39.19% | ★★★★☆☆ |

| German American Bancorp | 13.8x | 4.6x | 46.98% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

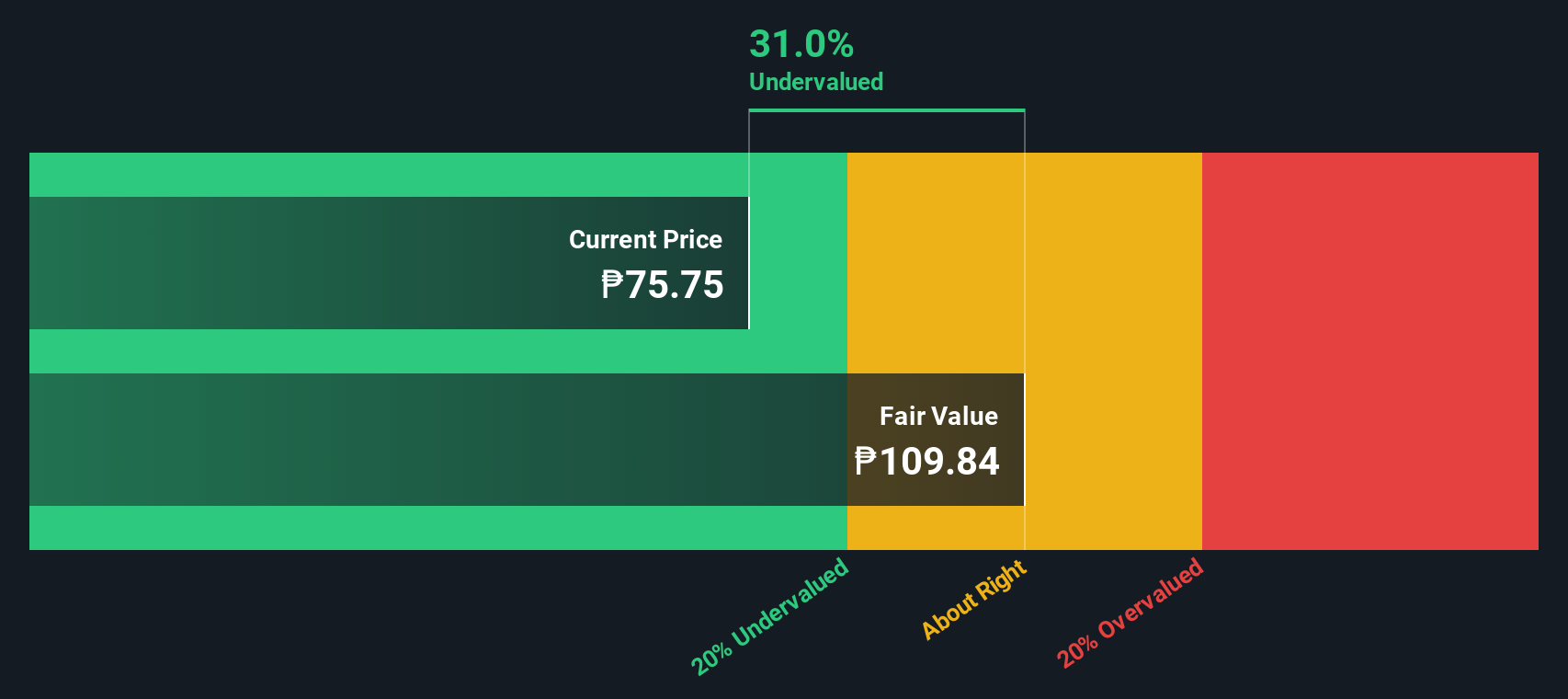

Security Bank (PSE:SECB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Security Bank is a financial institution that provides retail banking, business banking, financial market services, and wholesale banking with a market cap of ₱103.45 billion.

Operations: Security Bank generates revenue primarily from Wholesale Banking (₱8.10 billion), with significant contributions from Retail Banking (₱1.97 billion) and Business Banking (₱1.05 billion). The company has seen its net income margin fluctuate, reaching a high of 48.86% in Q1 2015 and a low of 19.53% in Q2 2021, reflecting varying operating expenses over the periods analyzed.

PE: 7.5x

Security Bank, a small cap stock, has shown promising signs of being undervalued. Recent insider confidence is evident with Enrico Cruz purchasing 49,000 shares worth PHP 2.95 million in August 2024. The company reported net interest income of PHP 21.66 billion for the first half of 2024, up from PHP 15.75 billion the previous year. Additionally, Security Bank completed a PHP 20 billion fixed-income offering and announced strategic executive appointments to enhance risk management and retail banking operations starting September 2024.

- Navigate through the intricacies of Security Bank with our comprehensive valuation report here.

Evaluate Security Bank's historical performance by accessing our past performance report.

Shanghai Chicmax Cosmetic (SEHK:2145)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Chicmax Cosmetic is a company engaged in the manufacture and sale of cosmetic products with a market capitalization of CN¥6.11 billion.

Operations: The company generates revenue primarily from the manufacture and sale of cosmetic products, with recent revenue reaching CN¥6106.30 million. The gross profit margin has shown an upward trend, reaching 74.96% as of June 2024. Operating expenses are significantly driven by sales and marketing costs, which amounted to CN¥3406.32 million in the same period.

PE: 18.1x

Shanghai Chicmax Cosmetic reported a significant rise in sales and net income for the half year ended June 30, 2024, with sales jumping to CNY 3.5 billion from CNY 1.6 billion and net income increasing to CNY 401.2 million from CNY 101 million a year ago. They announced an interim dividend of RMB 0.75 per share, payable on November 19, following shareholder approval on September 30. Insider confidence is evident with recent share purchases by company executives throughout this period, indicating strong belief in future performance potential.

- Click here and access our complete valuation analysis report to understand the dynamics of Shanghai Chicmax Cosmetic.

Learn about Shanghai Chicmax Cosmetic's historical performance.

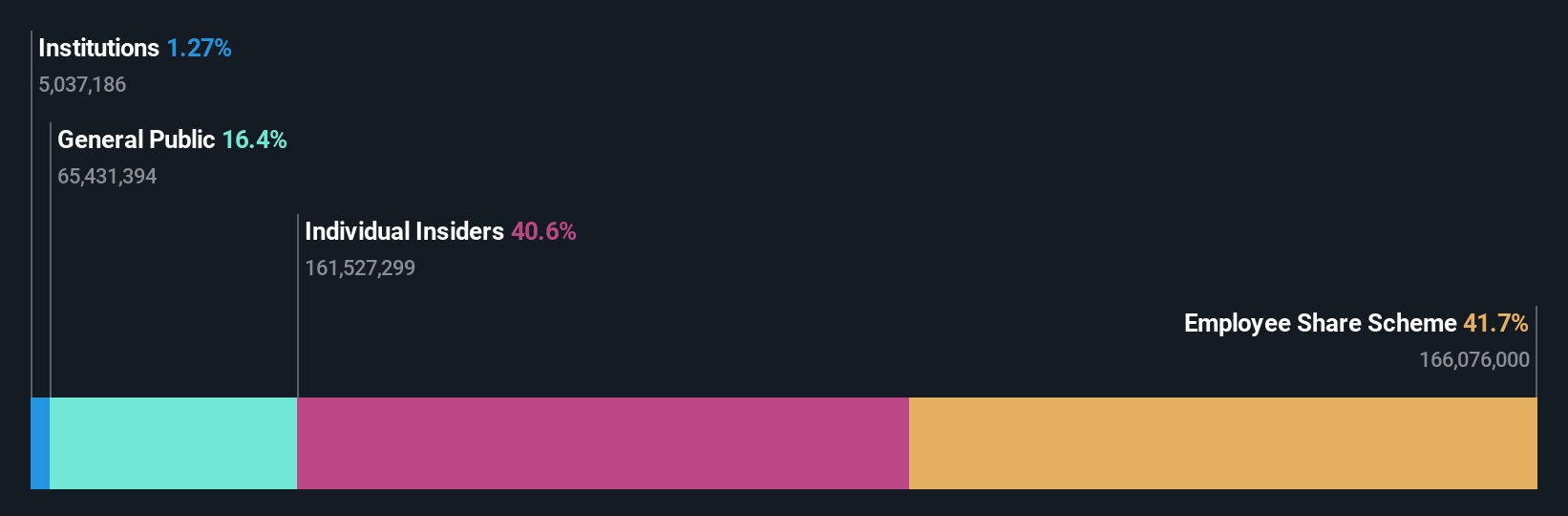

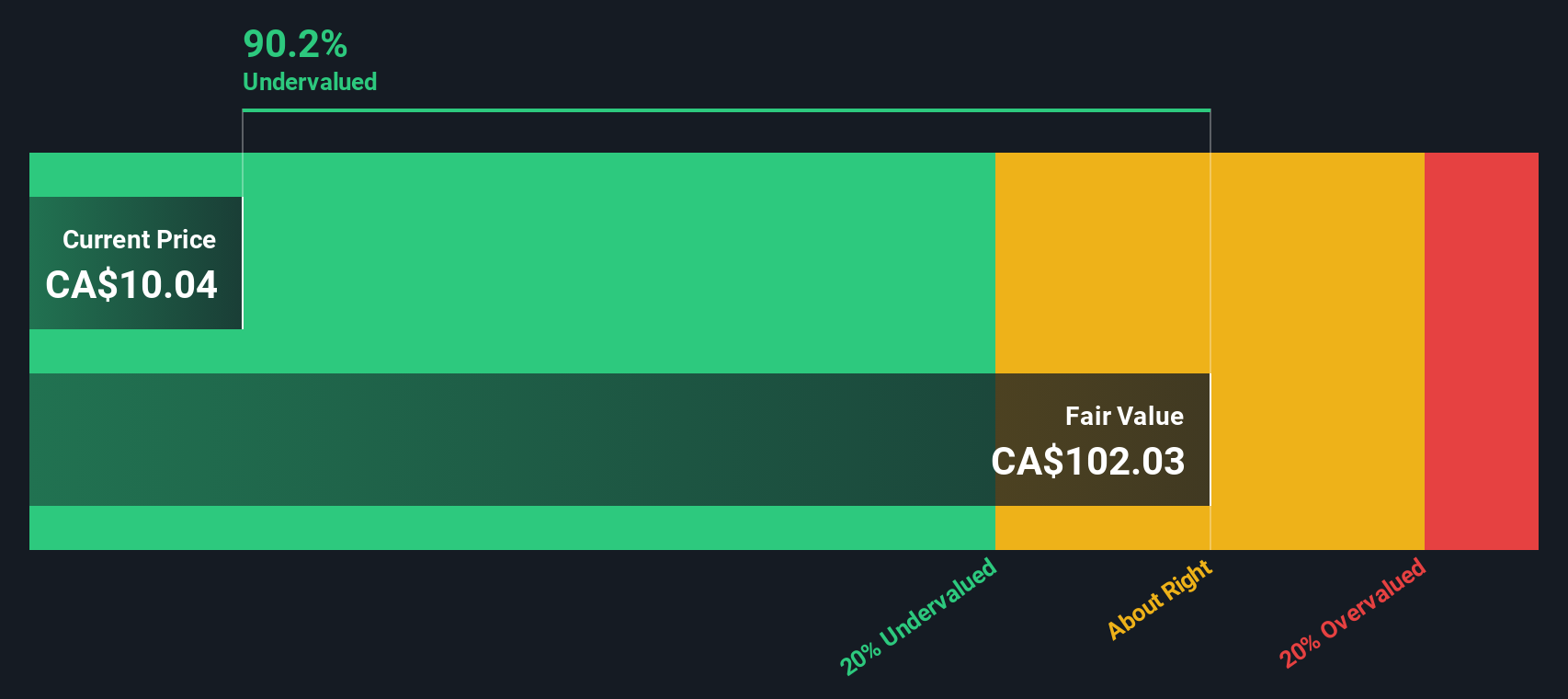

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centerra Gold is a mining company that focuses on gold and copper production, with operations in Turkey, Canada, and the United States, and has a market cap of approximately C$1.92 billion.

Operations: Centerra Gold's revenue streams are primarily from Öksüt ($603.31M), Mount Milligan ($429.08M), and Molybdenum ($239.65M). The company has experienced fluctuations in its net income margin, with recent periods showing negative margins, such as -0.34708% for the quarter ending June 30, 2023, and -0.18956% for the quarter ending September 30, 2023. Gross profit margins have varied significantly over time, reaching as high as 58.82% in Q3 2019 but dropping to lower levels like 14.42% in Q1 2023 and recovering slightly to around 23.70%-32.93% by the end of that year.

PE: 12.1x

Centerra Gold, a small-cap mining company, has seen significant insider confidence with multiple share purchases since July 2024. The company reported strong earnings for Q2 2024, with sales of US$282.31 million and net income of US$37.67 million, reversing a loss from the previous year. Additionally, Centerra repurchased 1.44 million shares from April to June for US$9.8 million and announced a quarterly dividend of CAD$0.07 per share payable in August 2024.

- Unlock comprehensive insights into our analysis of Centerra Gold stock in this valuation report.

Explore historical data to track Centerra Gold's performance over time in our Past section.

Turning Ideas Into Actions

- Get an in-depth perspective on all 177 Undervalued Small Caps With Insider Buying by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

A gold mining company, engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet, good value and pays a dividend.