As trade tensions ease and interest rates remain steady, the Canadian market has shown resilience, with stocks posting gains amid global economic developments. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking to navigate uncertain times while benefiting from regular payouts.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.23% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.87% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.09% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.06% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.40% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.74% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.57% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.91% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.64% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.99% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Rogers Sugar (TSX:RSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. is involved in the refining, packaging, marketing, and distribution of sugar, maple, and related products across Canada, the United States, Europe, and internationally with a market cap of CA$714.61 million.

Operations: Rogers Sugar Inc. generates revenue through its operations in refining, packaging, marketing, and distributing sugar and maple products across various regions including Canada, the United States, and Europe.

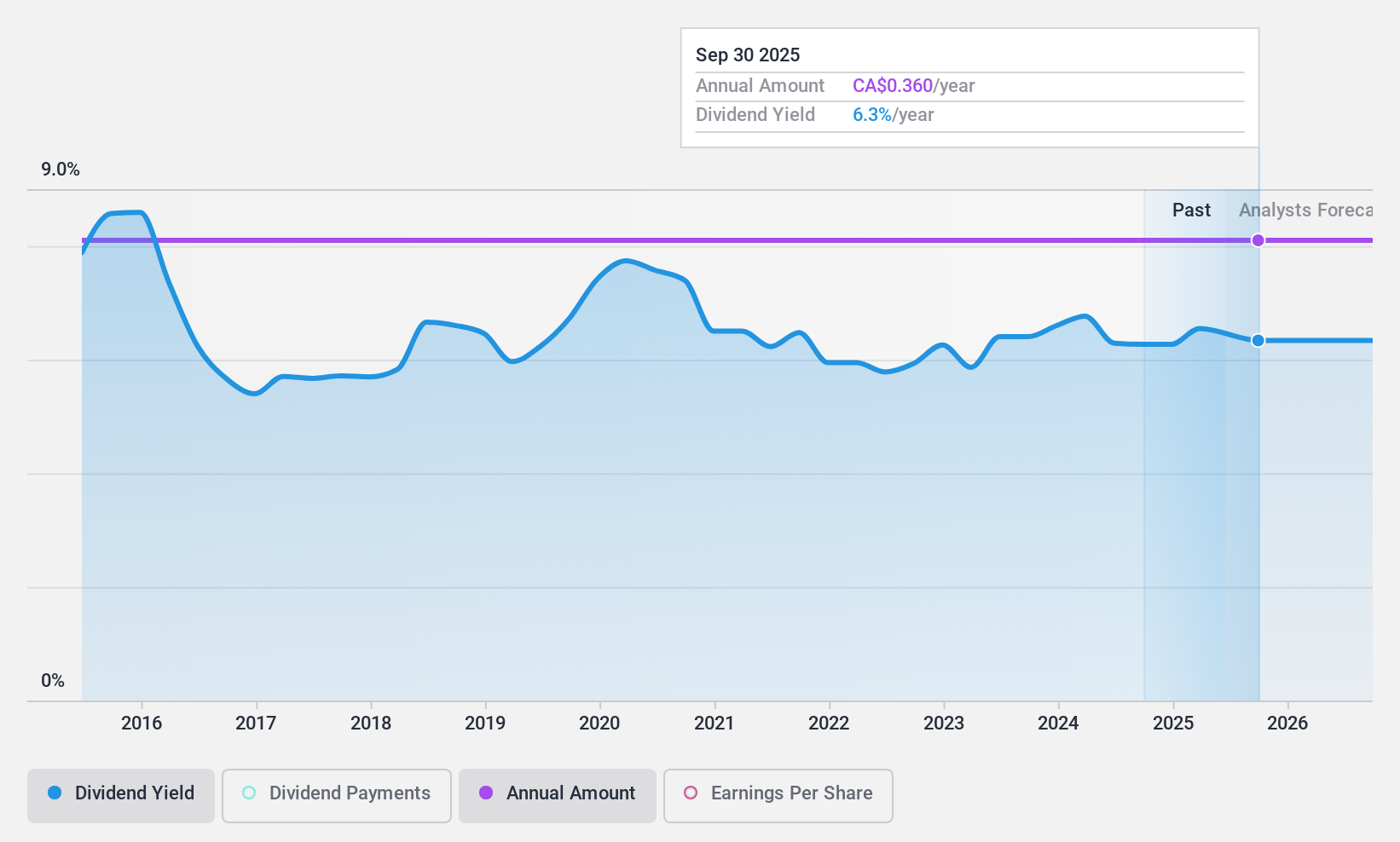

Dividend Yield: 6.5%

Rogers Sugar offers a high dividend yield of 6.46%, ranking in the top 25% of Canadian dividend payers, but its dividends are not covered by free cash flow and have been unreliable over the past decade. The company maintains a reasonable payout ratio of 74.9%, yet its debt is not well-covered by operating cash flow. Recent earnings showed growth, with Q2 sales at C$326.31 million and net income rising to C$20.54 million from C$13.94 million a year ago, amidst stable production volumes and new supply agreements enhancing operational stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Rogers Sugar.

- Our comprehensive valuation report raises the possibility that Rogers Sugar is priced lower than what may be justified by its financials.

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada operates as a diversified financial services company worldwide, with a market cap of CA$241.88 billion.

Operations: Royal Bank of Canada generates revenue from several segments, including Insurance (CA$1.27 billion), Capital Markets (CA$12.42 billion), Personal Banking (CA$16.30 billion), Wealth Management (CA$20.41 billion), and Commercial Banking (CA$6.75 billion).

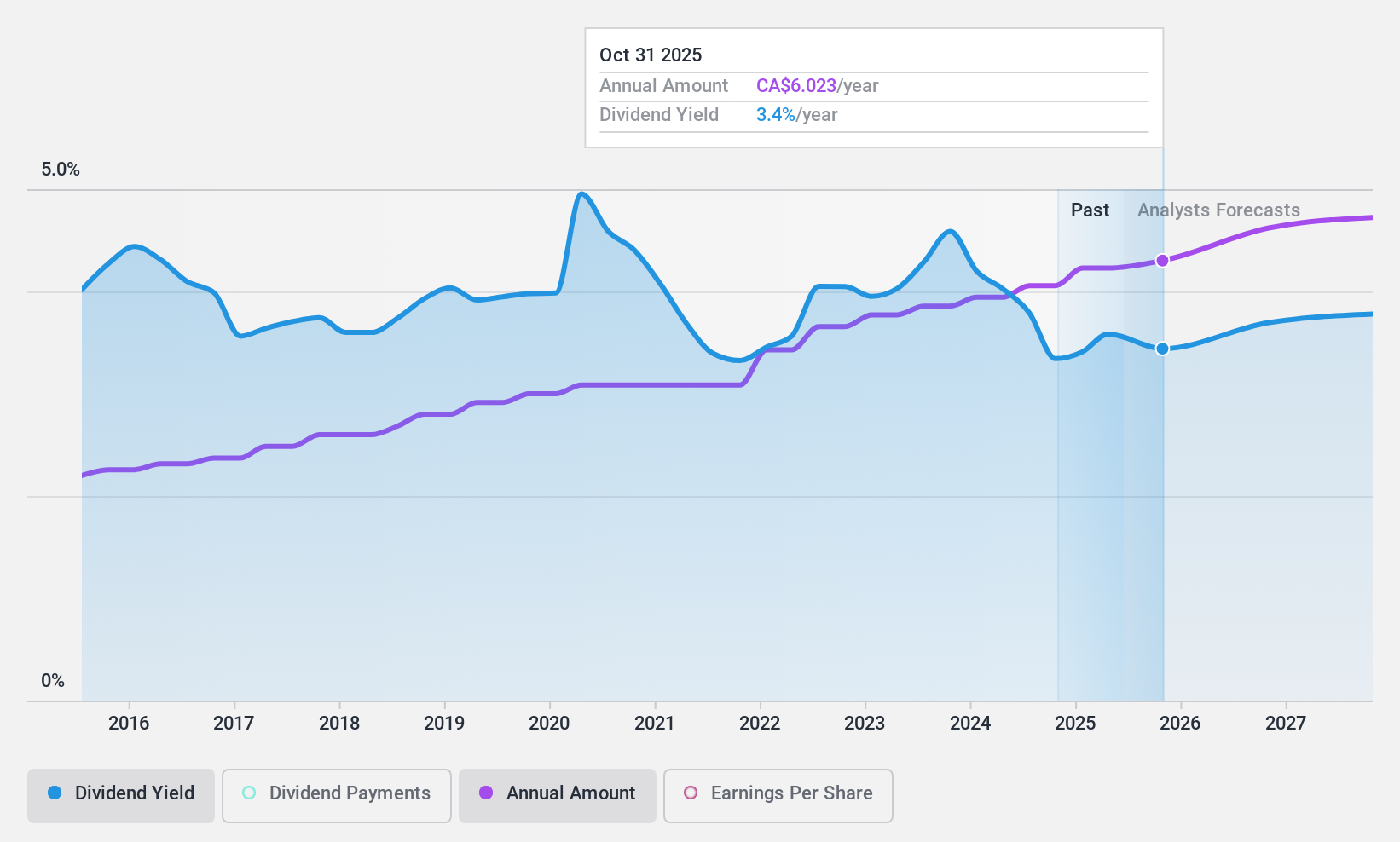

Dividend Yield: 3.4%

Royal Bank of Canada offers a reliable dividend yield of 3.4%, though it is lower than the top Canadian dividend payers. Its dividends have been stable and growing over the past decade, supported by a low payout ratio (46.3%). Despite recent insider selling, earnings growth remains positive, with profits covering dividends now and projected to do so in three years. Recent fixed-income offerings suggest ongoing capital management efforts amidst legal challenges related to derivative contracts in California.

- Get an in-depth perspective on Royal Bank of Canada's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Royal Bank of Canada's current price could be quite moderate.

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company operating primarily in Canada, the United States, Australia, and internationally with a market cap of CA$394.21 million.

Operations: Total Energy Services Inc. generates revenue through its energy services operations across Canada, the United States, Australia, and other international markets.

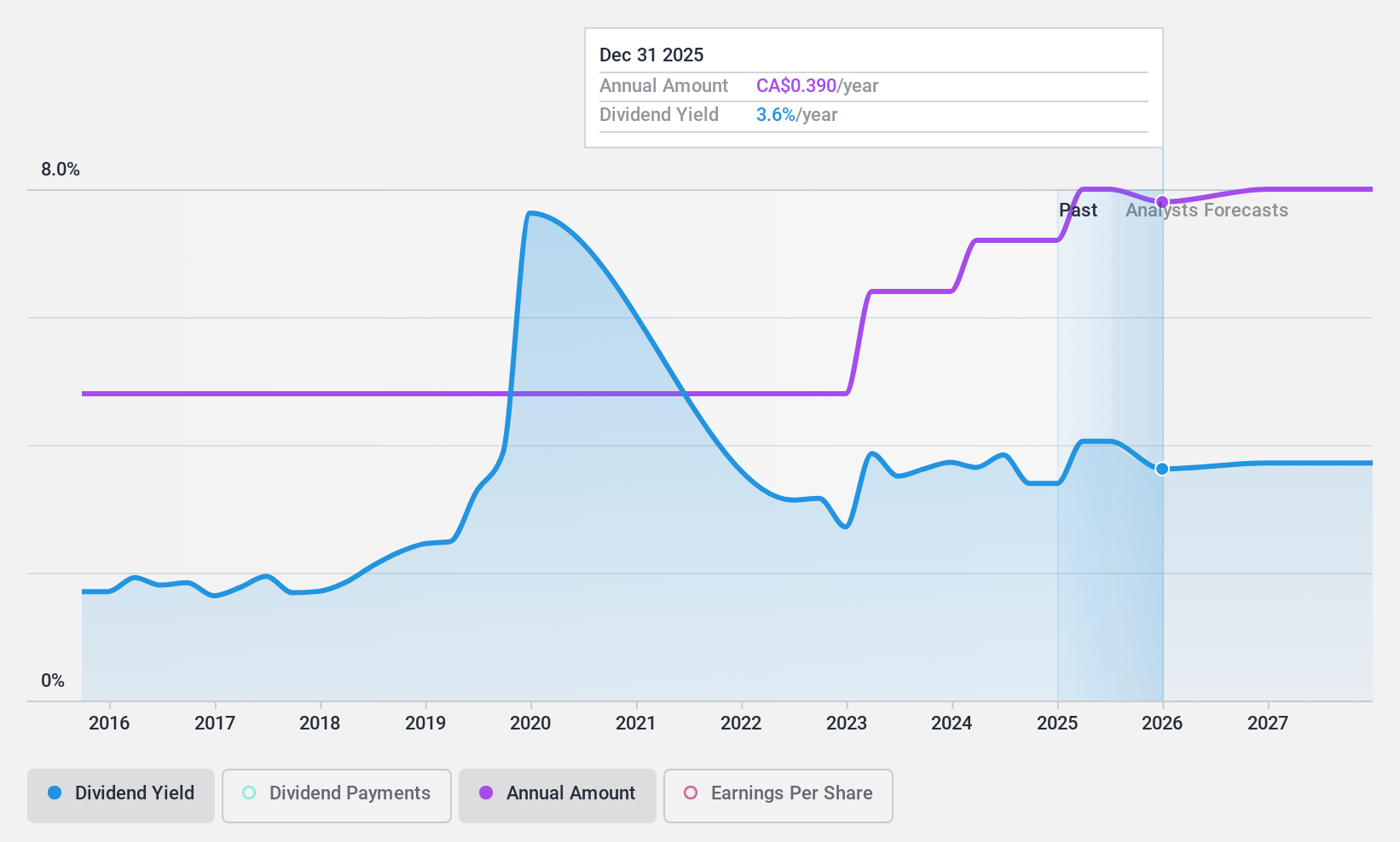

Dividend Yield: 3.9%

Total Energy Services' dividends have seen volatility over the past decade, but recent increases suggest growth. The payout ratios are low, with earnings and cash flows covering dividends comfortably. Trading significantly below estimated fair value, its dividend yield of 3.91% is modest compared to top Canadian payers. Recent earnings reports show increased sales and net income, reflecting financial strength despite an unstable dividend history and recent board changes with Tim McMillan's election as director.

- Click to explore a detailed breakdown of our findings in Total Energy Services' dividend report.

- Upon reviewing our latest valuation report, Total Energy Services' share price might be too pessimistic.

Next Steps

- Navigate through the entire inventory of 26 Top TSX Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives