- Canada

- /

- Life Sciences

- /

- CNSX:TELI

General Copper Gold And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market has been navigating a landscape of economic shifts and evolving investor sentiment, reflecting broader global trends. Despite the vintage feel of the term "penny stocks," these investments remain relevant as they often represent smaller or newer companies with potential for significant returns. In this article, we explore three TSX penny stocks that showcase financial strength and offer intriguing opportunities for investors seeking hidden value in quality companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.28 | CA$116.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.31 | CA$907.23M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.02 | CA$391.6M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$483.37M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$224.43M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.27 | CA$168.47M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.46M | ★★★★★☆ |

Click here to see the full list of 952 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

General Copper Gold (CNSX:GGLD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: General Copper Gold Corp. is an independent mineral exploration company focused on exploring and evaluating mineral properties, with a market cap of CA$1.33 million.

Operations: General Copper Gold Corp. does not report any revenue segments as it is primarily engaged in mineral exploration and evaluation activities.

Market Cap: CA$1.33M

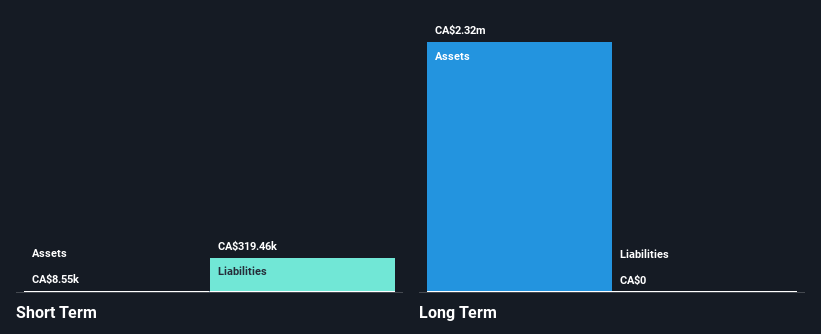

General Copper Gold Corp., with a market cap of CA$1.33 million, is a pre-revenue mineral exploration company facing challenges typical of penny stocks. The company has no significant revenue streams and remains unprofitable, with losses increasing by 20.6% annually over the past five years. Short-term liabilities significantly exceed short-term assets (CA$319.5K vs CA$8.5K), but there's been improvement in equity from negative to positive over five years, suggesting some financial progress. The board is experienced with an average tenure of 3.7 years, though management experience data is insufficiently detailed for assessment. Shareholder dilution has not been substantial recently, and the company holds no long-term liabilities.

- Jump into the full analysis health report here for a deeper understanding of General Copper Gold.

- Explore historical data to track General Copper Gold's performance over time in our past results report.

Telescope Innovations (CNSX:TELI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Telescope Innovations Corp. is a chemical technology company that focuses on developing manufacturing processes and tools for the pharmaceutical and chemical industries, with a market cap of CA$18.53 million.

Operations: The company generates revenue from its Chemicals segment, amounting to CA$3.90 million.

Market Cap: CA$18.53M

Telescope Innovations Corp., with a market cap of CA$18.53 million, operates in the chemical technology sector and is currently unprofitable but not pre-revenue, generating CA$3.90 million from its Chemicals segment. The company maintains a strong financial position with short-term assets (CA$2.2M) exceeding both short-term (CA$1M) and long-term liabilities (CA$1.9M), while being debt-free and having a stable cash runway for over three years despite shrinking free cash flow. Although the management team is relatively new, the board's experience suggests governance stability, complemented by minimal shareholder dilution over the past year.

- Take a closer look at Telescope Innovations' potential here in our financial health report.

- Gain insights into Telescope Innovations' historical outcomes by reviewing our past performance report.

Canadian Silver Hunter (TSXV:AGH.H)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Canadian Silver Hunter Inc. is an exploration stage company focused on acquiring, exploring, and developing base and precious metal mineral properties in Canada, with a market cap of CA$427,795.

Operations: Currently, there are no reported revenue segments for this exploration stage company focused on base and precious metal mineral properties in Canada.

Market Cap: CA$427.8k

Canadian Silver Hunter Inc., with a market cap of CA$427,795, operates as a pre-revenue exploration stage company focusing on base and precious metal properties. Despite being unprofitable, it maintains a stable cash runway for over three years due to positive free cash flow. The company's short-term assets (CA$361.3K) comfortably cover its short-term liabilities (CA$56.6K), and it is debt-free, indicating financial prudence in managing obligations. Recent earnings reported a reduced net loss for the third quarter compared to the previous year, suggesting some improvement in financial performance despite ongoing challenges typical of the sector's early-stage ventures.

- Click here and access our complete financial health analysis report to understand the dynamics of Canadian Silver Hunter.

- Gain insights into Canadian Silver Hunter's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Click this link to deep-dive into the 952 companies within our TSX Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Telescope Innovations, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Telescope Innovations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:TELI

Telescope Innovations

A chemical technology company, develops manufacturing processes and tools for the pharmaceutical and chemical industry in the United States and Canada.

Adequate balance sheet and fair value.

Market Insights

Community Narratives