- Canada

- /

- Metals and Mining

- /

- CNSX:IRV

Here's Why We're Not Too Worried About Irving Resources' (CSE:IRV) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Irving Resources (CSE:IRV) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Irving Resources

Does Irving Resources Have A Long Cash Runway?

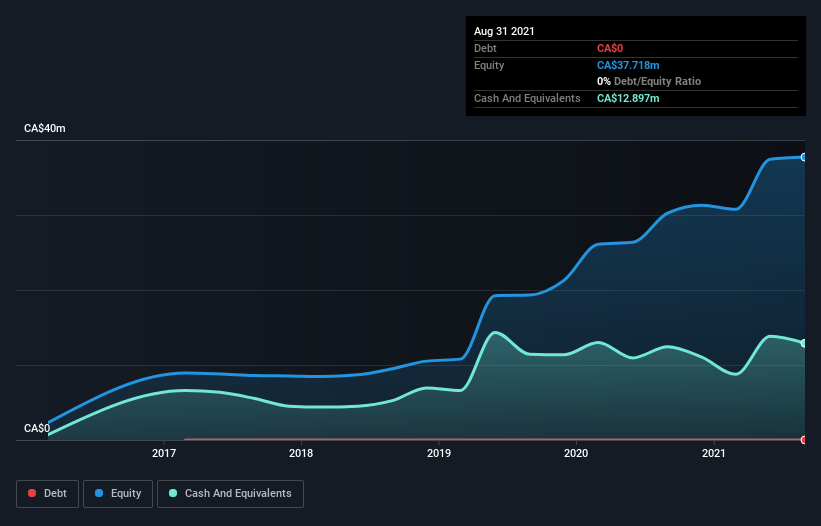

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Irving Resources last reported its balance sheet in August 2021, it had zero debt and cash worth CA$13m. Importantly, its cash burn was CA$8.4m over the trailing twelve months. So it had a cash runway of approximately 19 months from August 2021. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

How Is Irving Resources' Cash Burn Changing Over Time?

Because Irving Resources isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Even though it doesn't get us excited, the 30% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Admittedly, we're a bit cautious of Irving Resources due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

Can Irving Resources Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Irving Resources to raise more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of CA$71m, Irving Resources' CA$8.4m in cash burn equates to about 12% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Irving Resources' Cash Burn?

The good news is that in our view Irving Resources' cash burn situation gives shareholders real reason for optimism. One the one hand we have its solid cash burn reduction, while on the other it can also boast very strong cash burn relative to its market cap. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Irving Resources' situation. On another note, Irving Resources has 5 warning signs (and 2 which can't be ignored) we think you should know about.

Of course Irving Resources may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:IRV

Irving Resources

A junior resource exploration company, acquires and explores mineral properties in Canada and Japan.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)