- Canada

- /

- Aerospace & Defense

- /

- TSX:CAE

3 Stocks That May Be Trading At An Estimated Discount Of Up To 33.1%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by climbing U.S. stock indexes and heightened inflation expectations, investors are keenly observing opportunities for value amidst the volatility. In this environment, identifying stocks that may be trading at an estimated discount can offer potential advantages, as these investments might provide room for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.48 | US$36.92 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$55.32 | US$110.32 | 49.9% |

| América Móvil. de (BMV:AMX B) | MX$14.90 | MX$29.71 | 49.9% |

| Power Wind Health Industry (TWSE:8462) | NT$111.00 | NT$221.07 | 49.8% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.07 | CN¥30.02 | 49.8% |

| Com2uS (KOSDAQ:A078340) | ₩48300.00 | ₩96047.78 | 49.7% |

| F-Secure Oyj (HLSE:FSECURE) | €1.706 | €3.41 | 49.9% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| EKINOPS (ENXTPA:EKI) | €3.285 | €6.57 | 50% |

| Hindustan Foods (BSE:519126) | ₹572.85 | ₹1143.64 | 49.9% |

Let's explore several standout options from the results in the screener.

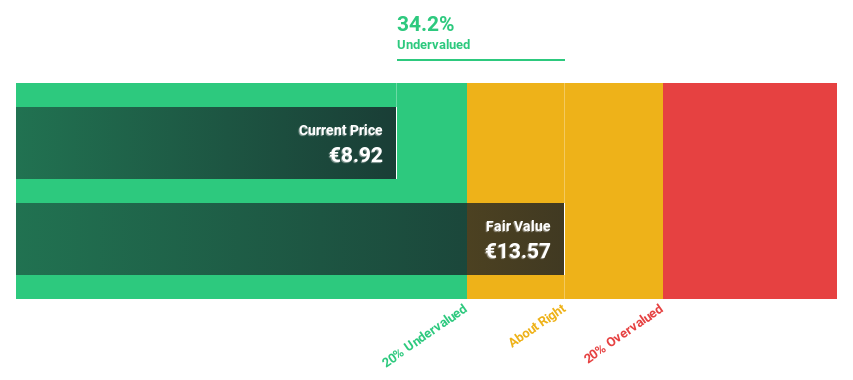

Metso Oyj (HLSE:METSO)

Overview: Metso Oyj offers technologies, end-to-end solutions, and services for the aggregates, minerals processing, and metals refining industries across multiple regions worldwide with a market cap of €9 billion.

Operations: The company's revenue segments consist of €3.66 billion from Minerals and €1.21 billion from Aggregates.

Estimated Discount To Fair Value: 15.5%

Metso Oyj appears undervalued based on discounted cash flow analysis, trading at €10.88 compared to an estimated fair value of €12.88. Although not significantly undervalued, its earnings are expected to grow faster than the Finnish market at 12% annually. Despite high debt levels and a dividend yield of 3.49% not fully covered by free cash flows, Metso's strategic equipment installations in projects like Sangdong could enhance long-term operational capabilities and revenue growth prospects.

- In light of our recent growth report, it seems possible that Metso Oyj's financial performance will exceed current levels.

- Take a closer look at Metso Oyj's balance sheet health here in our report.

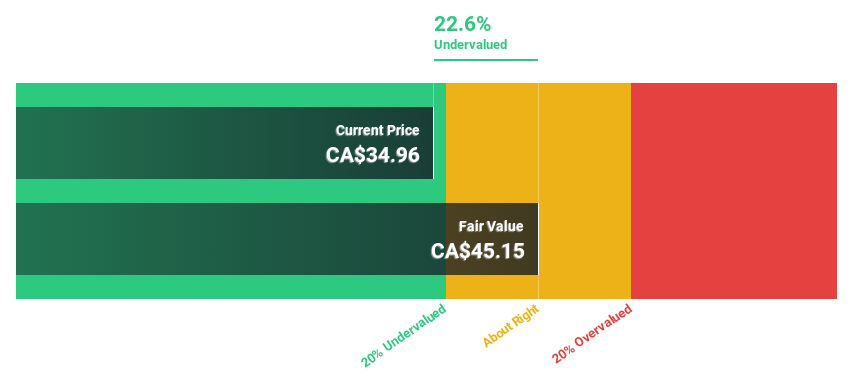

CAE (TSX:CAE)

Overview: CAE Inc. offers simulation training and critical operations support solutions worldwide, with a market cap of CA$12.13 billion.

Operations: The company's revenue is primarily derived from its Civil Aviation segment, which accounts for CA$2.68 billion, and its Defense and Security segment, contributing CA$1.88 billion.

Estimated Discount To Fair Value: 17.9%

CAE, trading at CA$36.88, is undervalued based on discounted cash flow analysis with a fair value estimate of CA$44.93. The company is expected to achieve profitability within three years, surpassing average market growth. Recent earnings showed strong performance with net income rising significantly from the previous year. Despite high debt levels, CAE's strategic role in Canada's Future Fighter Lead-in Training program and recent board changes could support future growth and stability.

- The analysis detailed in our CAE growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in CAE's balance sheet health report.

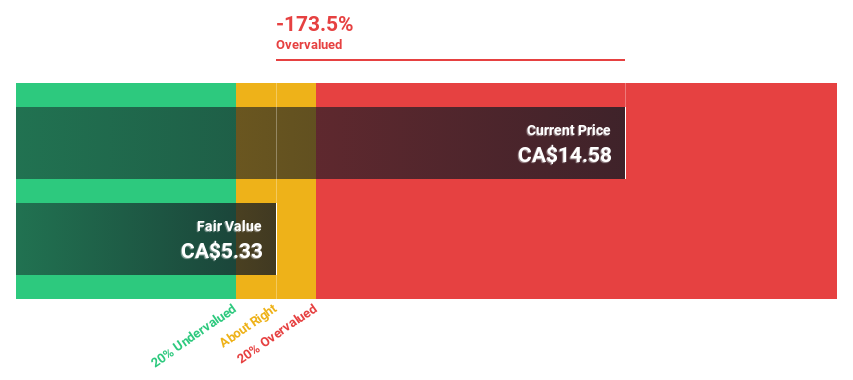

SSR Mining (TSX:SSRM)

Overview: SSR Mining Inc. operates in the exploration, development, and acquisition of precious metal resource properties across the United States, Türkiye, Canada, and Argentina with a market cap of CA$2.69 billion.

Operations: The company's revenue segments include the operation, acquisition, exploration, and development of precious metal resource properties across its locations.

Estimated Discount To Fair Value: 33.1%

SSR Mining, trading at CA$14.96, is highly undervalued based on discounted cash flow analysis with a fair value estimate of CA$22.36. Despite recent losses and lower production figures for 2024, the company's earnings are forecast to grow significantly by 77.89% annually and surpass Canadian market growth rates in revenue expansion. The appointment of Laura Mullen to the board may enhance financial oversight, potentially supporting future profitability amid current challenges in production and sales performance.

- According our earnings growth report, there's an indication that SSR Mining might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of SSR Mining.

Key Takeaways

- Click this link to deep-dive into the 927 companies within our Undervalued Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CAE, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CAE

CAE

Provides simulation training and critical operations support solutions in Canada, the United States, the United Kingdom, Europe, Asia, the Oceania, Africa, and Rest of the Americas.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives