- Belgium

- /

- Communications

- /

- ENXTBR:EVS

Imagine Owning EVS Broadcast Equipment (EBR:EVS) And Wondering If The 42% Share Price Slide Is Justified

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For many, the main point of investing is to generate higher returns than the overall market. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in EVS Broadcast Equipment S.A. (EBR:EVS), since the last five years saw the share price fall 42%. Unhappily, the share price slid 3.8% in the last week.

Check out our latest analysis for EVS Broadcast Equipment

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate half decade during which the share price slipped, EVS Broadcast Equipment actually saw its earnings per share (EPS) improve by 0.6% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS. Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Having said that, we might get a better idea of what's going on with the stock by looking at other metrics.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower. The revenue decline of around 2.6% would not have helped the stock price. So it seems weak revenue and dividend trends may have influenced the share price.

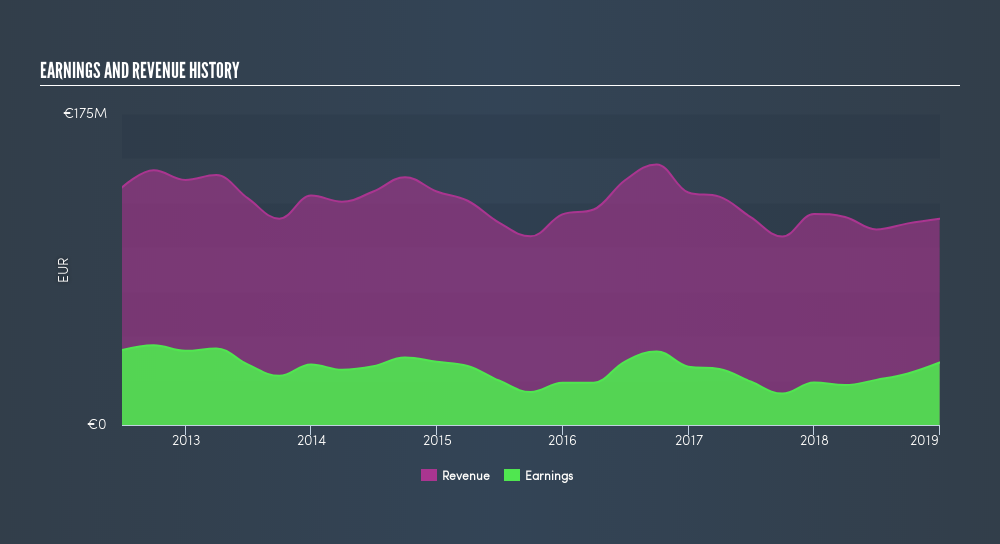

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We know that EVS Broadcast Equipment has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for EVS Broadcast Equipment in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for EVS Broadcast Equipment the TSR over the last 5 years was -32%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that EVS Broadcast Equipment shareholders have received a total shareholder return of 12% over the last year. And that does include the dividend. Notably the five-year annualised TSR loss of 7.4% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Importantly, we haven't analysed EVS Broadcast Equipment's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

But note: EVS Broadcast Equipment may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTBR:EVS

EVS Broadcast Equipment

Provides live video technology for broadcast and media productions in the United States, Europe, Africa, Middle East, and Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)