- Canada

- /

- Consumer Finance

- /

- TSX:GSY

How goeasy’s (TSX:GSY) CFO Transition May Reshape Its Financial Stewardship and Investment Narrative

Reviewed by Sasha Jovanovic

- goeasy Ltd. recently appointed Felix Wu as Interim Chief Financial Officer, following the announced departure of Hal Khouri after third quarter reporting in November 2025.

- Wu’s extensive background in finance and non-prime lending, including leadership roles at KOHO and President's Choice Financial, is expected to support operational oversight and stability through the CFO transition.

- We'll examine how Wu’s leadership experience could impact goeasy’s investment narrative and financial continuity going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

goeasy Investment Narrative Recap

To own shares in goeasy Ltd., investors need confidence in the company’s ability to grow its non-prime and secured lending presence while managing credit risk and adapting to regulatory changes. The appointment of Felix Wu as Interim CFO offers operational continuity through this transition period, but the most important near-term catalyst remains ongoing loan demand and portfolio performance; this executive change is not expected to be a material driver or risk in the short run.

Of the recent announcements, the upsized August 2025 debt offering stands out, as it bolsters goeasy’s liquidity for continued expansion and partial debt repayment. This increased access to funding is closely tied to the company’s ability to maintain loan growth, supporting its most important catalyst, though it also underscores the sensitivity to future funding costs and potential rate risk through Wu’s initial tenure.

However, in contrast to the focus on growth, investors should be aware that the shift toward more secured loans is lowering overall portfolio yield and could...

Read the full narrative on goeasy (it's free!)

goeasy's outlook anticipates CA$2.7 billion in revenue and CA$476.3 million in earnings by 2028. Achieving this projection implies a 48.7% annual revenue growth rate and an increase in earnings of CA$191.6 million from the current CA$284.7 million.

Uncover how goeasy's forecasts yield a CA$240.33 fair value, a 46% upside to its current price.

Exploring Other Perspectives

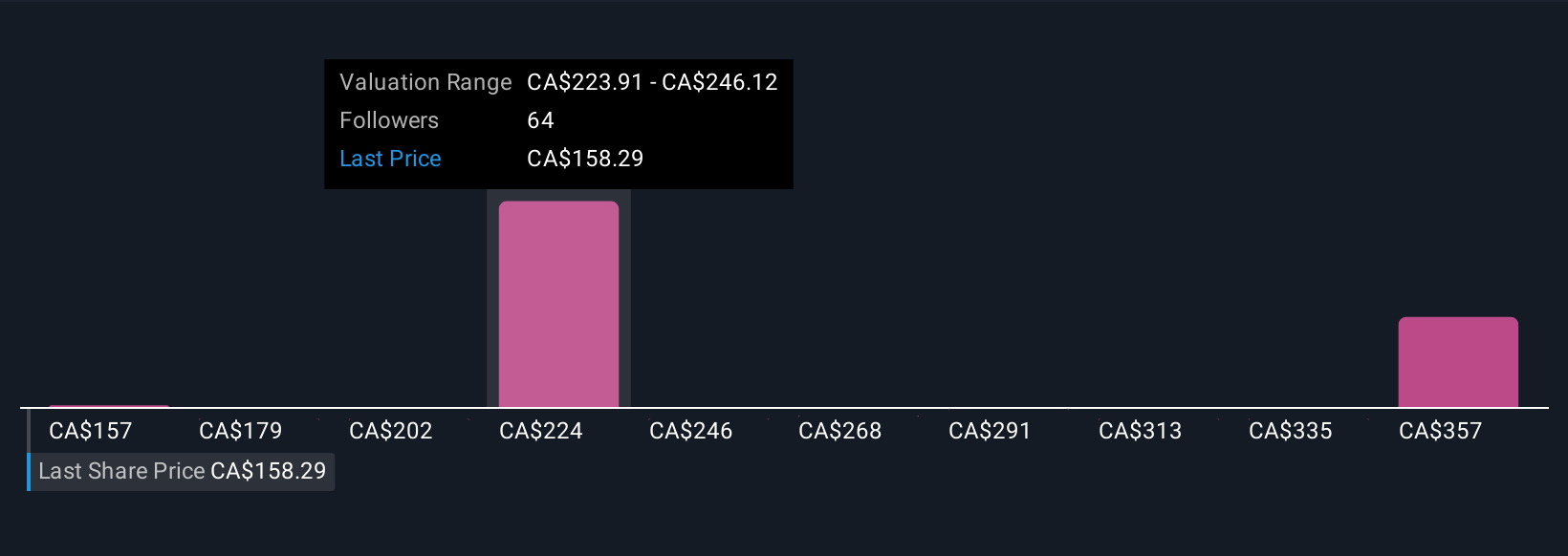

Eleven members of the Simply Wall St Community have posted fair value estimates for goeasy ranging from CA$157.27 to CA$380.74 per share. While this diversity highlights how opinions differ, many also point to revenue growth as an important influence on future performance, inviting you to compare several perspectives before forming your own view.

Explore 11 other fair value estimates on goeasy - why the stock might be worth just CA$157.27!

Build Your Own goeasy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your goeasy research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free goeasy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate goeasy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Very undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives