- Canada

- /

- Paper and Forestry Products

- /

- TSX:ADN

3 TSX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the Canadian economy faces challenges with a recent contraction in GDP and rate cuts by the Bank of Canada, investors are keenly observing market dynamics for opportunities. In such an environment, dividend stocks can be appealing for their potential to provide steady income and resilience against economic fluctuations.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.44% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.68% | ★★★★★★ |

| Power Corporation of Canada (TSX:POW) | 5.14% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.16% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.48% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.73% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.51% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.03% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.58% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.06% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

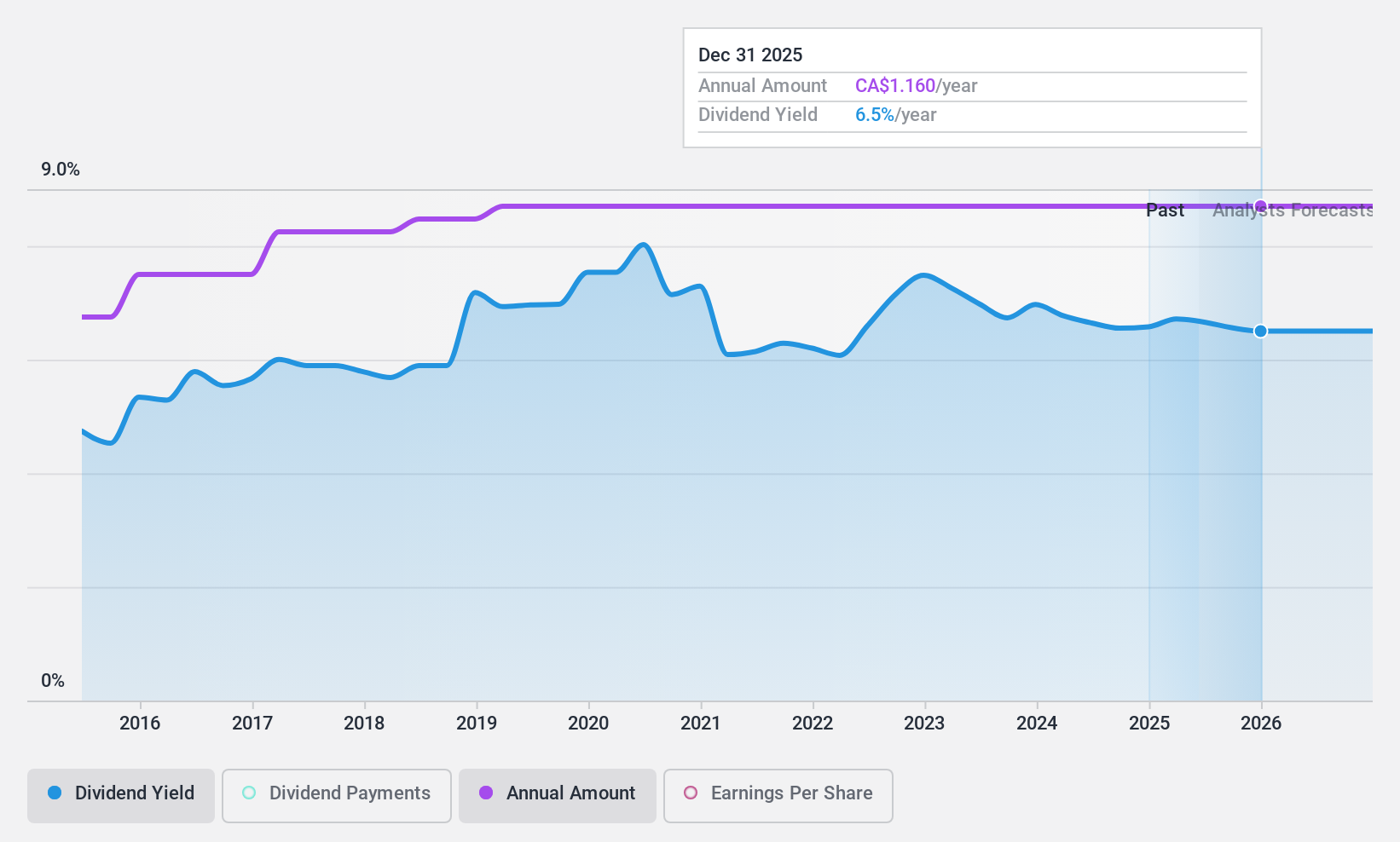

Acadian Timber (TSX:ADN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Acadian Timber Corp. supplies primary forest products in Eastern Canada and the Northeastern United States, with a market cap of CA$301.02 million.

Operations: Acadian Timber Corp.'s revenue segments include CA$18.31 million from Maine Timberlands and CA$76.88 million from New Brunswick Timberlands.

Dividend Yield: 6.7%

Acadian Timber offers a compelling dividend yield of 6.68%, placing it in the top 25% of Canadian dividend payers. The company's dividends are well-covered by both earnings, with a payout ratio of 72.8%, and cash flows at 84.5%. While profit margins have decreased from last year, its price-to-earnings ratio remains attractive at 11.1x compared to the broader Canadian market's average of 14.4x, suggesting good value for investors focused on dividends.

- Click to explore a detailed breakdown of our findings in Acadian Timber's dividend report.

- Our expertly prepared valuation report Acadian Timber implies its share price may be too high.

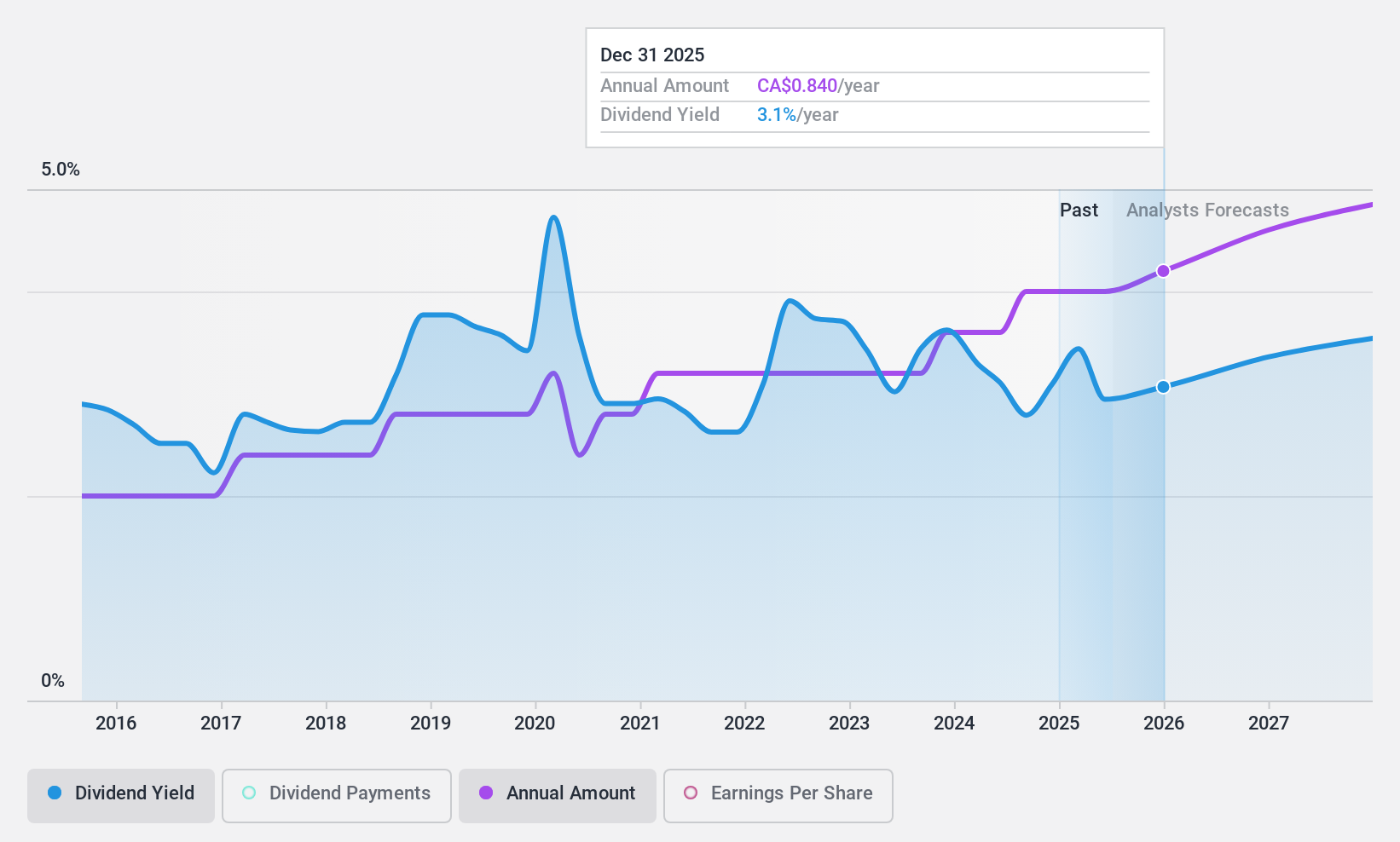

Leon's Furniture (TSX:LNF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited, along with its subsidiaries, operates as a retailer of home furnishings, mattresses, appliances, and electronics across Canada with a market cap of CA$1.69 billion.

Operations: Leon's Furniture Limited generates revenue of CA$2.52 billion from the sale of home furnishings, mattresses, appliances, and electronics in Canada.

Dividend Yield: 3.1%

Leon's Furniture presents a mixed picture for dividend investors. While the company offers a quarterly dividend of C$0.20 per share, its track record over the past decade has been unstable and volatile, with payments not consistently growing. However, dividends are well-covered by earnings and cash flows, with payout ratios of 38.2% and 23.7%, respectively. Recent business expansions, including a significant investment in new facilities in Edmonton, may support future growth despite recent declines in net income and sales figures.

- Unlock comprehensive insights into our analysis of Leon's Furniture stock in this dividend report.

- In light of our recent valuation report, it seems possible that Leon's Furniture is trading behind its estimated value.

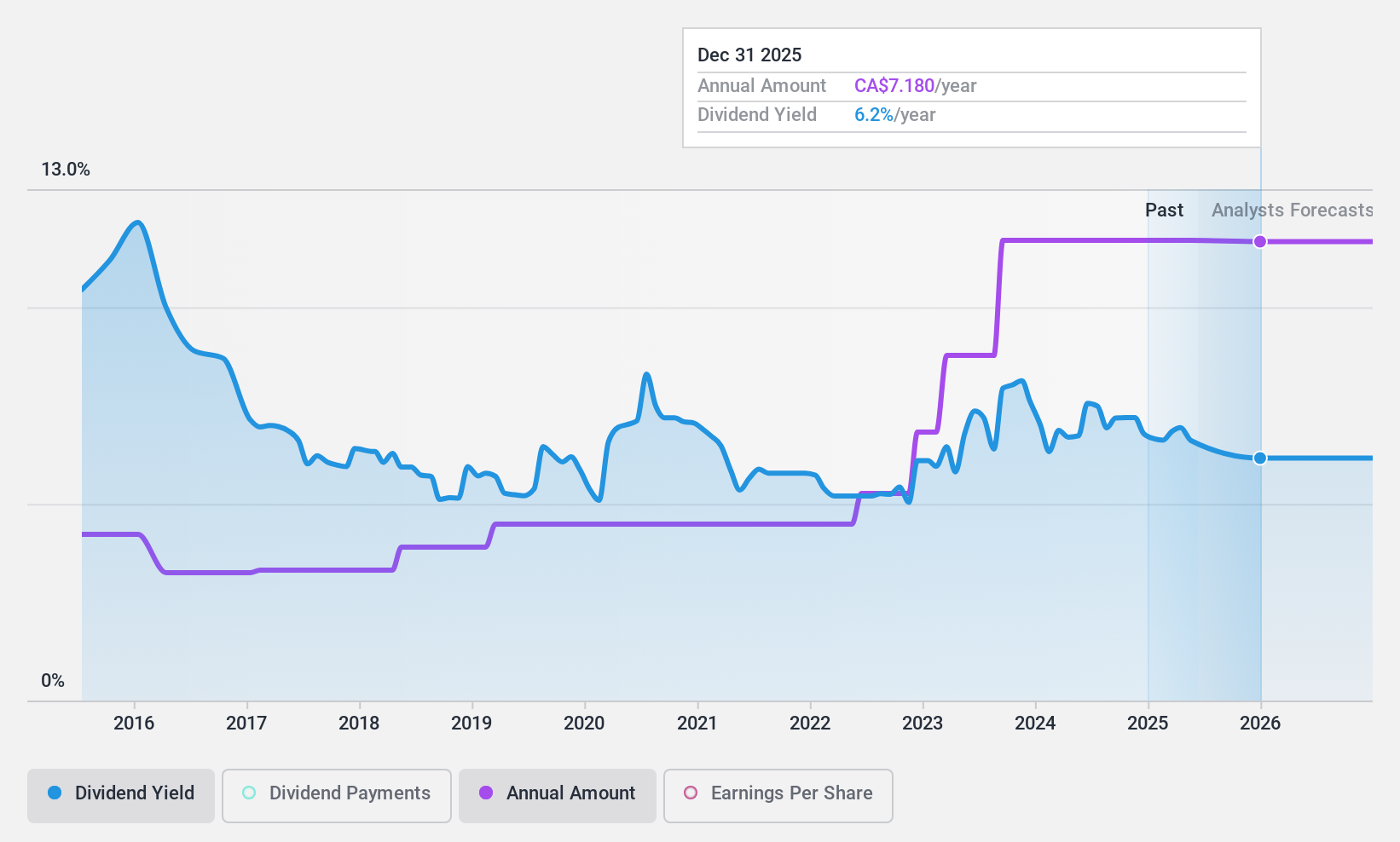

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., with a market cap of CA$258.08 million, operates in Canada as a non-deposit taking trust company through its subsidiary, Olympia Trust Company.

Operations: Olympia Financial Group Inc. generates revenue through its subsidiary, Olympia Trust Company, with segments including Investment Account Services (CA$79.36 million), Currency and Global Payments (CA$7.15 million), Health (CA$10.26 million), Corporate and Shareholder Services (CA$4.04 million), Corporate (CA$0.11 million), and Exempt Edge (EE) (CA$1.44 million).

Dividend Yield: 6.6%

Olympia Financial Group offers a monthly dividend of C$0.60 per share, with a payout ratio of 70.9% covered by earnings and 74.9% by cash flows, indicating sustainability despite an unstable track record over the past decade. While dividends have grown over ten years, they remain volatile and unreliable, with potential declines in future earnings challenging stability. The stock trades at a discount to its estimated fair value and features a top-tier dividend yield within the Canadian market.

- Navigate through the intricacies of Olympia Financial Group with our comprehensive dividend report here.

- Our expertly prepared valuation report Olympia Financial Group implies its share price may be lower than expected.

Where To Now?

- Take a closer look at our Top TSX Dividend Stocks list of 27 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ADN

Acadian Timber

Provides forest products in Eastern Canada and the Northeastern United States.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives