As the Canadian market continues to climb, buoyed by trade optimism and strong corporate earnings, investors are enjoying a period of low volatility with the TSX reaching new highs. In this environment, dividend stocks offer a compelling opportunity for those seeking stability and income, especially as solid fundamentals support a cautiously optimistic outlook amidst potential near-term volatility.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.16% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.86% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.44% | ★★★★★☆ |

| Quebecor (TSX:QBR.A) | 3.53% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.40% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.28% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 4.88% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.91% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.40% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.39% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Acadian Timber (TSX:ADN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acadian Timber Corp. operates in the forest products industry across Eastern Canada and the Northeastern United States, with a market cap of CA$326.64 million.

Operations: Acadian Timber Corp. generates revenue primarily from its New Brunswick Timberlands segment, contributing CA$77.31 million, and its Maine Timberlands segment, which adds CA$15.24 million.

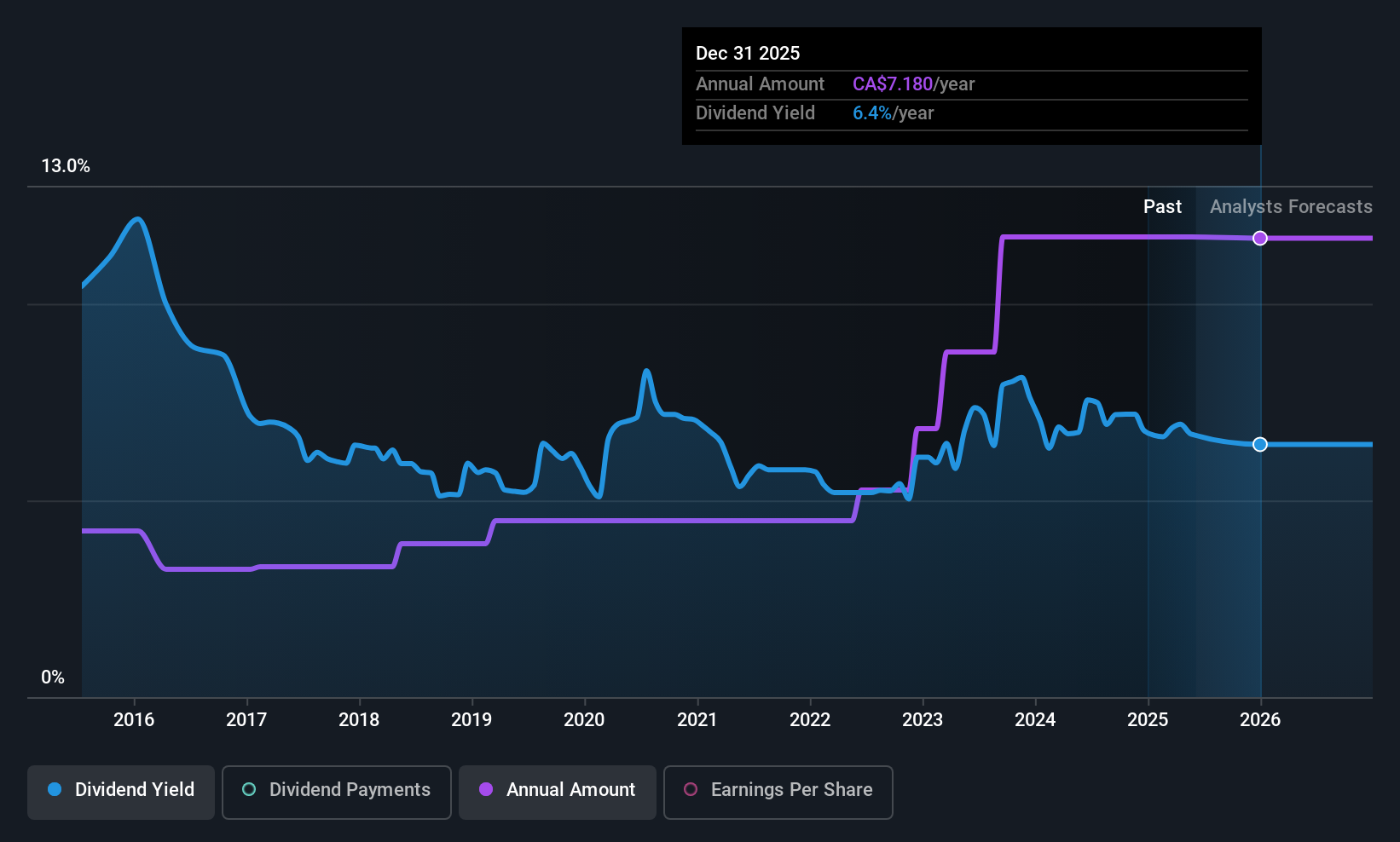

Dividend Yield: 6.4%

Acadian Timber's dividend yield of 6.39% is among the top 25% in Canada, though its high payout ratio of 106% raises sustainability concerns. Despite stable and growing dividends over the past decade, earnings coverage is weak, with a cash payout ratio at 87.2%. Recent Q1 results showed a decline in sales to C$24.83 million and net income to C$3.66 million year-over-year, highlighting potential challenges for future dividend sustainability amidst declining earnings forecasts.

- Navigate through the intricacies of Acadian Timber with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Acadian Timber is priced higher than what may be justified by its financials.

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Olympia Financial Group Inc., with a market cap of CA$297.18 million, operates in Canada as a non-deposit taking trust company through its subsidiary, Olympia Trust Company.

Operations: Olympia Financial Group Inc. generates revenue through several segments, including Investment Account Services (CA$79.09 million), Health (CA$10.28 million), Currency and Global Payments (CA$6.80 million), Corporate and Shareholder Services (CA$5.12 million), Exempt Edge (CA$1.51 million), and Corporate services (CA$0.04 million).

Dividend Yield: 5.8%

Olympia Financial Group's dividend yield of 5.84% falls short of Canada's top 25%. Despite a reasonable payout ratio (73.5%), its dividends have been volatile over the past decade, raising reliability concerns. However, dividends are covered by earnings and cash flows, with a cash payout ratio at 70.4%. Recent affirmations confirm consistent monthly payouts of C$0.60 per share despite declining earnings forecasts and slight drops in revenue and net income in Q1 2025 results.

- Click here and access our complete dividend analysis report to understand the dynamics of Olympia Financial Group.

- Upon reviewing our latest valuation report, Olympia Financial Group's share price might be too pessimistic.

Sun Life Financial (TSX:SLF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a financial services company offering asset management, wealth, insurance, and health solutions to individual and institutional clients across various countries including Canada, the United States, and several in Asia and Europe; it has a market cap of approximately CA$48.14 billion.

Operations: Sun Life Financial Inc. generates revenue from several segments including Asia (CA$2.27 billion), Canada (CA$11.39 billion), Asset Management (CA$6.82 billion), and the United States (CA$13.55 billion).

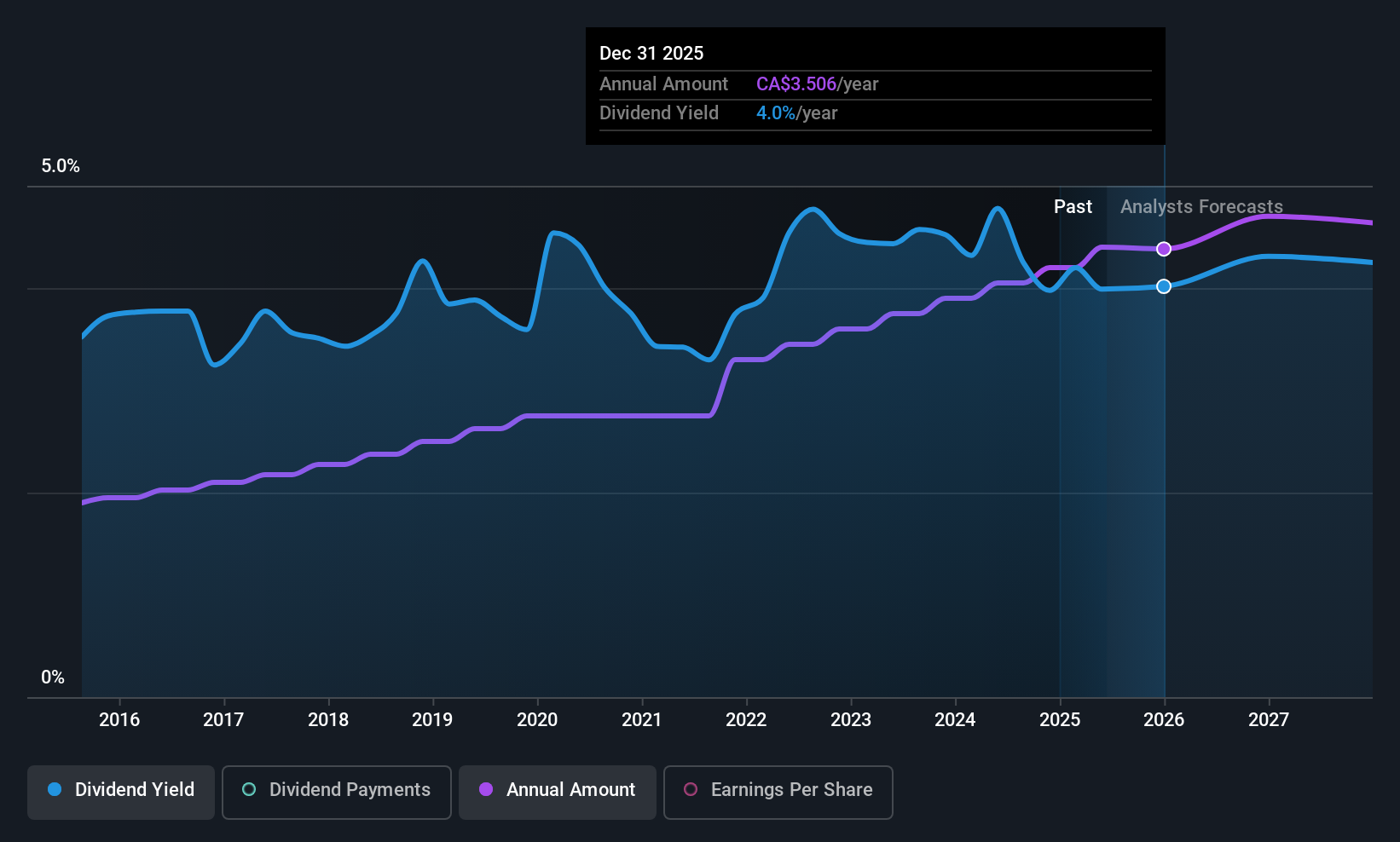

Dividend Yield: 4.2%

Sun Life Financial's dividend yield of 4.16% is below Canada's top 25% threshold, but its dividends are well-covered by earnings and cash flows, with payout ratios of 60.2% and 44%, respectively. The company has consistently increased dividends over the past decade with minimal volatility. Recent business expansions in the U.S., including Family Leave Insurance offerings, support Sun Life's strategic growth initiatives, potentially enhancing long-term shareholder value through diversified revenue streams.

- Dive into the specifics of Sun Life Financial here with our thorough dividend report.

- Our valuation report unveils the possibility Sun Life Financial's shares may be trading at a discount.

Next Steps

- Unlock our comprehensive list of 24 Top TSX Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives