- Brazil

- /

- Specialty Stores

- /

- BOVESPA:CEAB3

The total return for C&A Modas (BVMF:CEAB3) investors has risen faster than earnings growth over the last three years

C&A Modas S.A. (BVMF:CEAB3) shareholders have seen the share price descend 21% over the month. But that doesn't change the fact that the returns over the last three years have been pleasing. To wit, the share price did better than an index fund, climbing 59% during that period.

Since the long term performance has been good but there's been a recent pullback of 13%, let's check if the fundamentals match the share price.

View our latest analysis for C&A Modas

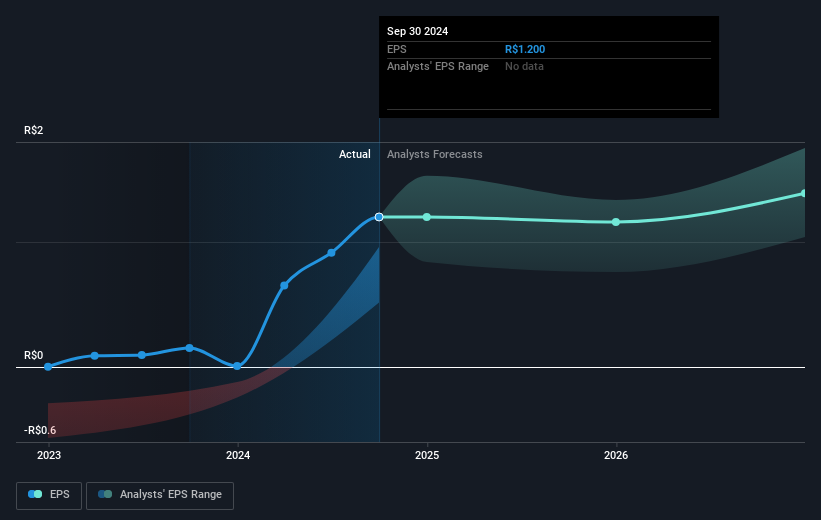

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, C&A Modas achieved compound earnings per share growth of 9.3% per year. In comparison, the 17% per year gain in the share price outpaces the EPS growth. So it's fair to assume the market has a higher opinion of the business than it did three years ago. That's not necessarily surprising considering the three-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that C&A Modas has improved its bottom line lately, but is it going to grow revenue? Check if analysts think C&A Modas will grow revenue in the future.

A Different Perspective

It's good to see that C&A Modas has rewarded shareholders with a total shareholder return of 17% in the last twelve months. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with C&A Modas , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CEAB3

C&A Modas

Operates as a fashion retailer for women, men, and children in Brazil and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives