- Canada

- /

- Commercial Services

- /

- TSX:BYD

The one-year earnings decline is not helping Boyd Group Services' (TSE:BYD share price, as stock falls another 5.4% in past week

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Boyd Group Services Inc. (TSE:BYD) shareholders over the last year, as the share price declined 27%. That contrasts poorly with the market return of 20%. Longer term investors have fared much better, since the share price is up 7.9% in three years. And the share price decline continued over the last week, dropping some 5.4%.

With the stock having lost 5.4% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Boyd Group Services

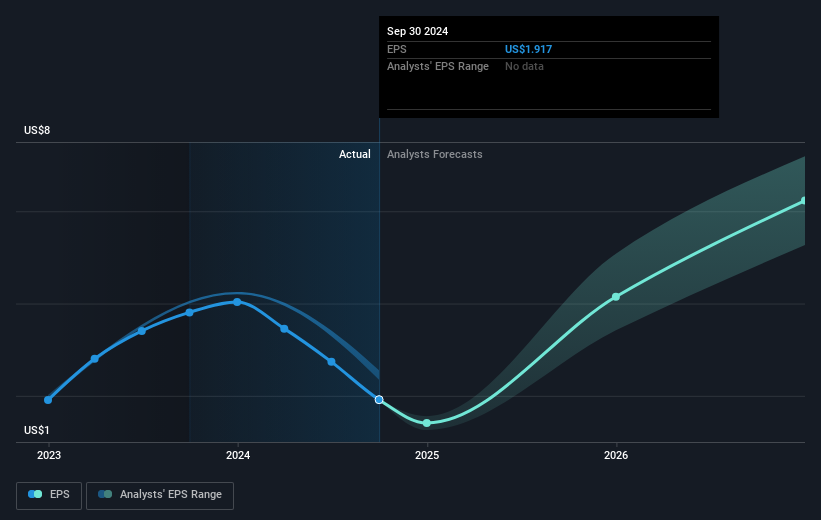

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, Boyd Group Services had to report a 50% decline in EPS over the last year. The share price fall of 27% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. Indeed, with a P/E ratio of 74.36 there is obviously some real optimism that earnings will bounce back.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Boyd Group Services' earnings, revenue and cash flow.

A Different Perspective

Investors in Boyd Group Services had a tough year, with a total loss of 26% (including dividends), against a market gain of about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Boyd Group Services (1 is significant) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Boyd Group Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BYD

Boyd Group Services

Operates non-franchised collision repair centers in North America.

Reasonable growth potential and fair value.

Market Insights

Community Narratives