- Canada

- /

- Oil and Gas

- /

- TSX:SU

3 Top TSX Dividend Stocks Yielding Up To 8.4%

Reviewed by Simply Wall St

Amidst ongoing tariff uncertainties and political shifts, the Canadian market has shown a cautious yet resilient stance, with the TSX slightly up despite broader global challenges. In such a climate, dividend stocks can offer stability and income potential for investors seeking to navigate volatility; here are three top TSX dividend stocks currently yielding up to 8.4%.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.80% | ★★★★★★ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.76% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.12% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.88% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.12% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.58% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.02% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.48% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.35% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.74% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

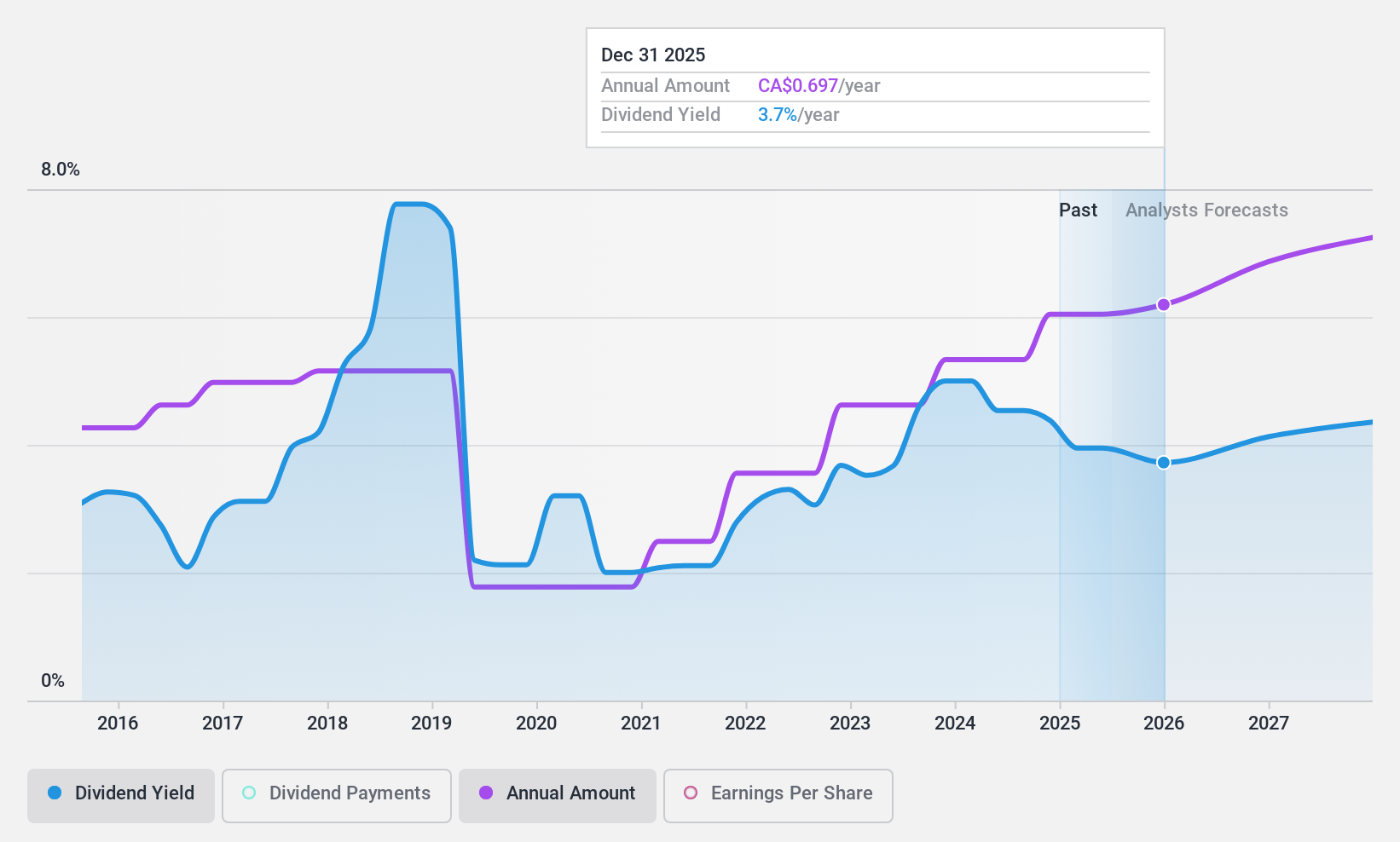

High Liner Foods (TSX:HLF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets frozen seafood products in North America with a market cap of CA$479.97 million.

Operations: High Liner Foods Incorporated generates revenue of $959.22 million from the manufacturing and marketing of prepared and packaged frozen seafood.

Dividend Yield: 4.1%

High Liner Foods shows a mixed dividend profile. While its dividends are well covered by earnings and cash flows, with low payout ratios of 22.7% and 20.7% respectively, the dividend history is volatile and unreliable over the past decade. The company trades at a significant discount to its estimated fair value but carries high debt levels. Recent earnings growth is strong, yet revenue declined year-over-year to US$959.22 million from US$1.08 billion previously, impacting overall stability for dividend investors in Canada’s market.

- Click here to discover the nuances of High Liner Foods with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that High Liner Foods is priced lower than what may be justified by its financials.

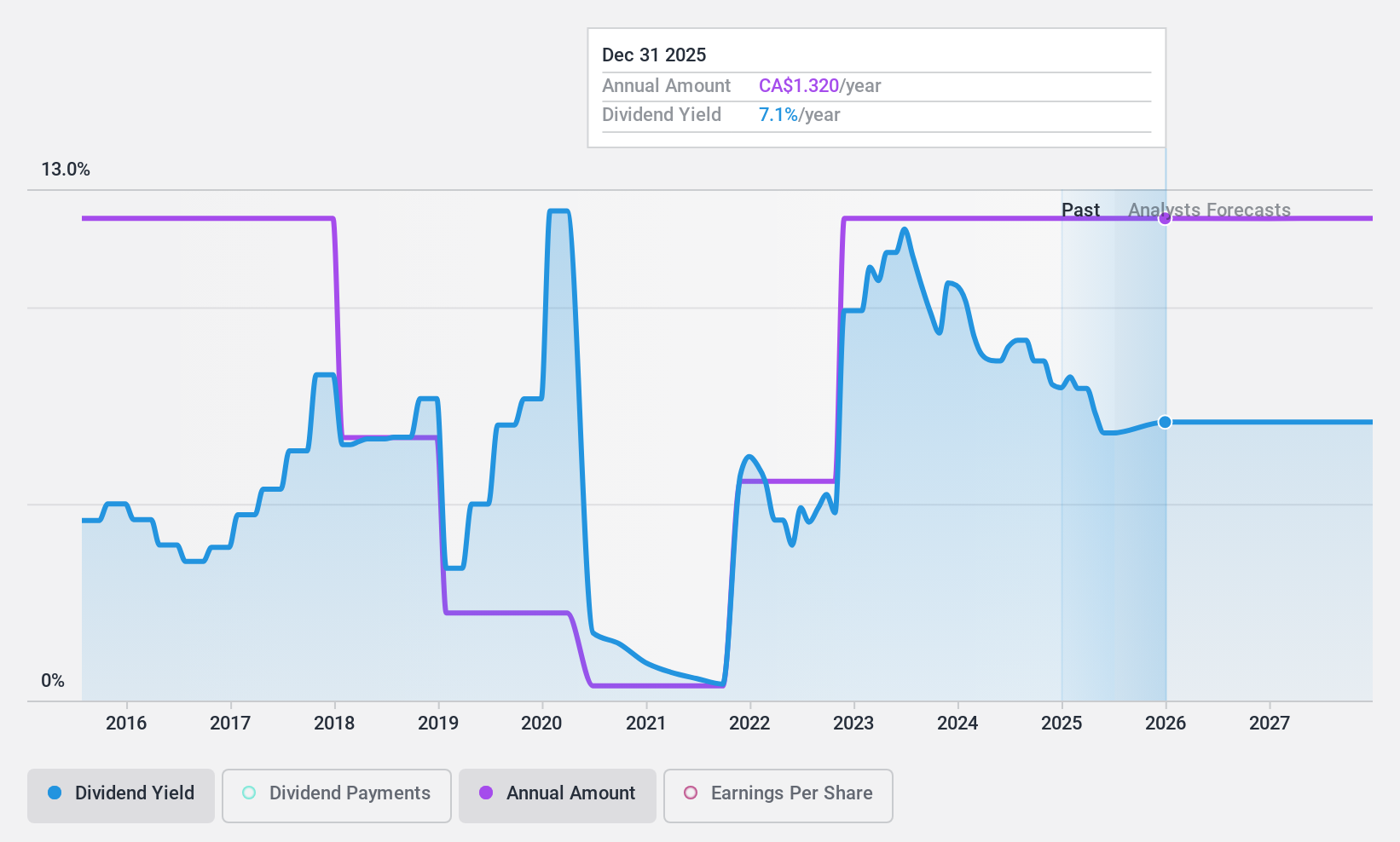

Peyto Exploration & Development (TSX:PEY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin, with a market cap of CA$3.10 billion.

Operations: Peyto Exploration & Development Corp. generates its revenue from the exploration, development, and production of oil and gas, amounting to CA$900.94 million.

Dividend Yield: 8.5%

Peyto Exploration & Development offers a high dividend yield of 8.47%, placing it in the top quartile among Canadian dividend stocks. However, this yield is not well supported by free cash flows, with a cash payout ratio of 125.6%. The company's dividends have been volatile over the past decade and are not reliably covered by earnings or cash flows despite trading at 46.2% below estimated fair value and having potential for price appreciation according to analysts.

- Dive into the specifics of Peyto Exploration & Development here with our thorough dividend report.

- The valuation report we've compiled suggests that Peyto Exploration & Development's current price could be quite moderate.

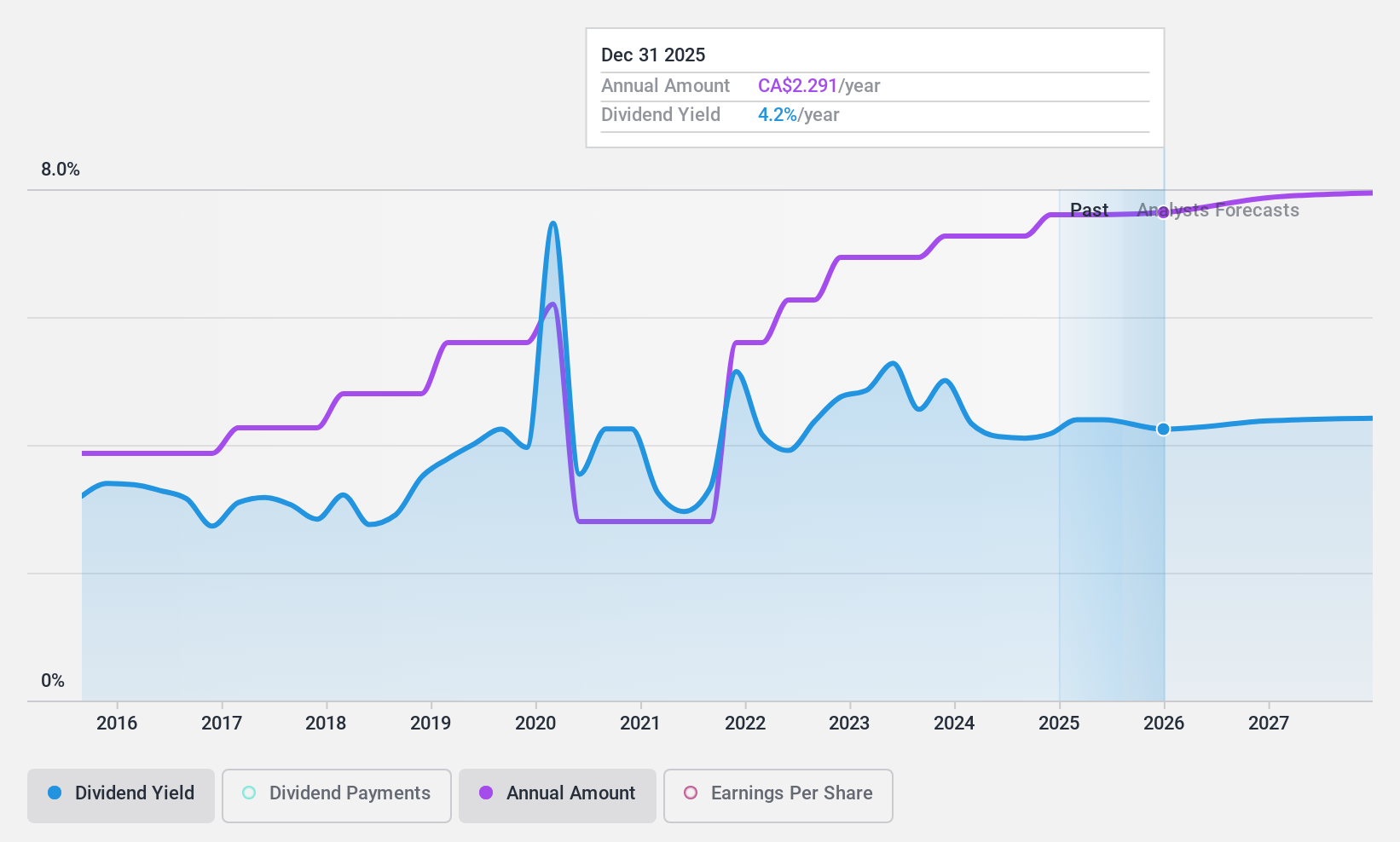

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$63.58 billion.

Operations: Suncor Energy Inc.'s revenue is primarily derived from its Oil Sands segment at CA$25.62 billion, Refining and Marketing at CA$31.34 billion, and Exploration and Production at CA$2.25 billion.

Dividend Yield: 4.4%

Suncor Energy's dividend, currently at CAD 0.57 per share, is well-supported by both earnings and cash flows with payout ratios of 46.7% and 29.8%, respectively. While the dividend has grown over the past decade, it has been volatile at times. The company is trading below estimated fair value and recently completed a significant share buyback program worth CAD 3.26 billion, potentially enhancing shareholder value despite forecasted earnings declines in the coming years.

- Navigate through the intricacies of Suncor Energy with our comprehensive dividend report here.

- Our valuation report unveils the possibility Suncor Energy's shares may be trading at a discount.

Summing It All Up

- Unlock more gems! Our Top TSX Dividend Stocks screener has unearthed 25 more companies for you to explore.Click here to unveil our expertly curated list of 28 Top TSX Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.