- Canada

- /

- Capital Markets

- /

- TSXV:LPC

Here's Why I Think Lorne Park Capital Partners (CVE:LPC) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Lorne Park Capital Partners (CVE:LPC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Lorne Park Capital Partners

Lorne Park Capital Partners's Improving Profits

In the last three years Lorne Park Capital Partners's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Lorne Park Capital Partners's EPS shot from CA$0.015 to CA$0.028, over the last year. Year on year growth of 89% is certainly a sight to behold.

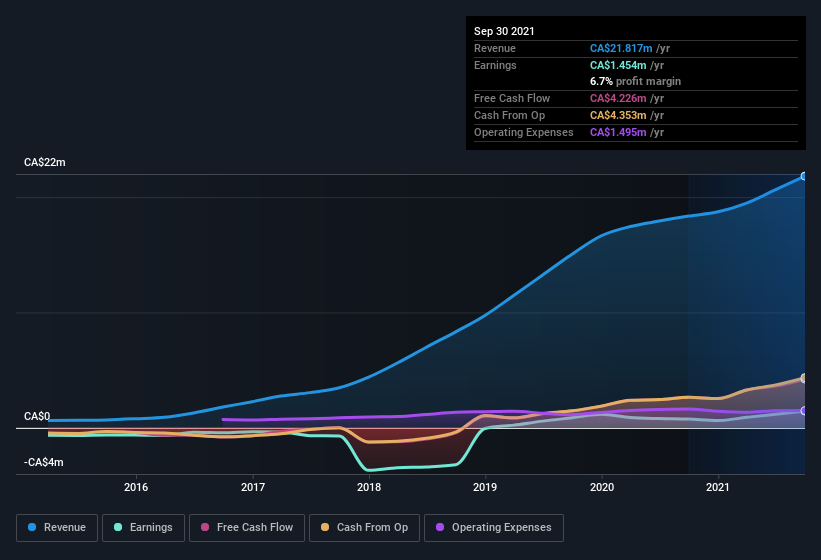

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Lorne Park Capital Partners shareholders can take confidence from the fact that EBIT margins are up from 4.3% to 10%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Lorne Park Capital Partners is no giant, with a market capitalization of CA$47m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Lorne Park Capital Partners Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last twelve months Lorne Park Capital Partners insiders spent CA$54k on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. Zooming in, we can see that the biggest insider purchase was by Director Stephen Meehan for CA$32k worth of shares, at about CA$0.84 per share.

On top of the insider buying, we can also see that Lorne Park Capital Partners insiders own a large chunk of the company. Actually, with 41% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only CA$47m Lorne Park Capital Partners is really small for a listed company. That means insiders only have CA$19m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Lorne Park Capital Partners Worth Keeping An Eye On?

Lorne Park Capital Partners's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Lorne Park Capital Partners belongs on the top of your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Lorne Park Capital Partners you should know about.

The good news is that Lorne Park Capital Partners is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:LPC

Lorne Park Capital Partners

Provides portfolio management services to affluent Canadian investors, estates, trusts, endowments, and foundations in Canada and the United States.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives