- Canada

- /

- Oil and Gas

- /

- TSX:LCFS

Tidewater Renewables Ltd. Beat Analyst Profit Forecasts, And Analysts Have New Estimates

It's been a good week for Tidewater Renewables Ltd. (TSE:LCFS) shareholders, because the company has just released its latest second-quarter results, and the shares gained 4.9% to CA$8.73. Revenues of CA$13m missed forecasts by 12%, but despite this Tidewater Renewables reported a surprise statutory profit instead of the losses that the analysts had expected. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Tidewater Renewables

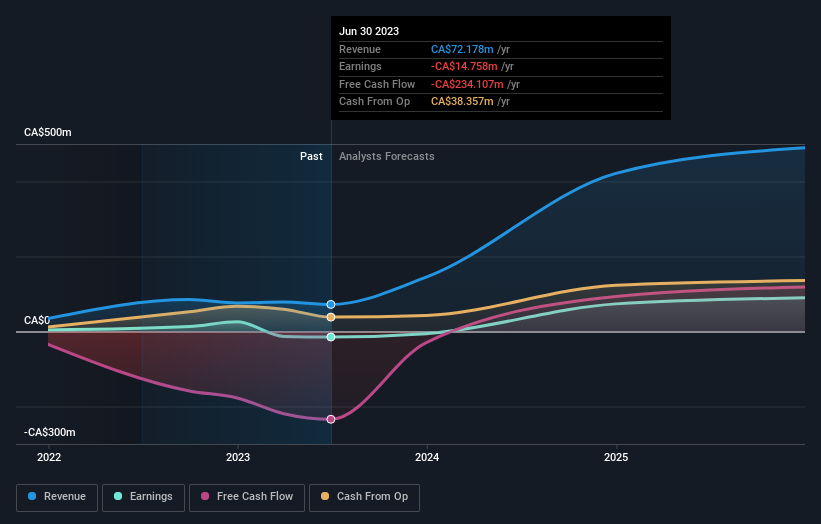

Taking into account the latest results, the most recent consensus for Tidewater Renewables from six analysts is for revenues of CA$145.0m in 2023. If met, it would imply a substantial 101% increase on its revenue over the past 12 months. Statutory losses are forecast to balloon 48% to CA$0.22 per share. Before this earnings report, the analysts had been forecasting revenues of CA$199.0m and earnings per share (EPS) of CA$0.0017 in 2023. There looks to have been a major change in sentiment regarding Tidewater Renewables' prospects following the latest results, with a pretty serious reduction to revenues and the analysts now forecasting a loss instead of a profit.

The average price target was broadly unchanged at CA$15.19, perhaps implicitly signalling that the weaker earnings outlook is not expected to have a long-term impact on the valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Tidewater Renewables, with the most bullish analyst valuing it at CA$17.50 and the most bearish at CA$10.75 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Tidewater Renewables' rate of growth is expected to accelerate meaningfully, with the forecast 3x annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 6.0% over the past year. Compare this with other companies in the same industry, which are forecast to grow their revenue 2.6% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Tidewater Renewables to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts are expecting Tidewater Renewables to become unprofitable next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. The consensus price target held steady at CA$15.19, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Tidewater Renewables going out to 2025, and you can see them free on our platform here..

You still need to take note of risks, for example - Tidewater Renewables has 1 warning sign we think you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Tidewater Renewables might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LCFS

Tidewater Renewables

Engages in production of renewable fuel in North America.

High growth potential and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026