- Canada

- /

- Metals and Mining

- /

- CNSX:SASY

December 2024's Top TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market has recently experienced a pullback, with the TSX index losing ground amid political uncertainties and leadership transitions. Despite this volatility, long-term investors remain focused on opportunities that align with strong economic fundamentals and easing inflation. Penny stocks, often representing smaller or newer companies, continue to attract attention for their potential to uncover hidden value when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$116.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.33 | CA$907.23M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.15 | CA$391.6M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.49 | CA$15.47M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$483.37M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$224.43M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.36 | CA$168.47M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

Click here to see the full list of 953 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Sassy Gold (CNSX:SASY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sassy Gold Corp. is an exploration stage company focused on acquiring, identifying, exploring, and evaluating precious metals resources in Canada with a market cap of CA$1.38 million.

Operations: Sassy Gold Corp. has not reported any revenue segments as it is currently in the exploration stage, concentrating on precious metals resources in Canada.

Market Cap: CA$1.38M

Sassy Gold Corp., with a market cap of CA$1.38 million, is pre-revenue and focused on precious metals exploration in Canada. Despite being debt-free, its financial health is challenged by a less than one-year cash runway and increasing losses over the past five years. Recent developments include acquiring a 100% interest in the Ashuanipi Gold Property, which could enhance its exploration prospects. However, concerns about its ability to continue as a going concern persist following an auditor's report. The stock remains highly volatile compared to most Canadian stocks, reflecting inherent risks associated with penny stocks in this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Sassy Gold.

- Understand Sassy Gold's track record by examining our performance history report.

Golden Sky Minerals (TSXV:AUEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golden Sky Minerals Corp. is a Canadian mineral exploration company with a market cap of CA$1.78 million.

Operations: Golden Sky Minerals Corp. has not reported any revenue segments.

Market Cap: CA$1.78M

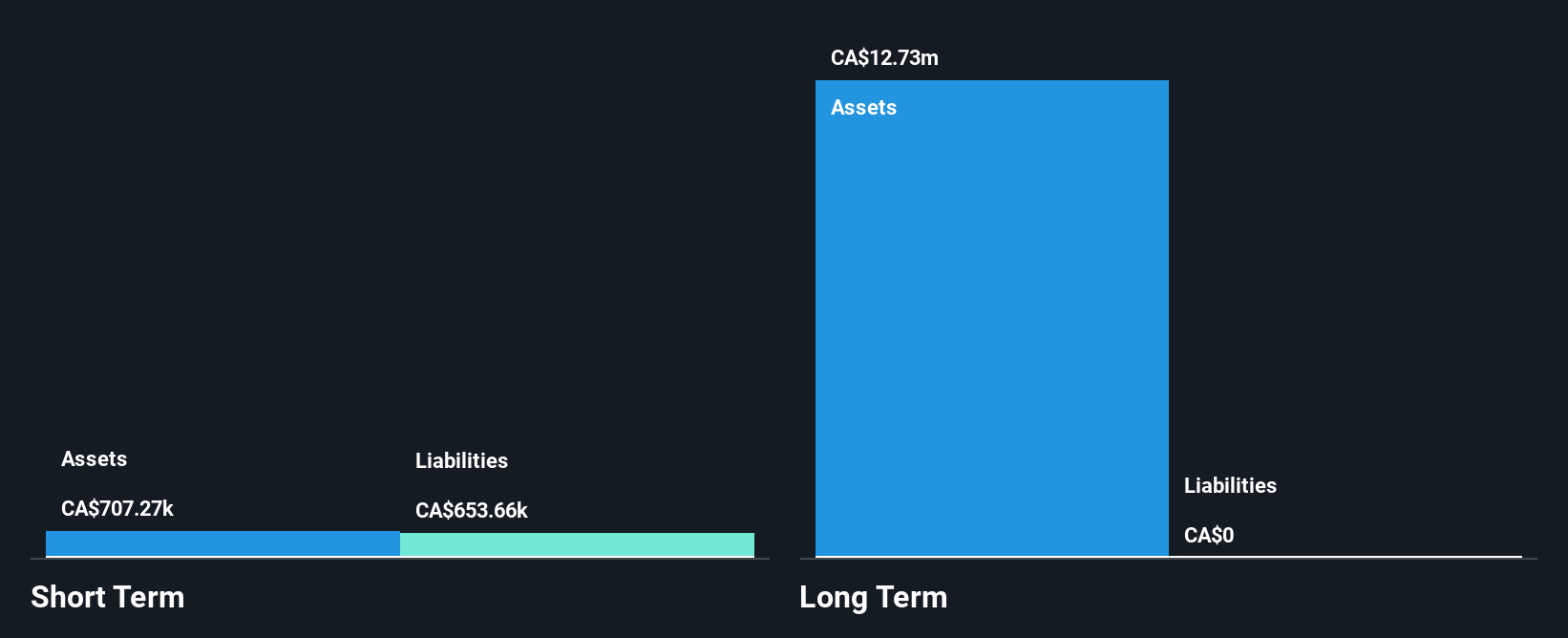

Golden Sky Minerals Corp., with a market cap of CA$1.78 million, is pre-revenue and engaged in mineral exploration. The company remains debt-free, which is positive for its financial health, but faces challenges with less than a year of cash runway and historical earnings declines of 68.8% annually over five years. Recent earnings show reduced losses compared to the previous year, yet it remains unprofitable with high share price volatility over the past three months. Short-term assets exceed liabilities, suggesting some liquidity strength amidst ongoing financial pressures typical in this sector's penny stocks.

- Get an in-depth perspective on Golden Sky Minerals' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Golden Sky Minerals' track record.

Parvis Invest (TSXV:PVIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Parvis Invest Inc. operates an online real estate investing platform and has a market cap of CA$1.47 million.

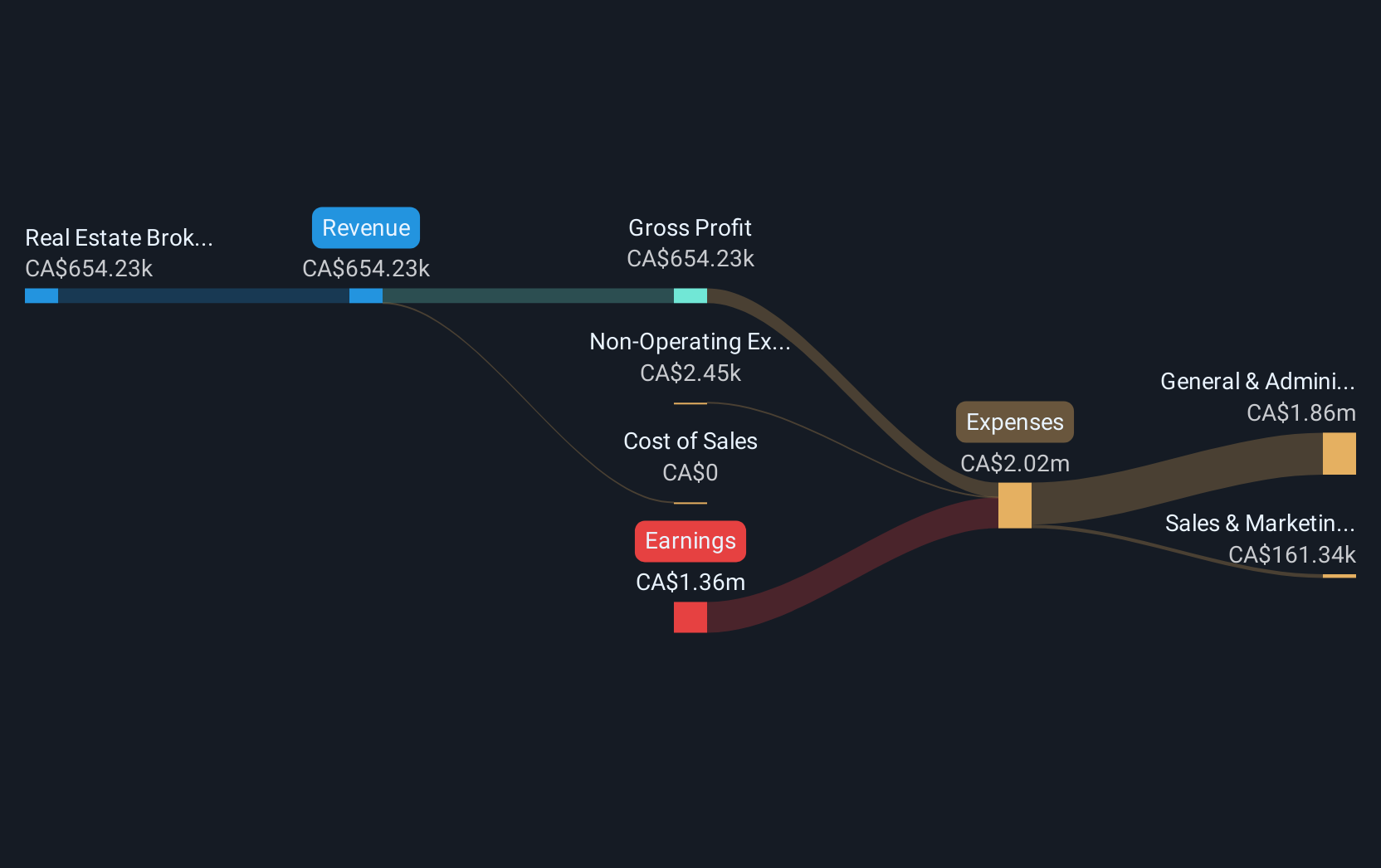

Operations: The company's revenue segment includes CA$0.51 million from Real Estate Brokers.

Market Cap: CA$1.47M

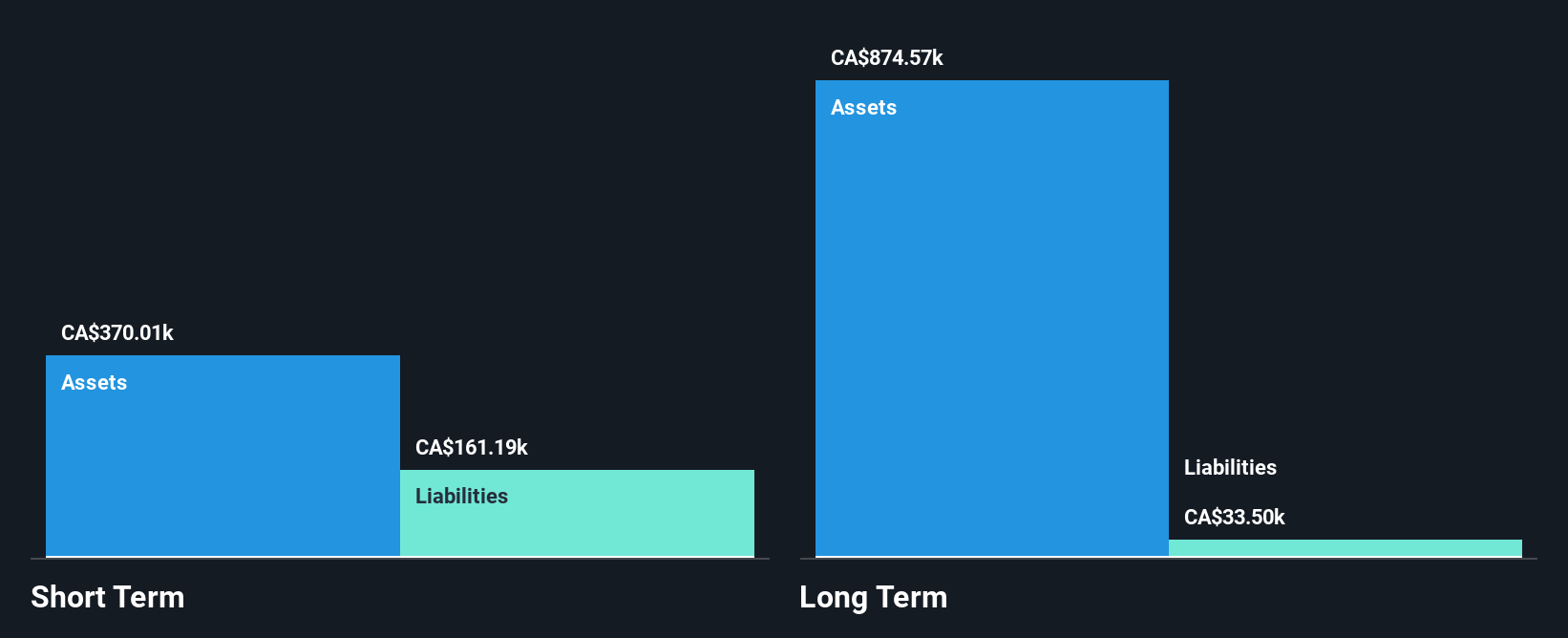

Parvis Invest Inc., with a market cap of CA$1.47 million, operates as a pre-revenue entity in the online real estate space, showing significant revenue growth though still under US$1 million. The company is debt-free and has sufficient cash to operate for over a year, but its negative return on equity indicates ongoing unprofitability. Recent earnings reports show reduced net losses compared to the previous year, while strategic partnerships with new issuer clients like Foundation Capital and Azure Properties Group enhance its platform offerings. Short-term assets cover liabilities, providing some financial stability amid expansion efforts.

- Click to explore a detailed breakdown of our findings in Parvis Invest's financial health report.

- Examine Parvis Invest's past performance report to understand how it has performed in prior years.

Taking Advantage

- Embark on your investment journey to our 953 TSX Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:SASY

Sassy Gold

An exploration stage company, acquires, identifies, explores for, and evaluates of precious metals resources in Canada.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion