- Canada

- /

- Consumer Finance

- /

- TSX:GSY

goeasy (TSE:GSY) Will Pay A Larger Dividend Than Last Year At CA$0.91

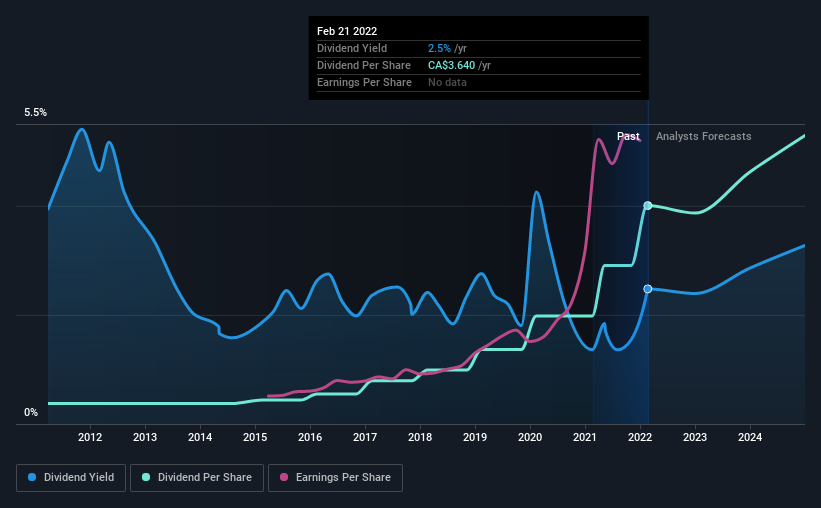

goeasy Ltd. (TSE:GSY) will increase its dividend on the 8th of April to CA$0.91. This takes the annual payment to 2.0% of the current stock price, which is about average for the industry.

Check out our latest analysis for goeasy

goeasy's Payment Has Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Prior to this announcement, goeasy's earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

EPS is set to fall by 25.6% over the next 12 months. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 33%, which is comfortable for the company to continue in the future.

goeasy Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2012, the dividend has gone from CA$0.34 to CA$3.64. This implies that the company grew its distributions at a yearly rate of about 27% over that duration. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. goeasy has seen EPS rising for the last five years, at 46% per annum. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We don't think goeasy is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 4 warning signs for goeasy (of which 2 are a bit concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Exceptional growth potential, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in