Is Now The Time To Put Inventronics (CVE:IVX) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Inventronics (CVE:IVX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Our analysis indicates that IVX is potentially undervalued!

Inventronics' Improving Profits

In the last three years Inventronics' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Inventronics' EPS shot from CA$0.20 to CA$0.53, over the last year. It's a rarity to see 166% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

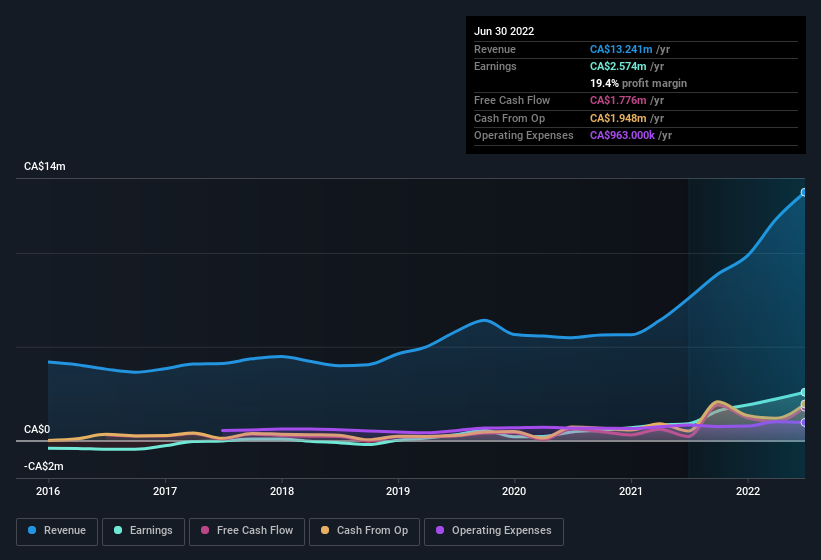

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Inventronics is growing revenues, and EBIT margins improved by 8.3 percentage points to 20%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Inventronics isn't a huge company, given its market capitalisation of CA$18m. That makes it extra important to check on its balance sheet strength.

Are Inventronics Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The CA$43k worth of shares that insiders sold during the last 12 months pales in comparison to the CA$7.0m they spent on acquiring shares in the company. We find this encouraging because it suggests they are optimistic about Inventronics'future. It is also worth noting that it was President Dan Stearne who made the biggest single purchase, worth CA$2.3m, paying CA$2.70 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Inventronics insiders own more than a third of the company. To be exact, company insiders hold 54% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only CA$18m Inventronics is really small for a listed company. So this large proportion of shares owned by insiders only amounts to CA$9.7m. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Dan Stearne is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations under CA$272m, like Inventronics, the median CEO pay is around CA$241k.

The Inventronics CEO received CA$183k in compensation for the year ending December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Inventronics Deserve A Spot On Your Watchlist?

Inventronics' earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Inventronics belongs near the top of your watchlist. Even so, be aware that Inventronics is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Inventronics, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:IVX

Inventronics

Designs, manufactures, and sells protective enclosures and related products for the telecommunications, electric transmission, cable, energy, and other industries in Canada and the United States.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion